Grayscale's GBTC Shares Hit Record 43% Discount to Bitcoin

The GBTC (Grayscale Bitcoin Trust) shares have reached a historic low, trading at a 43% discount to Bitcoin, following news that Genesis Trading, a sibling company of Grayscale, has halted withdrawals due to its exposure to the FTX collapse.

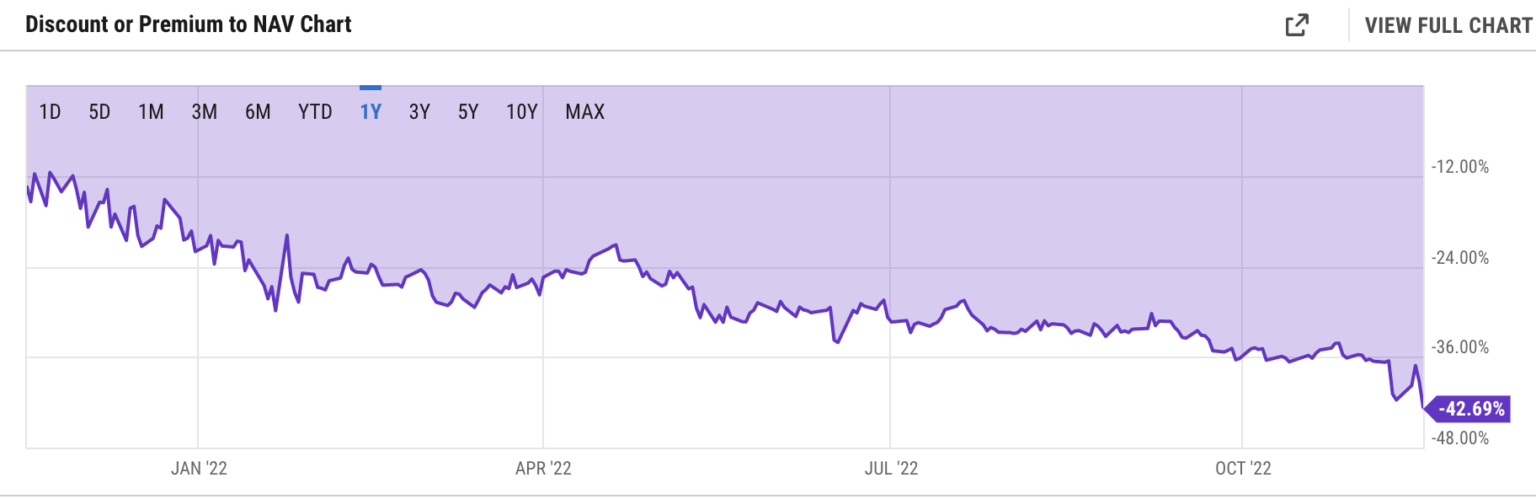

According to data from yCharts, the discount between GBTC shares and the underlying Bitcoin assets has reached -42.69%, the lowest since the product’s inception in 2017.

Price fluctuation of GBTC shares relative to Bitcoin from the start of 2022 to now. Source: yCharts

GBTC is a fund product issued by Grayscale, where the company holds a certain amount of Bitcoin (BTC) in the Grayscale Bitcoin Trust (GBTC). GBTC shares can be purchased by both individual and institutional investors through U.S. brokerage accounts, providing a popular indirect exposure to Bitcoin for U.S. entities.

Between 2017 and 2020, GBTC shares consistently traded at a premium to Bitcoin's market price due to overwhelming demand. At one point, GBTC was priced as much as 100% higher than Bitcoin, but this premium has gradually decreased to around 20-40% in subsequent years.

