Fed Maintains Interest Rates for Fourth Consecutive Time, Bitcoin Prices Plummet Again

The Federal Reserve (Fed) has decided to keep its benchmark interest rates unchanged in its fourth consecutive policy meeting, aligning with market expectations.

Fed Maintains Interest Rates, Bitcoin Prices Plunge Again

Early morning on February 1st (Vietnam time), the Federal Open Market Committee (FOMC), responsible for setting Fed's monetary policy, unanimously agreed to maintain the interest rates for the fourth time in a row within the range of 5.25 - 5.5%, the highest in nearly 23 years.

History of Fed interest rate adjustments from March 2022 to present. Source: CNBC (01/02/2024)

Fed's unchanged interest rates in 2023: June | September | November | December

This continues to signal that the Fed is halting its rate-hiking process, but the committee remains cautious about lowering rates as inflation remains above the 2% target. The FOMC stated:

"The Committee does not believe it would be appropriate to lower the target range for the federal funds rate until it is confident that inflation is returning to 2% sustainably."

Through this statement, it's evident that the Fed hasn't completely ruled out the possibility of future rate hikes. Speaking to the press after the meeting, Fed Chair Jerome Powell noted that cutting rates in March would be "difficult" as more economic data needs to be observed to ascertain future trends.

Ahead of the meeting, the market anticipated that the Fed would lower interest rates as early as March or May this year. However, Fed officials have exercised caution and emphasized that future actions depend on forthcoming economic data. Contrary to market expectations, the Fed had previously hinted at three rate cuts in 2024, significantly fewer than anticipated.

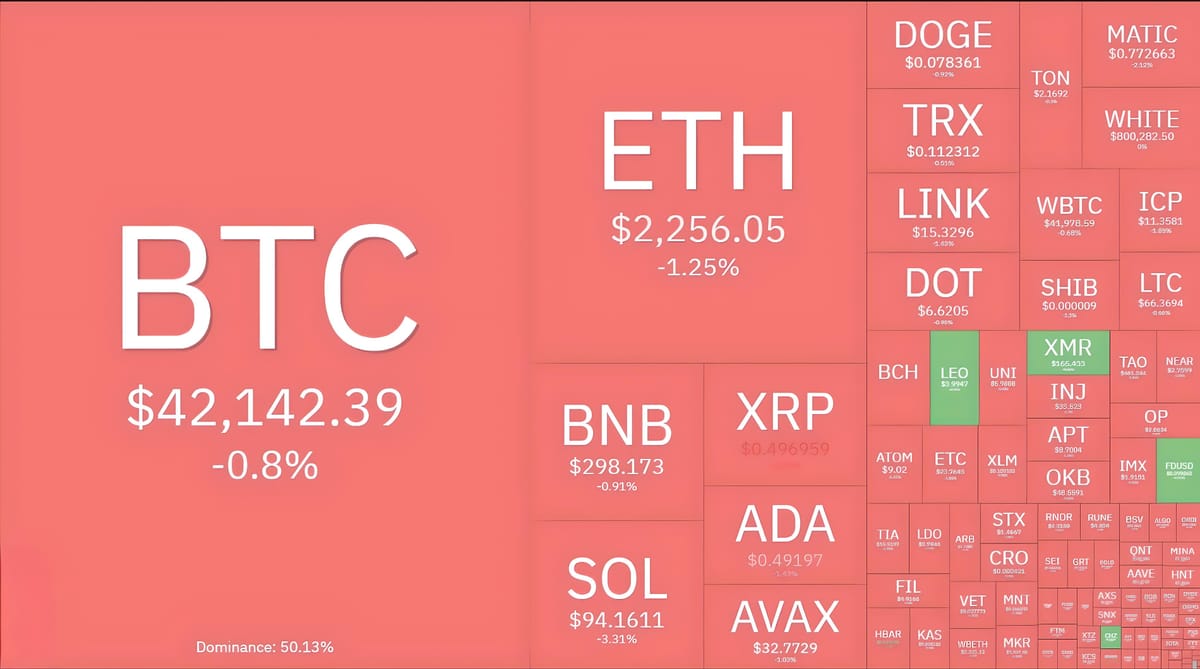

Following this news, Bitcoin experienced a steep decline of over $1,800, dropping from $43,700 to $41,884 USD. Altcoins also followed suit with declines ranging from 5-10%. Overall, the world's largest cryptocurrency is still expected to rebound, amidst anticipation for the Bitcoin spot ETF and the upcoming Halving event.

1-hour chart of BTC/USDT pair on Binance at 09:35 AM on February 1, 2024

The U.S. stock market also saw significant declines in the January 31st trading session. The Dow Jones index closed nearly 1% lower, while the S&P 500 and Nasdaq fell sharply by 1% and 1.5% respectively.