Ethereum Gas Fees Continue to Hit New Lows – Are Users Leaving the Network?

Ethereum gas fees have been hitting new lows over the past two years. Have users decided to leave the network?

Ethereum Gas Fees Continue to Hit New Lows – Are Users Leaving?

Current Context

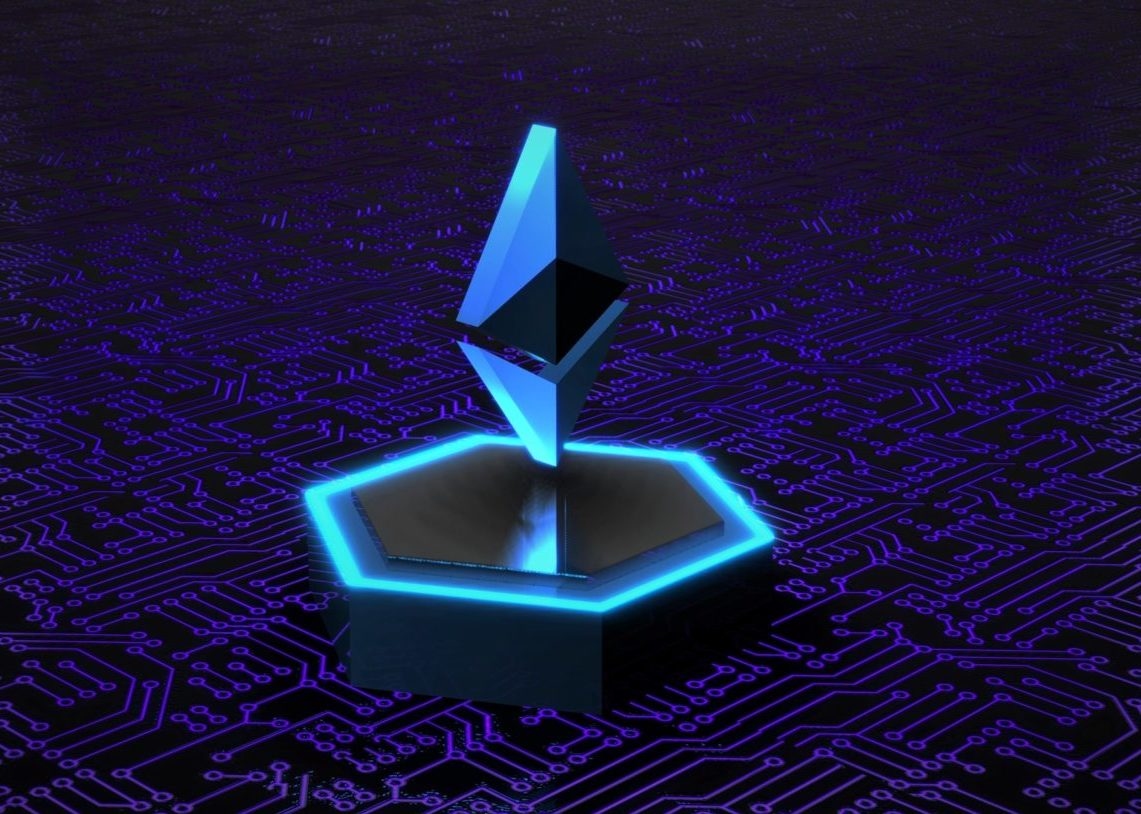

High Ethereum transaction fees have always been a hot topic in the crypto community. However, compared to the peak in May 2021, ETH gas fees have significantly decreased. According to BitInfoCharts, the current gas fee on Ethereum hovers around 0.001 ETH, roughly $1.32 – the lowest in two years.

Average Transaction Fees on Ethereum

Source: BitInfoCharts

Ethereum gas fees surged during the DeFi summer and the NFT boom, propelling the market into a promising uptrend. Over the past nearly two years, Ethereum transaction fees have typically been around $40, with an ATH recorded at 8,400 gwei, or over $2,400 on May 1, 2022 – an unprecedented figure compared to competitors like BNB Chain and Solana.

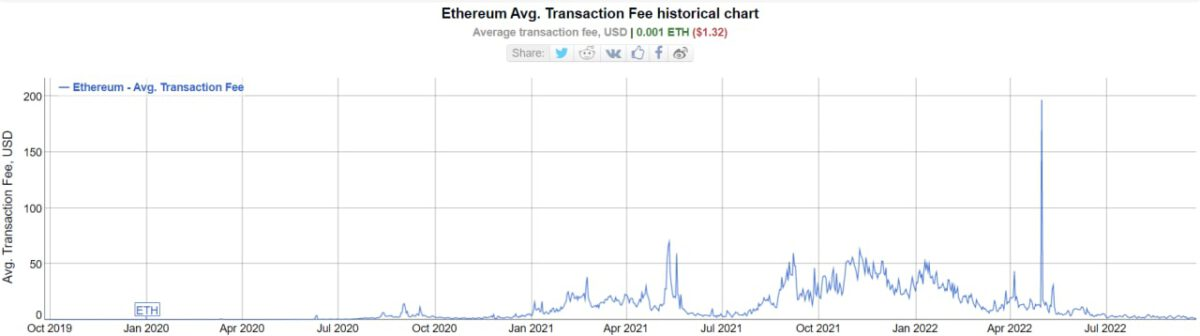

Yet, today, it's surprising to see users paying just over $1 on average for an Ethereum transaction. Swaps or liquidity additions on Uniswap – one of the highest gas-consuming applications on Ethereum – now cost less than $2 at most.

ERC20 Token Transfer and Uniswap Swap Fees at 09:45 AM on 26/09/2022

Source: Etherscan

Could the current downturn indicate that users are gradually leaving the market? Let’s explore the on-chain data!

