Ethereum (ETH) Returns to Deflationary State Thanks to Revived Network Activity

After nearly two months of inflationary conditions, the amount of ETH burned from transaction fees has once again surpassed the supply from staking.

Ethereum (ETH) Returns to Deflationary State Thanks to Revived Network Activity

According to data from Ultrasound.money, the Ethereum network has returned to a deflationary state for the first time since early December 2022.

As of 07:00 AM on January 24, 2023, Ethereum is experiencing an annual deflation rate of 0.002%, with the ETH supply down by more than 2,800 coins since the The Merge upgrade in mid-September 2022. However, this deflation rate remains below the 0.0051% observed in mid-November when the crypto market saw significant volatility following the collapse of FTX.

As explained by Coin68, after The Merge, Ethereum transitioned to a Proof-of-Stake (PoS) consensus mechanism and staking, reducing the issuance of new coins by up to 90% compared to the previous Proof-of-Work (PoW) system. Combined with the EIP-1559 upgrade, which burns a portion of ETH transaction fees, this can create deflationary pressure on the world’s second-largest cryptocurrency.

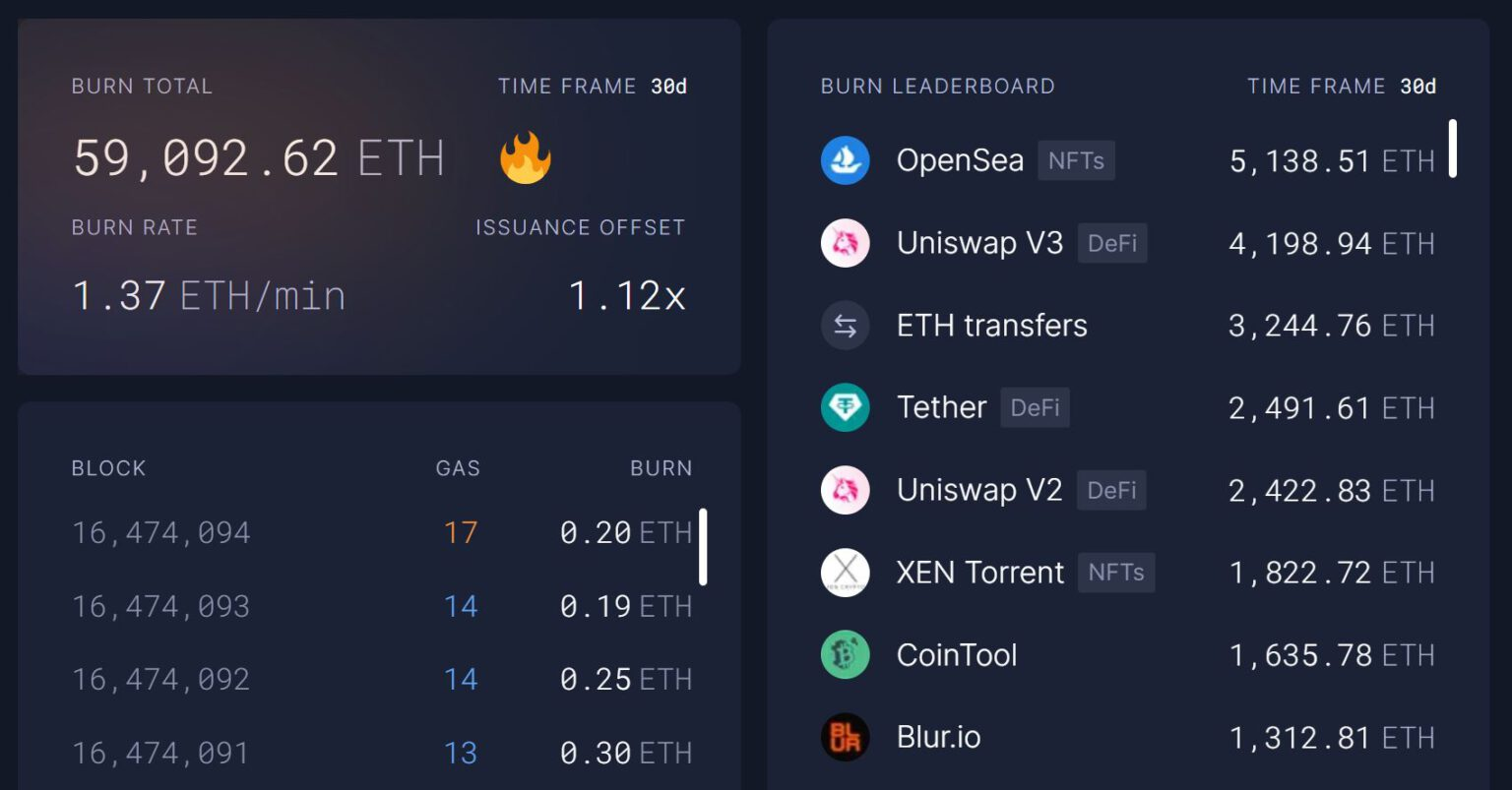

In the past 30 days, more than 59,000 ETH has been burned, primarily from NFT protocols like OpenSea and Blur. This contrasts with early December when DEXs and on-chain ETH circulation were the primary sources of coin burning due to high trading demand. Currently, the surge in NFT transactions is the main driver behind the increased ETH burn, contributing to Ethereum’s deflationary effect.

