Ethena Stablecoin Project (USDe) Launches Mainnet and Announces Reward Program

Following the recent strategic funding round where Ethena Labs raised $14 million from major institutions on February 19, the project has now announced the launch of its community mainnet and the Shard reward program.

Ethena Labs Successfully Raises Funds and Launches Mainnet

Ethena Labs, the developer behind the USDe stablecoin on Ethereum, has secured $14 million in a strategic funding round led by Dragonfly and Maelstrom, an investment fund by former BitMEX CEO Arthur Hayes. Ethena has also received support from major centralized exchanges (CEX) like Binance, Bybit, OKX, Deribit, Kraken, and Gemini.

Although Ethena has previously raised over $50 million, the team decided to cap this round at $14 million, stating no immediate need for additional funds. Following this announcement, Ethena's valuation reached $300 million.

On February 19, Ethena also announced the launch of its mainnet on Ethereum and the release of the USDe stablecoin, hinting at an airdrop event through the Shard reward program.

Announcing the @ethena_labs public mainnet 🌅

— Ethena Labs (@ethena_labs) February 19, 2024

Details on our "Shard Campaign" in the following tweet pic.twitter.com/kXU5WjJ4rB

USDe Stablecoin Operational Model

Unlike stablecoins such as USDC or USDT, which are backed by USD, USDe is backed by Ethereum (ETH) and liquid staking tokens like Lido's stETH. This stablecoin aims to achieve price stability through a "delta-neutral strategy" on centralized exchanges (CEX).

To hedge the ETH and derivative tokens held, Ethena will establish short ETH positions on CEXs and earn funding fees. This method ensures that losses or profits from any position can be offset. Hence, Ethena has partnered with CEXs from the outset to facilitate the establishment of hedging positions for ETH derivatives.

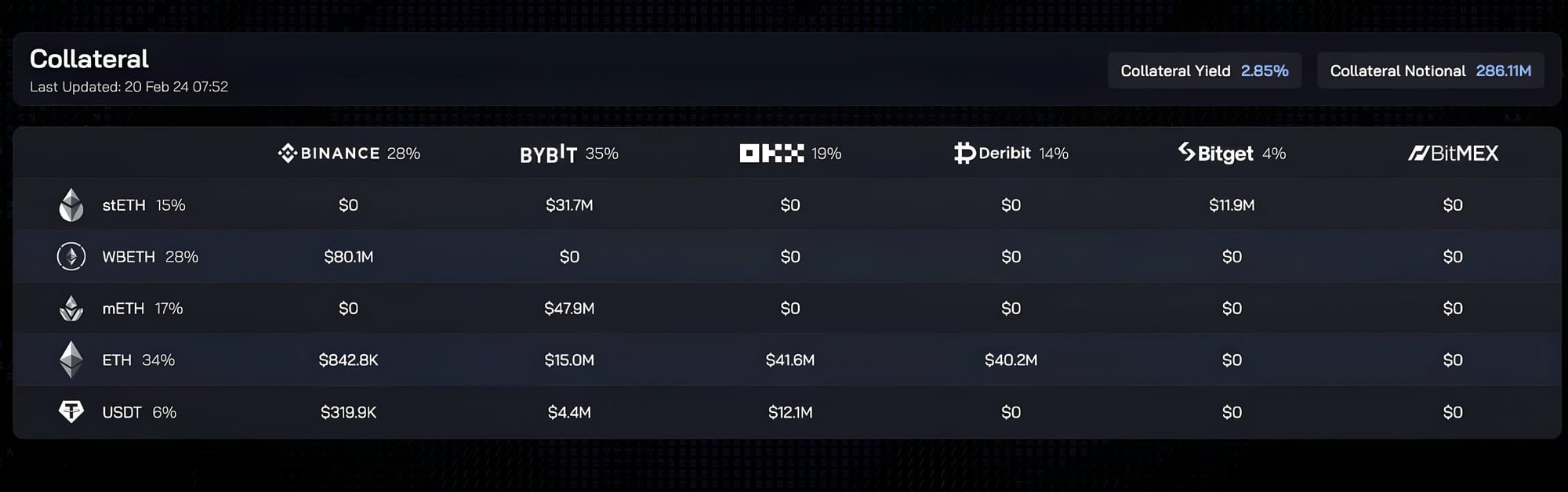

Collateral for USDe is held on CEXs

To mint USDe, Ethena allows whitelisted market makers to collateralize ETH and liquid staking ETH tokens to create the stablecoin. General users can only swap other stablecoins for USDe.

