Fed Hikes Rates by 0.25%, Bitcoin Approaches $29,000 Before a Sharp Dump

The Federal Reserve (Fed) has announced a 0.25% interest rate hike, maintaining its aggressive stance despite recent banking sector turmoil, which initially propelled Bitcoin higher.

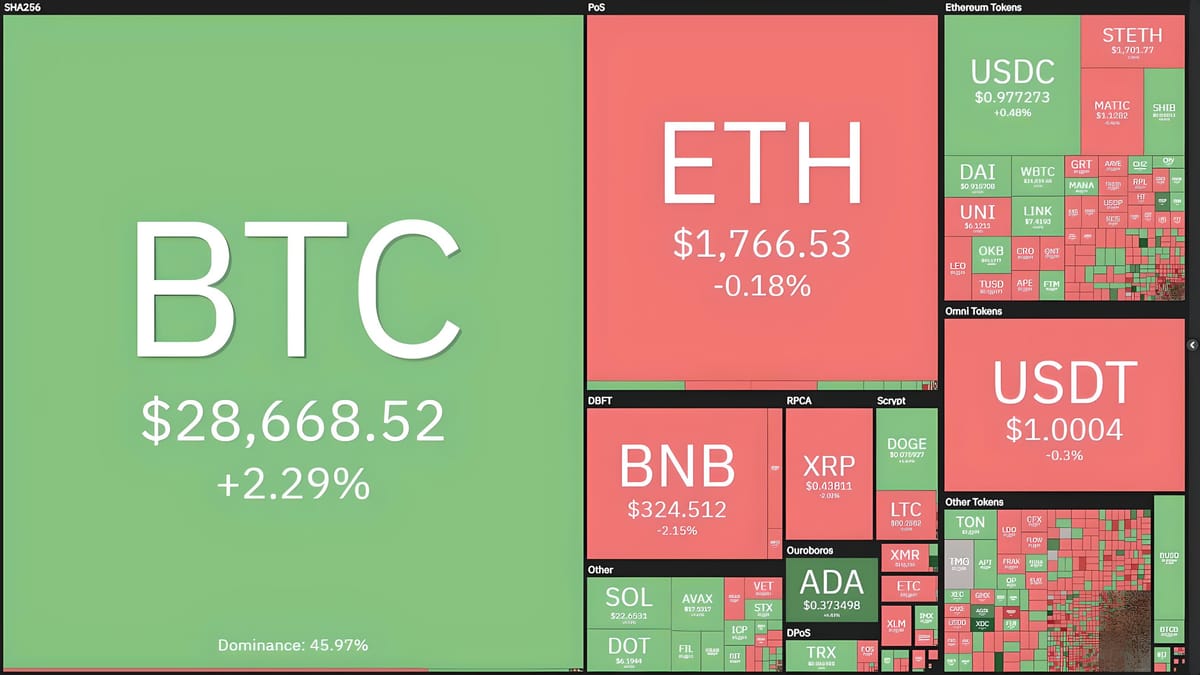

Price Movements of Major Cryptocurrencies at 01:08 AM UTC on March 23, 2023. Source: Coin360

Update:

Following the interest rate decision, Fed Chair Jerome Powell reaffirmed that, despite recent disruptions in the U.S. banking sector requiring emergency measures to prevent a wider crisis, the Fed’s long-term goal remains to curb inflation from 6% down to just 2%.

To achieve this target, the Fed will continue adjusting interest rates as needed. However, rather than the continuous hikes projected at the end of 2022, the Fed's Board of Governors will hold meetings to closely monitor the banking situation and adjust accordingly.

Bitcoin (BTC) experienced a significant dump, falling to $26,601 after Powell's remarks.

15-Minute Chart of BTC/USDT on Binance at 03:25 AM UTC on March 23, 2023

The crypto market saw a wave of liquidation, with nearly $174 million in derivatives positions liquidated before and after the Fed’s rate hike announcement, with half of that amount coming from Bitcoin. The liquidation ratio for long positions reached 82%.

Crypto Liquidation Values in the Last 4 Hours, Data from Coinglass at 03:25 AM UTC on March 23, 2023

Original Article:

The latest rate hike from the Federal Reserve stands at 0.25%, maintaining the same increase pace as the adjustment in January.

The current Fed interest rate is at 5%, 4.5% higher than the same time last year, and the highest rate since the 2008 financial crisis.

Fed’s Interest Rate Changes. Source: Trading Economics

With this latest development, U.S. financial observers project the year-end target rate for 2023 to be just 5.1%, and 4.3% for 2024—suggesting that the rate hike cycle may be nearing its end.

With the U.S. facing potential banking crisis risks following the collapse of three major banks in March (Silvergate, Silicon Valley, Signature), observers conclude that the Fed is under pressure and may not continue increasing rates to control U.S. inflation.

In the past week, the Fed has injected up to $300 billion into the U.S. financial system to bolster liquidity, leading many to believe that the era of quantitative tightening has ended or at least been paused.

At the same time, U.S. inflation for February 2023 decreased for the eighth consecutive month, dropping to 6%, the lowest since November 2021, though still above the 2% target set by Fed Chair Powell.

Bitcoin has benefited significantly from the current macroeconomic instability, rising by 37% since mid-March and consistently hitting new highs for 2023. On the evening of March 22, BTC surged from $28,200 to a new 2023 high of $28,868, and is now fluctuating around $28,600.

15-Minute Chart of BTC/USDT on Binance at 01:08 AM UTC on March 23, 2023

The Fed will have additional rate adjustments scheduled for 04/05, 06/15, 07/27, 09/27, October or November, and 12/14 (Vietnam time).