ETH Burned and Top Ethereum Applications by Burn Fees in the Past 30 Days

Source: Ultrasound.money, 10:55 AM on January 24, 2023

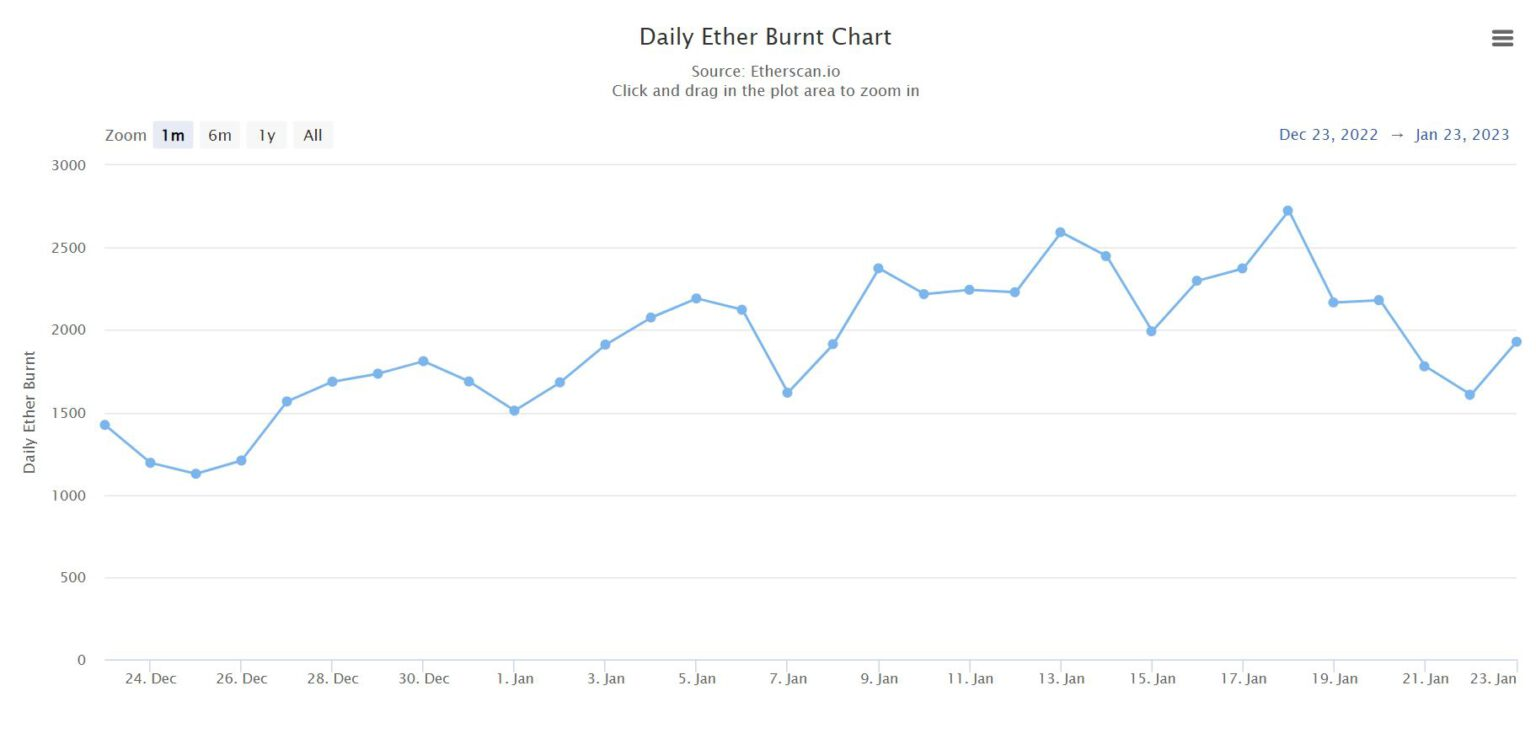

The daily ETH burn statistics have also shown a slight recovery over the past month, averaging around 1,900 to 2,000 ETH per day.

Daily ETH Burn from EIP-1559 Since Late December 2022

Source: Etherscan

Since the beginning of 2023, ETH has experienced a notable recovery in line with Bitcoin’s (BTC) price increase. From a low of $1,196 on January 1, ETH surged to $1,679, marking a 40% increase. However, unlike BTC, Ethereum has not yet surpassed its pre-FTX collapse price from early November.

ETH/USDT 1-Day Chart on Binance, 10:55 AM on January 24, 2023

Historically, January and February have been positive periods for ETH, often showing strong monthly gains.

ETH Price Fluctuations by Month from 2015 to Present

Source: Coinglass

In Q1 2023, Ethereum may proceed with the Shanghai upgrade, which aims to unlock approximately $25 billion worth of ETH currently staked. Shanghai was successfully hard-forked on the testnet last night and is expected to be implemented in March if no unforeseen issues arise.

The imminent unlocking of a significant amount of ETH is driving investment trends towards Liquid Staking projects. Investors are expected to channel their ETH into flexible staking solutions such as Lido or Rocket Pool, rather than selling on the open market.