Fed Keeps Interest Rates Unchanged for Third Consecutive Time, Bitcoin Price Recovers

Bitcoin prices surged to $43,475 after the U.S. Federal Reserve (Fed) decided not to adjust interest rates.

Cryptocurrency market fluctuations as of 08:45 AM on December 14, 2023. Photo: Coin360

In an announcement early on December 14, the U.S. Federal Reserve (Fed) decided to maintain interest rates within the range of 5.25% to 5.5%, unchanged from previous levels, in line with economic observers' predictions.

This marks the third consecutive time the Fed has kept interest rates steady following adjustments in September and November, as reported by Coin68, and the fourth instance in 2023 without any rate changes, including June.

Fed stated:

“Tighter financial and credit conditions for households and businesses could impact the economy, employment, and inflation. Recent signals suggest economic growth has slowed from the strong pace in Q3. Job creation remains relatively robust, though, with unemployment rates held low.”

The U.S. Federal Reserve also revised its forecast for the year-end 2024 interest rate to 4.6%, indicating a potential 0.75% reduction over the next year. Goldman Sachs had previously forecasted that the Fed would only begin reducing rates in mid-2024.

Fed anticipates that maintaining stable interest rates for a while longer will help the U.S. central bank reduce inflation to 2.4% by late 2024, down from the current 3.2% level.

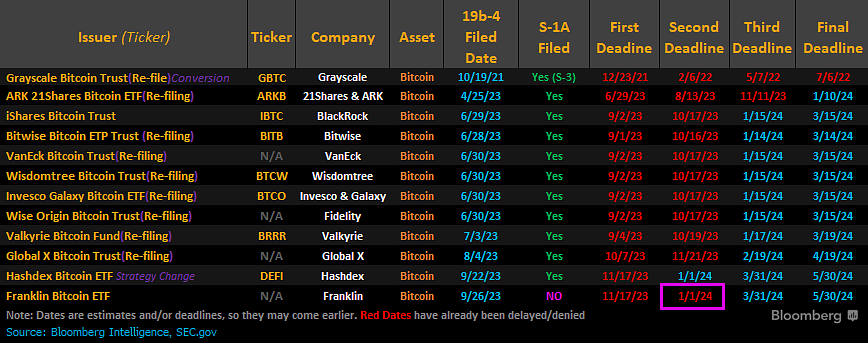

After correcting from $44,000 to around $40,500 earlier this week, the price of Bitcoin (BTC) rebounded to $43,475. The world's largest cryptocurrency is poised for further growth in the remaining days of December as the deadline approaches for the U.S. Securities and Exchange Commission (SEC) to approve a series of Bitcoin spot ETF proposals in early January 2024.

1-hour chart of BTC/USDT pair on Binance as of 08:45 AM on December 14, 2023

The momentum from Bitcoin spot ETFs is also the reason behind BTC's strong upward trend in Q4 2023, returning to its highest value in 19 months.

ImageProposals for Bitcoin spot ETFs are currently under SEC review. Photo: Bloomberg (29/11/2023)

Similarly, Ethereum (ETH) has returned to around $2,280, still below its December 9 peak of $2,403.

1-hour chart of ETH/USDT pair on Binance as of 08:45 AM on December 14, 2023

Current top altcoins are also showing impressive recoveries, with price increases ranging from 4% to 16% over the past 24 hours.

The total value of liquidated derivative orders in the last 12 hours was less than $95 million, with 77% being short orders.

Data on liquidations in the last 12 hours, screenshot from CoinGlass at 08:45 AM on December 14, 2023