How The Merge Has Impacted Ethereum's (ETH) Supply After One Month

Although it has only been a month since The Merge upgrade, its impact on Ethereum's (ETH) supply is already becoming apparent.

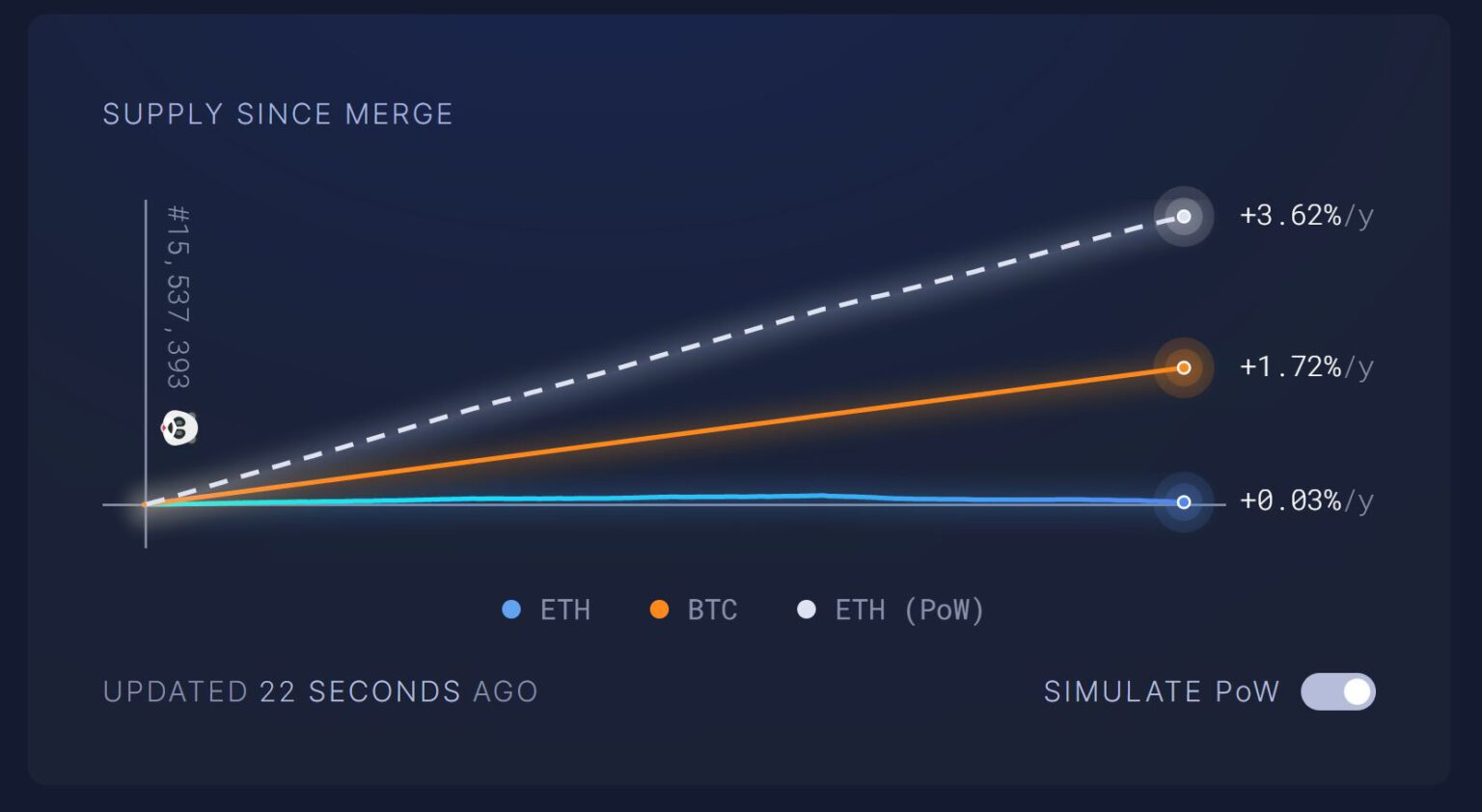

Ethereum Supply Growth Since The Merge

The Merge is arguably the most significant upgrade in Ethereum’s history to date. This upgrade transitioned Ethereum’s consensus mechanism from Proof-of-Work (PoW) to Proof-of-Stake (PoS). As a result, Ethereum no longer requires miners, cutting electricity consumption by up to 99% and reducing block rewards previously given to miners.

