Ethereum Burns Over 3 Million ETH Thanks to EIP-1559

The Ethereum network has achieved a new milestone, with over 3 million ETH burned since the implementation of the EIP-1559 burning mechanism 18 months ago.

Ethereum Crosses 3 Million ETH Burned Thanks to EIP-1559

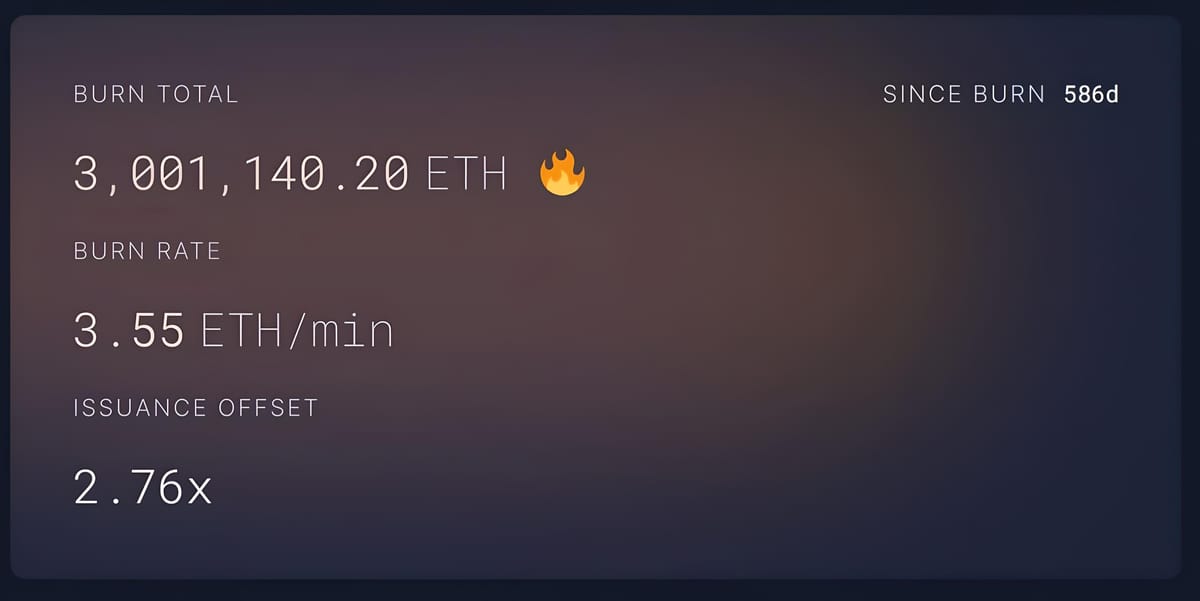

According to data from Ultrasound.money, as of early March 15, 2023, the Ethereum network has burned 3 million ETH through EIP-1559.

At the current market price of ETH, which is $1,710, this burned Ether represents a total value of over $9.1 billion.

🔥🔥🔥

— ultra sound money 🦇🔊 (@ultrasoundmoney) March 14, 2023

3M ETH burned since EIP-1559

🔥🔥🔥 pic.twitter.com/7L9pzdI12a

As Coin68 has explained, EIP-1559 is a special mechanism implemented by Ethereum in August 2021. This mechanism introduces a base fee for all transactions on Ethereum, replacing the previous model where users set their own fees. In the past, this led to extremely high gas fees during peak times. EIP-1559 aims to stabilize fees and make gas costs more predictable, while also allowing users to pay a priority fee to speed up transaction processing.

The most notable change brought by EIP-1559 is the burning of the entire base fee, creating a deflationary pressure on Ethereum.

Historical ETH Burn Statistics from EIP-1559. Screenshot from Etherscan at 10:30 AM on March 15, 2023

Ethereum reached the milestone of 1 million ETH burned on November 24, 2021, 2 million ETH on March 21, 2022, and most recently, 3 million ETH on March 15, 2023. The interval between each million ETH burned has been increasing, reflecting the decline in Ethereum network activity due to the crypto market downturn in 2022.

Thanks to EIP-1559, the circulating supply of ETH on Ethereum is now 64,300 coins lower than it was when The Merge upgrade was implemented in September 2022. The annual deflation rate of Ether, combined with the decrease in transaction validation rewards under Proof-of-Stake and EIP-1559, is 0.108% per year.

ETH Supply Changes Since The Merge. Screenshot from Ultrasound.money at 11:30 AM on March 15, 2023

Had Ethereum continued with Proof-of-Work, it would have recorded an annual inflation rate of 3.423%, with approximately 2 million new ETH issued to the market.

Comparison of Supply Growth: Ethereum Proof-of-Work (dashed line), Bitcoin (orange line), and Ethereum Proof-of-Stake (blue line). Screenshot from Ultrasound.money at 10:30 AM on March 15, 2023

Since the implementation of EIP-1559, the highest fee-consuming activities include ETH transfers, stablecoin transactions (USDT and USDC), trades on the DEX Uniswap, MetaMask transactions, and NFT trades through OpenSea.

Top Fee-Consuming Ethereum Activities Since August 2021. Screenshot from Ultrasound.money at 10:30 AM on March 15, 2023

Seeing the success and impact of EIP-1559 on Ethereum, other blockchain projects are also launching similar initiatives, such as EIP-1559 on Polygon and BEP-95 on BNB Chain.