The current yield APR for USDe is up to 27.6%.

To attract users, the project announced a high yield stake of up to 27% annually and hinted at an airdrop through the Shard reward program for those providing liquidity, locking LP, buying/holding USDe, staking/buying sUSDe, and inviting others to join.

Community Opinions on Ethena's Model

The attractive yield for staking USDe has raised concerns, particularly on X (formerly Twitter), where users question how the project can offer a 27.6% yield in a not-so-hot market. This figure also brings to mind the algorithmic stablecoin LUNA from the past.

how is Ethena doing 27%?

— @0xKNL__ (🫡, 🫡) (@0xKNL__) February 19, 2024

mkt isn't that overheated (yet)?

Moreover, there are risks of CEXs closing short positions, raising questions about why these exchanges allow Ethena's operations and how Ethena plans to manage risks in such scenarios.

Gimme your best @ethena_labs FUD

— Seraphim (@MacroMate8) February 19, 2024

I will address all of it no matter how ridiculous

Currently, Ethena's Total Value Locked (TVL) is around $280 million. If this number reaches $1 billion, large short positions and market volatility might affect the project's interests, as investors may not reduce their positions due to a perceived delta-neutral strategy protection.

Project's Response to Concerns

Addressing the yield concerns, the project's founder explained that USDe is created by balancing risks through a delta hedging strategy, where liquid staking tokens are shorted.

Understandably seen some comments trying to understand the $sUSDe yield

— G | Ethena (@leptokurtic_) February 19, 2024

After last cycle it is absolutely fair to diligence where the source of the yield originates from, and we are happy to discuss it openlyhttps://t.co/dAU3jAtYcz

Explanation below: pic.twitter.com/l3dZMWwA2x

Additionally, the actual yield for staking USDe could exceed 27.6% as not all USDe is staked into sUSDe. The 27.6% is the actual yield paid into sUSDe last Thursday, annualized from the average weekly sUSDe balance. This rate will be updated this week after Thursday's interest payment.

In response to the risk of position closures, the project disclosed the use of custody solutions like Copper, Cobo, and Ceffu. Additionally, funds are stored outside CEXs alongside asset delegation, minimizing direct liquidation risks on CEXs.

The maximum leverage being traded is 2x, meaning for liquidation to occur, LS tokens need to depeg by more than 40%, which has never happened on Ethereum.

According to the project's analysis, ETH funding rates have been negative for only over 20% of the days in the past three years, even during the 2022 downtrend. Using stETH as collateral provides more safety compared to negative funding rates. Thus, attention should be paid to days when ETH's negative funding rate exceeds stETH's yield. Considering stETH's yield, days with negative yields drop to only 11%.

The ratio of days with positive vs. negative ETH funding rates. Source: Ethena Labs

Furthermore, Ethena maintains an insurance fund to protect collateral from periods of negative funding rates. The project estimates that for every $1 billion USDe issued, about $20 million in insurance can cover negative funding rate periods. Chaos Labs has created a separate model, calculating $33 million per $1 billion USDe. Most of the recently raised $14 million will be allocated to the insurance fund.

A lot of new eyes on Ethena today and people are right to point out the risks involved

— Conor Ryder (@ConorRyder) February 19, 2024

I wanted to take a sec to highlight some of the extensive work we've done surrounding the risks of the design, and specifically addressing funding risk

Before I get into the meat and veg… pic.twitter.com/zfuWMljkSB