Furthermore, the annual inflation rate from rewards for PoS validators has dropped to just 0.03%, compared to over 3.6% under PoW.

Comparison of Supply Growth: Ethereum PoW (dashed line), Bitcoin (orange line), and Ethereum PoS (blue line)

Image source: Ultrasound.money as of 11:10 AM, 21/10/2022

According to data from Ultrasound.money, since The Merge successfully took place on September 15, the new ETH created amounts to 3,112 ETH. This figure is nearly 138 times lower than the 428,327 ETH that would have been minted as block rewards under PoW. This stark reduction highlights The Merge’s significant impact on lowering ETH’s annual inflation rate.

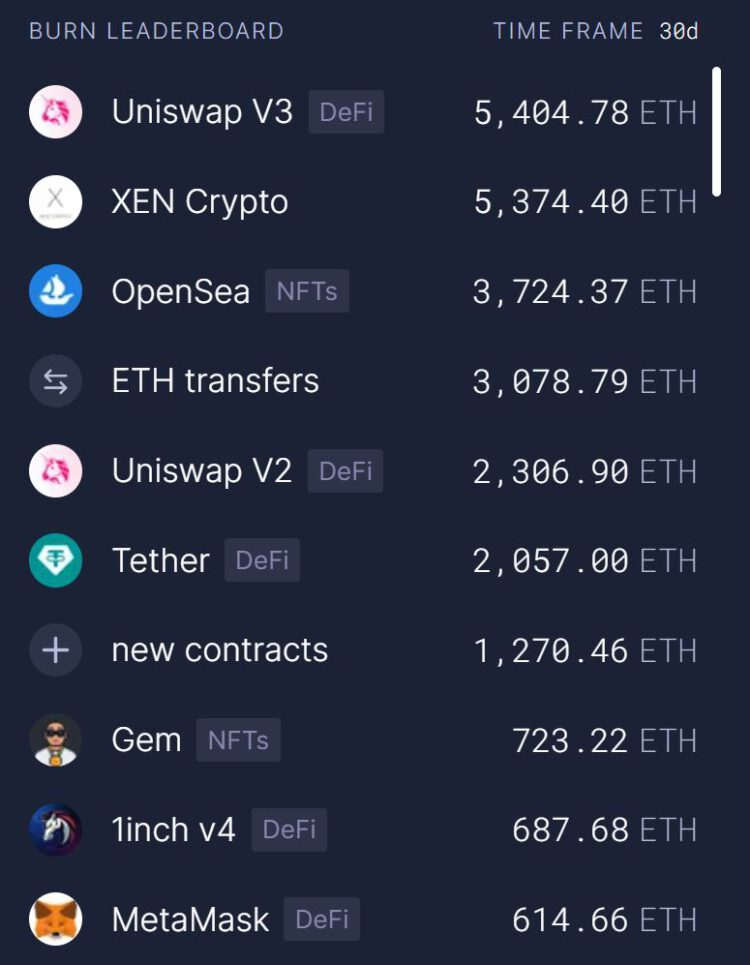

Ethereum advocates believe that combined with the EIP-1559 fee-burning mechanism, the network could even reach a deflationary state, where the amount of ETH burned daily surpasses the amount created.

ETH Supply Growth Over the Last 30 Days, Including EIP-1559 Impact

Image source: Ultrasound.money as of 11:10 AM, 21/10/2022

ETH Supply Fluctuations Over the Last 30 Days, Including EIP-1559 Impact

Image source: Ultrasound.money as of 11:10 AM, 21/10/2022

In the past 30 days, Ethereum has burned over 50,223 ETH from transaction fees, with significant contributions from DEXs like Uniswap and 1inch, NFT platforms like OpenSea and ENS, stablecoin transactions, and traditional ETH transfers.

Top Ethereum Fee Burners in the Last 30 Days

Image source: Ultrasound.money as of 11:10 AM, 21/10/2022

Despite this, Ethereum’s activity has decreased notably recently, leading to lower fee usage and preventing the network from achieving the desired deflationary effect. However, in the last 30 days, ETH supply growth has been negative, indicating that the intended effects are beginning to materialize.

Ethereum’s price post-The Merge has experienced a significant drop, affected by broader negative trends in the crypto market.

Daily Chart of BTC/USDT on Binance as of 11:20 AM, 21/10/2022