GoldenTree Asset Management Invests in SushiSwap (SUSHI)

Renowned asset management firm GoldenTree has surprisingly announced its interest in developing the SushiSwap (SUSHI) ecosystem.

GoldenTree, which manages nearly $50 billion in assets, announced on October 6 its interest in SushiSwap (SUSHI), a multi-chain decentralized exchange (DEX).

In a post on the SushiSwap community forum, a representative from GoldenTree stated that they have been following the project for some time and are optimistic about the future potential of this DEX platform.

SushiSwap emerged during the "DeFi summer" of 2020, replicating Uniswap's operational model but with a multi-chain approach, supporting various blockchains rather than solely focusing on Ethereum like Uniswap. Despite an initially promising trajectory with a talented team and a strong community, SushiSwap faced significant internal turmoil in late 2021, leaving the project leaderless. The subsequent partnership with Frog Nation only deepened the crisis, as the Frog Nation team got embroiled in drama involving 0xSifu, Solidly, and Andre Cronje earlier in 2022.

However, by mid-2022, SushiSwap made a comeback with a new development roadmap named Sushi 2.0. The DEX began by overhauling its leadership, appointing Jared Grey, an experienced DeFi developer, as the new “head chef.”

The first ever community/DAO driven election of a Head Chef has been a huge success 🎉

— Sushi.com (@SushiSwap) October 4, 2022

We're excited to introduce you to Sushi's Head Chef @jaredgrey:https://t.co/2tRJOaEi4X

💬 Want to ask questions in person? Join our Forum!

📩 RSVP: Oct 6 - 5pm UTC: https://t.co/8F0Qrhf8Rv pic.twitter.com/jpzhPus7wx

Grey is expected to coordinate and implement the Sushi 2.0 roadmap, which includes refining products such as the AMM Trident, MISO v2 launchpad, Shoyu NFT exchange, Kashi lending platform, and the Sushi Guard MEV protection mechanism. Additionally, the Sushi community will work on revitalizing Sushi DAO, a decentralized autonomous organization.

In light of these positive changes, GoldenTree has decided to invest in SushiSwap. GoldenTree revealed it has established a crypto investment fund called GoldenChain, led by former fund managers from the crypto space. SushiSwap was chosen for investment because, despite facing numerous challenges, the project and its community have navigated through them and are now setting a new direction. GoldenTree views SushiSwap as embodying the best qualities of DeFi: introducing and improving new innovations.

1/ You asked for the institutions to buy your bags, you get the institutions to buy your bags. https://t.co/MjzoFYT4P6

— Avi (@AviFelman) October 5, 2022

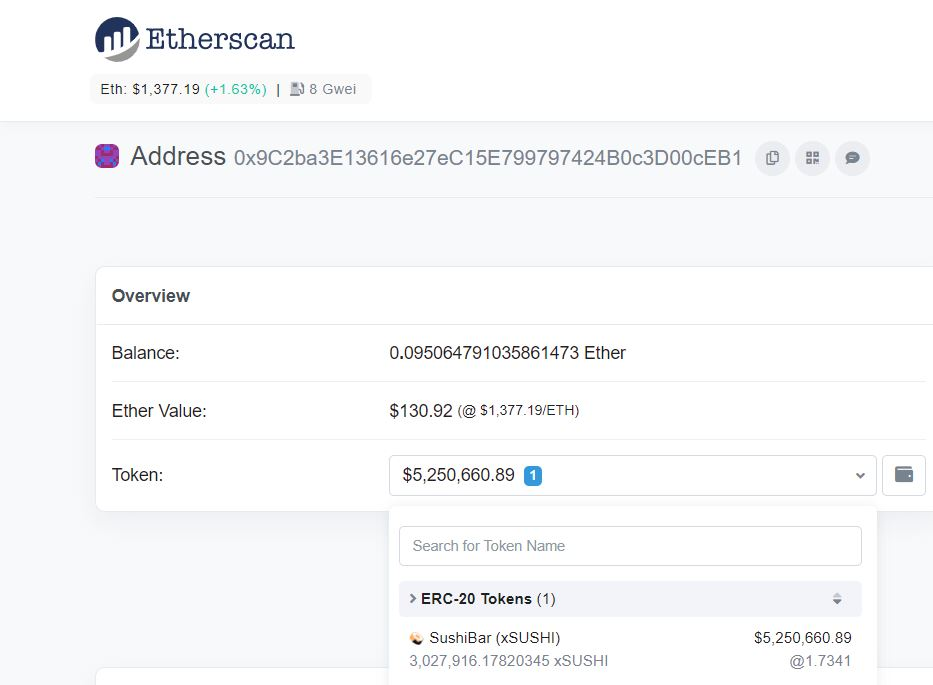

As part of the announcement, GoldenTree disclosed an investment of over 3 million SUSHI (worth $5.2 million at the time of writing). The fund also offered support and advisory services to SushiSwap in restructuring its tokenomics and designing the development strategy and operational models of its products.

GoldenTree also published its ETH wallet address to verify the investment in SushiSwap.

SUSHI’s price saw a significant increase following GoldenTree’s announcement.

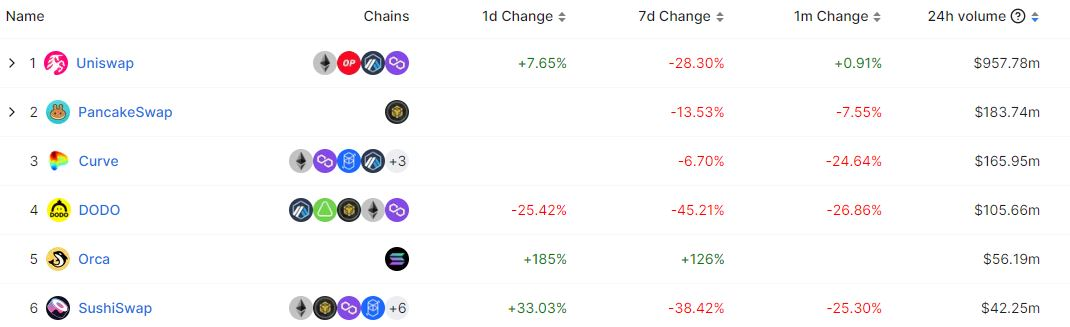

Despite this, the road ahead for SushiSwap to restore its position remains challenging. According to DeFi Llama, even though SushiSwap is deployed on 10 blockchains, its 24-hour trading volume stands at $42.25 million—23 times lower than Uniswap’s $957 million, despite Uniswap being available on only 4 blockchains/layer-2s.

Comparison of Major DEXs in the Crypto Space as of October 6, 2022

GoldenTree's interest in SushiSwap aligns with the trend of traditional financial giants re-entering the crypto space, following in the footsteps of BlackRock, Fidelity, NASDAQ, and most recently, DBS.