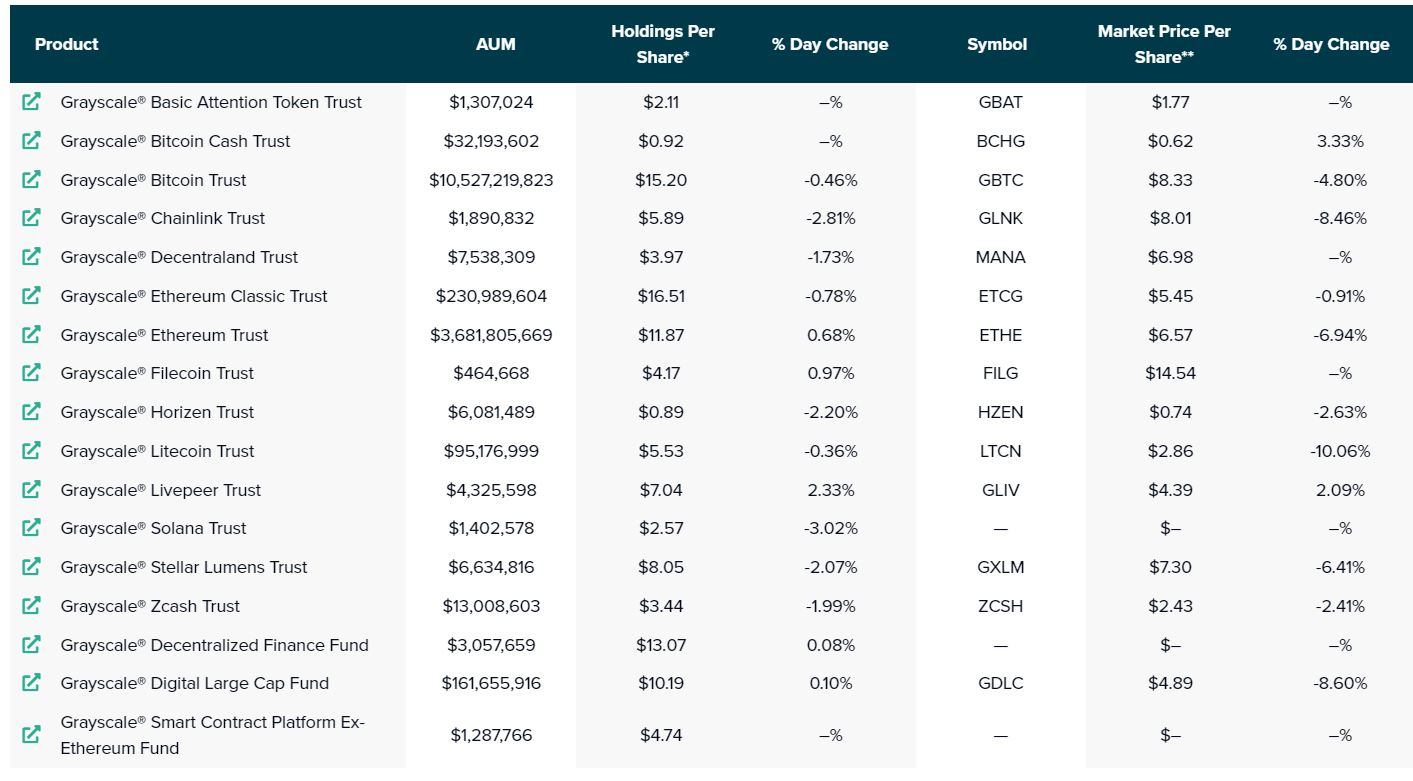

The popularity of GBTC led Grayscale to develop similar fund products for Ethereum (ETH) and other major altcoins in the crypto market. According to data from Grayscale's website, as of November 18, 2022, the company manages assets totaling $14.7 billion, including $10.5 billion in BTC and $3.6 billion in ETH.

Grayscale’s crypto fund products. Screenshot from Grayscale as of the morning of November 19, 2022

However, since the beginning of 2021, GBTC shares have continuously declined as demand waned. In 2022, as the crypto market experienced severe downturns following major events, GBTC faced significant sell-offs. In November, with news of Genesis Trading halting withdrawals due to its connection to the FTX bankruptcy, GBTC hit a new low, trading nearly 43% below Bitcoin’s actual value.

The impact on GBTC is due to the fact that Grayscale shares ownership with Genesis Trading. Investors are concerned that the ongoing crypto market crisis could further affect related companies like Grayscale and mining company Foundry, both subsidiaries of Digital Currency Group. Both Grayscale and Foundry have issued statements clarifying that they are not affected by Genesis.

In recent statements on November 19, Grayscale representatives reassured investors that their products remain safe and are fully custodied by Coinbase, the largest cryptocurrency exchange in the U.S. However, for security reasons, Grayscale cannot disclose wallet addresses, unlike the "Proof of Reserve" movement being adopted by major crypto exchanges following the FTX collapse.

[NEW TODAY] Due to recent events, investors are understandably inquiring deeper into their crypto investments. In this thread we’ve compiled additional information about the safety and security of the assets held by our digital asset products. https://t.co/MvTfUoK4o6 🧵

— Grayscale (@Grayscale) November 18, 2022

Grayscale has also provided a letter from Coinbase confirming that the exchange holds the company's assets and does not lend them out to third parties.

4) All digital assets that underlie Grayscale’s digital asset products are stored under the custody of Coinbase Custody Trust Company, LLC. Read more from @Coinbase’s CFO Alesia Haas, and CEO of Coinbase Custody Aaron Schnarch: pic.twitter.com/InBP9zPDkC

— Grayscale (@Grayscale) November 18, 2022