Fed Holds Interest Rates Steady for 5th Consecutive Time, Bitcoin Prices Rebound

In line with earlier predictions by market observers, the Federal Reserve (Fed) has maintained its interest rates at their highest levels in 23 years, between 5.25% and 5.5%.

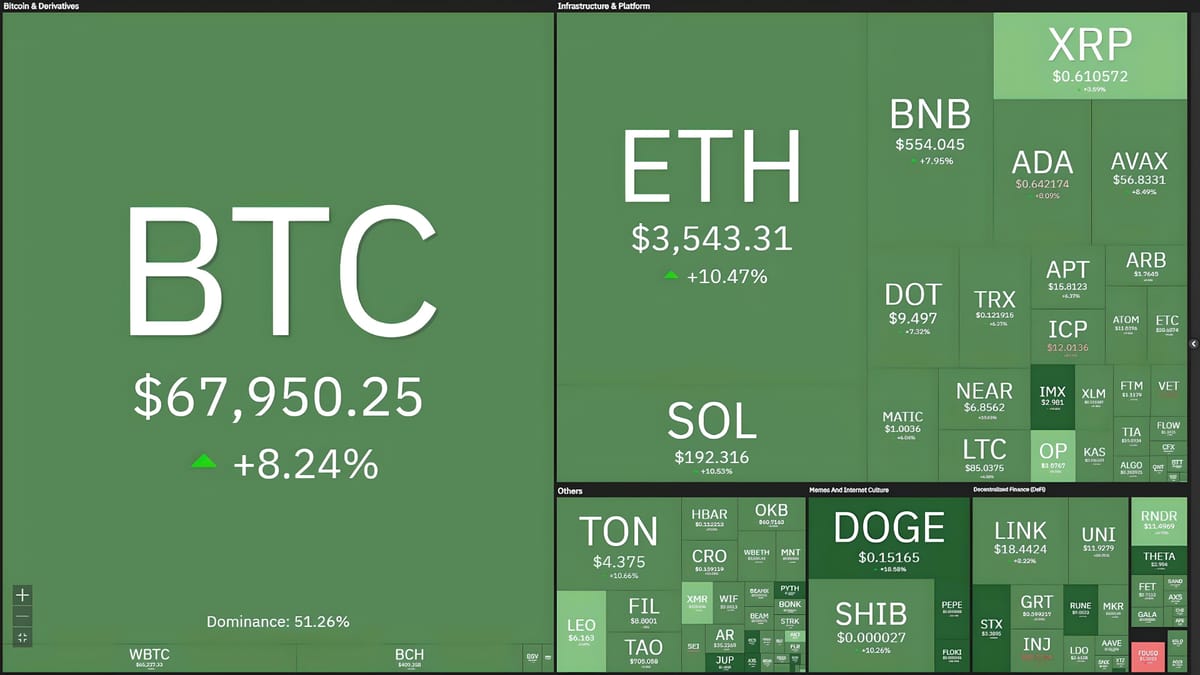

Fed Holds Interest Rates Steady for 5th Consecutive Time, Bitcoin Prices Rebound. Image: Coin360

Early morning on March 20, the Federal Open Market Committee (FOMC), the decision-making body of the U.S. Federal Reserve, decided to keep interest rates unchanged, while signaling potential multiple rate cuts later this year.

Interest rate adjustments through Fed meetings from March 2022 to date. Source: CNBC

This marks the fifth consecutive time the Fed has agreed not to adjust interest rates within the range of 5.25% to 5.5%, the highest level in 23 years.

Fed's no-change interest rates in 2023: June | September | November | December | April

Alongside this decision, the FOMC also anticipates three rate cuts this year, each by 0.25 percentage points. Many experts note that despite caution, the Fed remains optimistic about the economy, expecting a "soft landing" after a period of robust growth with inflation peaking at over four decades.

Fed Chair Jerome Powell indicated that while the central bank cannot pinpoint the timing, he expects rate cuts to occur.

At the post-meeting press conference, Powell stated:

"We believe that policy rates could peak in this cycle, and if the economy evolves as expected, tightening this year is warranted."

He also suggested that the Fed is prepared to maintain the current interest rates longer if necessary.

Following the interest rate news, Bitcoin saw a strong recovery, up 8% compared to 24 hours earlier. The crypto market has been volatile as Bitcoin ETFs recorded consecutive outflows for the second day. The world's largest cryptocurrency is trading around $67,692.

1-hour chart of BTC/USDT pair on Binance as of 09:15 AM on March 21, 2024

Altcoins have also shown impressive rebounds of 10-20% over the past few hours.

Derivatives liquidations in the last 12 hours amounted to approximately $210 million, with 62% attributed to short liquidations.

Latest 12-hour liquidation data, screenshot from CoinGlass at 09:20 AM on March 21, 2024

The S&P 500 index surged past 5,200 points, setting a new record. Financial stocks also rallied following the Fed's decision.

However, Bitcoin spot ETFs recorded a third consecutive day of significant outflows, with official figures from Farside Investors showing -$261 million, driven by Grayscale's GBTC fund dominating outflows over other ETFs.

Bitcoin ETF inflow/outflow data. Source: Farside Investors (March 21, 2024)