Fed Raises Interest Rates by 0.5%, Bitcoin Exhibits Volatility

The Federal Reserve has followed through on its commitment to moderate interest rate hikes, as inflation appears to be coming under control.

Fed Increases Rates by 0.5%, Bitcoin Experiences Fluctuations

In the early hours of December 15, the Federal Reserve announced its final interest rate adjustment for 2022, raising the benchmark rate by 0.5%. This increase was anticipated, following remarks from Fed Chairman Jerome Powell in early November, suggesting a potential slowdown in rate hikes as U.S. inflation showed signs of easing.

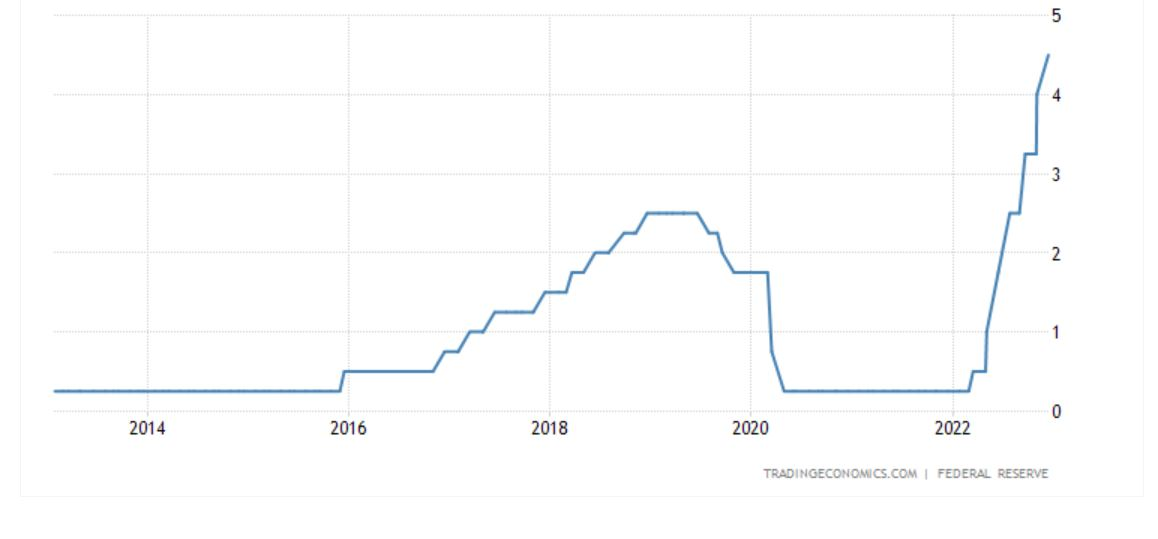

In total, the Fed has implemented seven rate hikes in 2022, elevating the key economic parameter from 0.25% to 4.5%. This marks the highest rate imposed by the Fed since the 2008 economic crisis, aimed at curbing U.S. inflation, which has remained at a 40-year high for several months.

However, according to Bloomberg, Fed officials plan to continue the rate hike strategy into 2023, targeting an annual rate of 5.1% before reducing it to 4.1% in 2024.

Fed’s Interest Rate Changes. Source: Trading Economics

During the press conference following the interest rate announcement, Fed Chairman Jerome Powell made several noteworthy statements:

After climbing above $18,000 and reaching a high of $18,387 since November 9, Bitcoin's price adjusted back to $17,700 as the market absorbed the news without significant surprise.

1-Hour BTC/USDT Chart on Binance as of 02:50 AM December 15, 2022

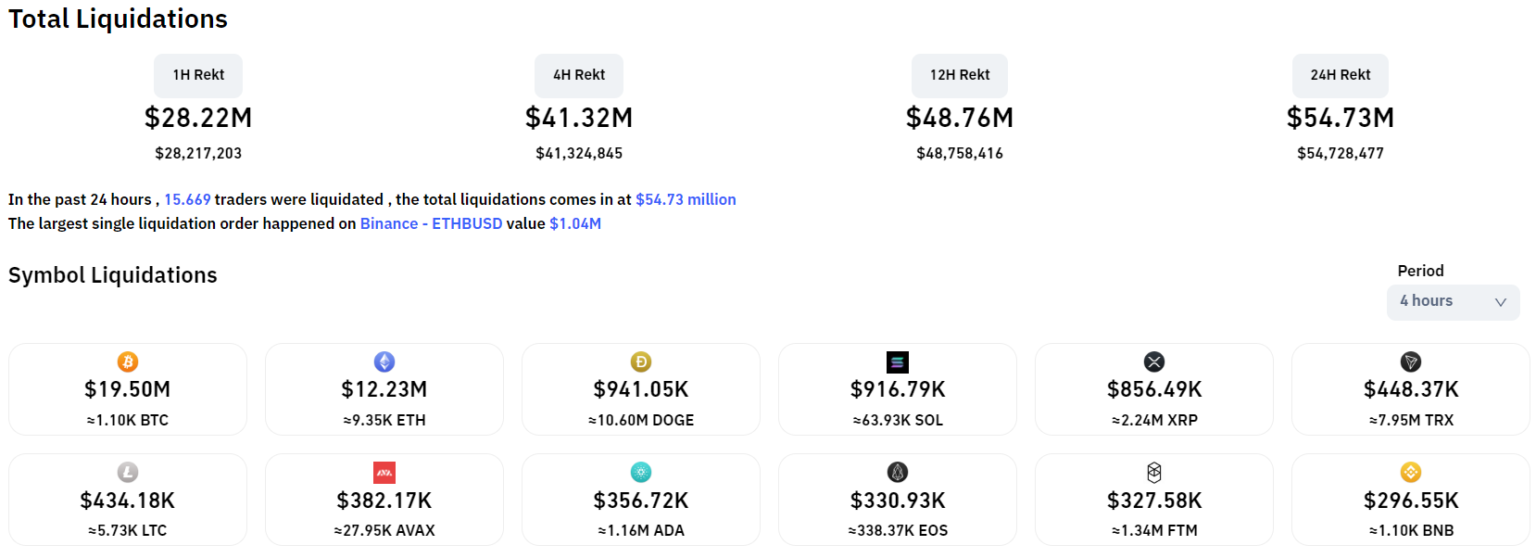

Liquidations over the past 4 hours amounted to just over $41 million, with 61% of these being long positions.

Crypto Liquidation Value in the Past 4 Hours. Source: Coinglass as of 02:50 AM December 15, 2022

Fed officials will reconvene on January 27-28, 2023, to decide on the next interest rate adjustment.