On-Chain Analysis

On-chain data shows that both transaction volumes and active user addresses are still on an upward trend. Most users seem satisfied with the current transaction fees amid the market's unpredictable swings.

When examining the total number of transactions and active wallet addresses on Ethereum, both metrics are far from their all-time lows, even increasing by 20% and 60% respectively over the past two years.

For instance, OpenSea has consumed 230,000 ETH, or about 16,400 ETH monthly (MoM). However, in the last 30 days, the MoM has dropped significantly compared to the average of 1,100 ETH.

What’s Behind the Drop in Gas Fees?

NFT Speculation is No Longer a Goldmine

NFTs were once a safe haven, offering refuge during market turmoil. The peak came when popular collections like Bored Ape Yacht Club (BAYC) rolled out numerous incentives to hold NFTs. However, the NFT market has faced increasing challenges since mid-June 2022, with floor prices falling and volumes on NFT marketplaces dropping to record lows over the past six months. Even NFTs are struggling to weather the current market storm.

The Rise of Layer-2 Solutions

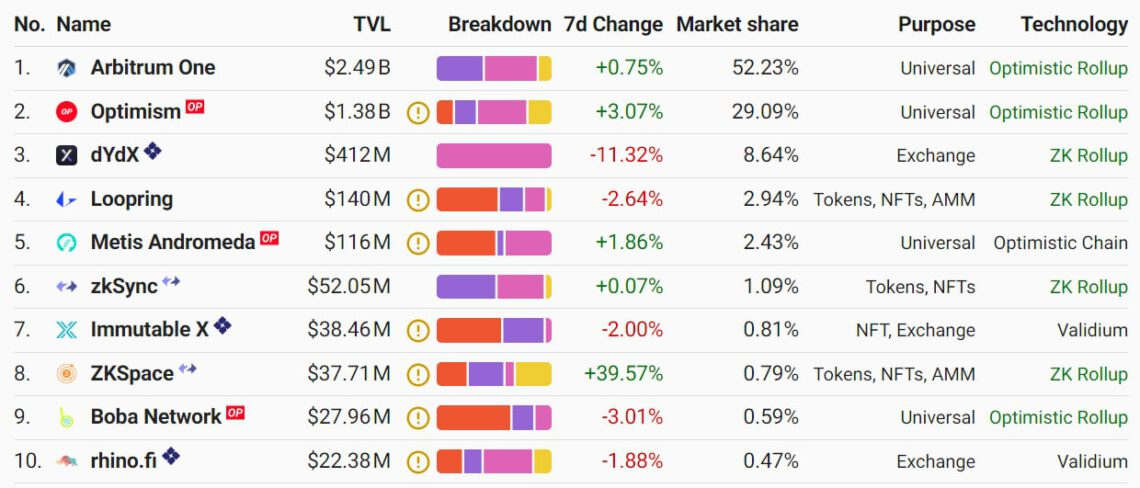

A significant amount of Ethereum’s activity has shifted to layer-2 ecosystems such as Arbitrum and Optimism. Arbitrum, for instance, holds the highest market share at 52.23% with $2.49 billion locked. This shift brings structural limitations, including transaction fees that, at times, have surpassed those of Ethereum’s layer-1.

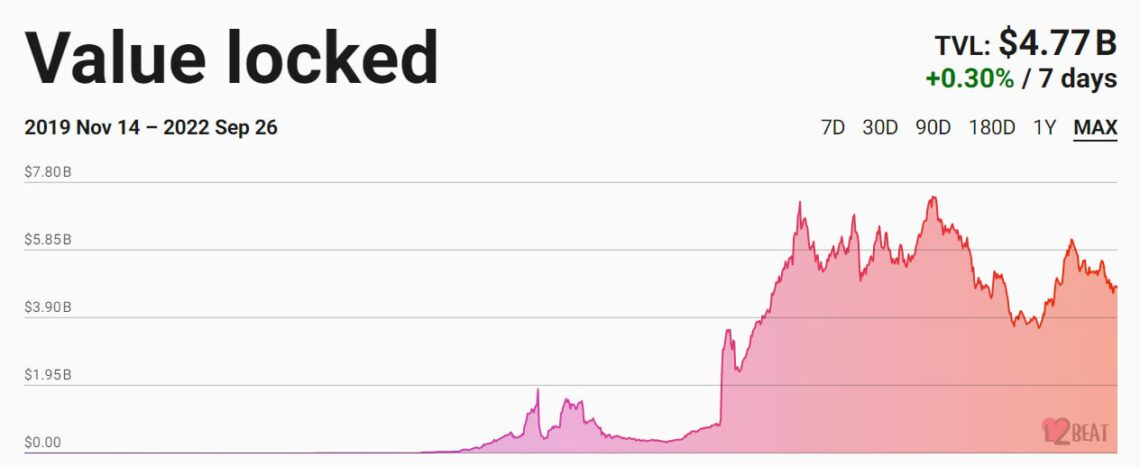

Total Value Locked (TVL) in Layer-2 Protocols

Source: L2beat

Top Layer-2 Protocols by TVL

Source: L2beat

For a deeper understanding of Ethereum Layer 2 scaling solutions, check out our article: Kyros Kompass #3: An Overview of the Layer 2 Landscape.

ETH Heading Back to Old Lows

Another factor contributing to the gas fee decline is Ethereum itself. Despite the successful implementation of The Merge – a major milestone that garnered industry-wide attention – the second-largest cryptocurrency by market cap is still experiencing significant adjustments and has lost some of its investor appeal. As of the time of reporting, ETH is trading around $1,305, far from its peak in November 2021.

1H Chart of ETH/USDT on Binance at 10:00 AM on 26/09/2022