Ethereum (ETH) Loses 12% of Its Value Post-The Merge

The second-largest cryptocurrency, Ethereum (ETH), has experienced a significant drop over the past 12 hours following the successful implementation of The Merge.

Price Volatility of Major Cryptocurrencies as of 09:25 AM on September 16, 2022. Source: Coin360

On the morning of September 16, ETH’s price dipped to $1,446, marking a 12.6% decline from the $1,655 peak seen the previous morning. This is the lowest price ETH has reached since August 28, erasing the gains achieved from The Merge.

15m Chart of ETH/USDT on Binance as of 09:25 AM on September 16, 2022

The primary reason for this drop is the successful completion of The Merge. With the upgrade now accomplished, investors lack motivation to hold ETH, as the upgrade is not expected to bring significant changes to Ethereum in the near future. The next milestone to watch will be 6-12 months post-The Merge, when the Shanghai upgrade is expected to unlock ETH locked in Ethereum 2.0 staking contracts, potentially creating new selling pressure.

Additionally, comments from the SEC Chairman suggesting Ethereum could be classified as a “security” due to The Merge have also dampened investor optimism about ETH’s future. Another factor contributing to ETH's decline is the emergence of PoW forks, which have siphoned some of Ethereum’s value.

Furthermore, despite the promising start to a “deflationary” trend shortly after The Merge, ETH’s supply has reverted to an “inflationary” state. The block rewards now exceed the amount of ETH being burned due to reduced network activity.

Congrats, Ethereum is inflationary again. Was fun while it lasted.

— foobar (@0xfoobar) September 16, 2022

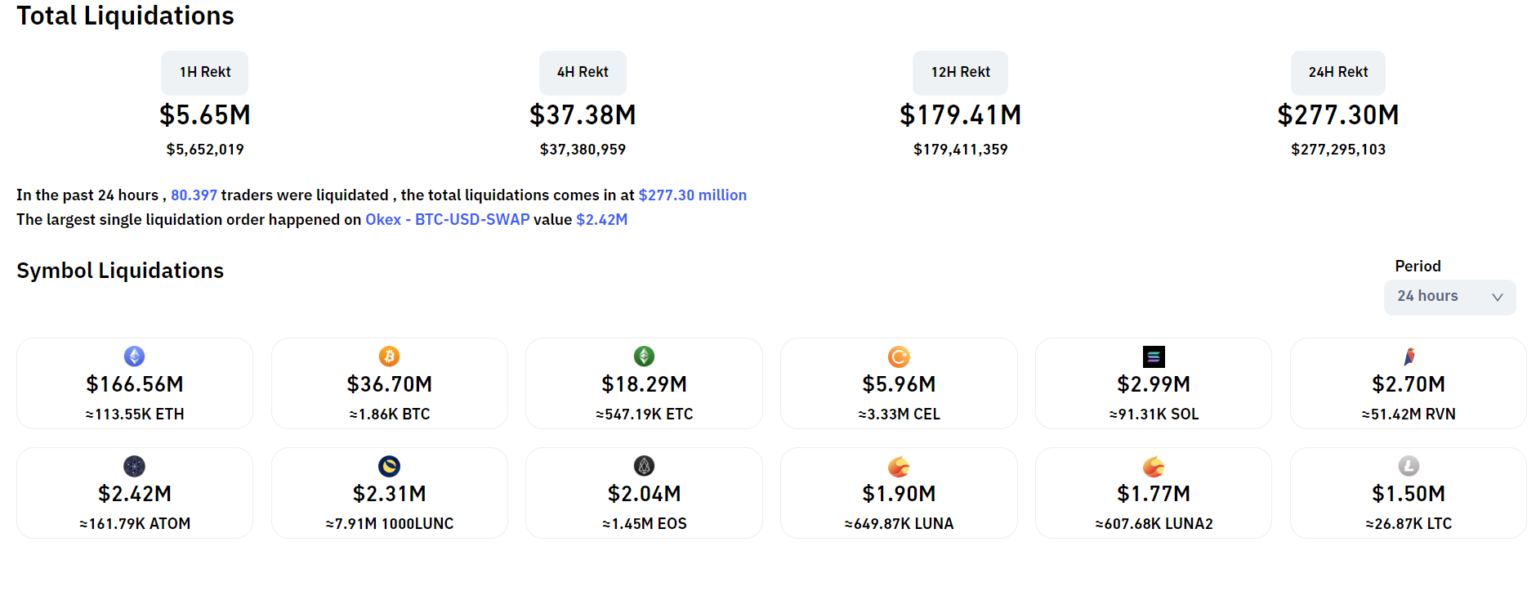

In the past 24 hours, $288 million worth of derivatives positions have been liquidated, with ETH accounting for over half of this at $167 million, overshadowing Bitcoin and other cryptocurrencies. Notably, long positions comprised over 70% of these liquidations.

Liquidated Cryptocurrency Value in the Last 24 Hours, Data from Coinglass as of 09:25 AM on September 16, 2022

On the evening of September 15, Bitcoin also fell to $19,497, the lowest level since September 9. The upcoming Fed interest rate decision on September 22 is now in focus. Despite a slight decrease in August inflation in the U.S., it fell short of expectations, and core CPI continues to rise. Observers are concerned that the Fed may maintain a 0.75% rate hike or even implement a more aggressive 1% increase to curb inflation.

15m Chart of BTC/USDT on Binance as of 09:25 AM on September 16, 2022

Other major cryptocurrencies have also experienced a 2-5% decline over the past 24 hours, though this is less severe compared to Ethereum.

In contrast, coins that share Ethereum’s mining algorithm and saw a surge before The Merge, such as Ethereum Classic (ETC), Ravencoin (RVN), and Beam (BEAM), are also seeing significant declines, with drops reaching double digits.

15m Chart of ETC/USDT on Binance as of 09:25 AM on September 16, 2022

15m Chart of RVN/USDT on Binance as of 09:25 AM on September 16, 2022

15m Chart of BEAM/USDT on Binance as of 09:25 AM on September 16, 2022