Huobi Delists In-House Stablecoin HUSD, Shifts to Justin Sun’s USDD

Despite Justin Sun's persistent denials of acquiring Huobi, the recent move to replace the in-house stablecoin HUSD with USDD signals otherwise.

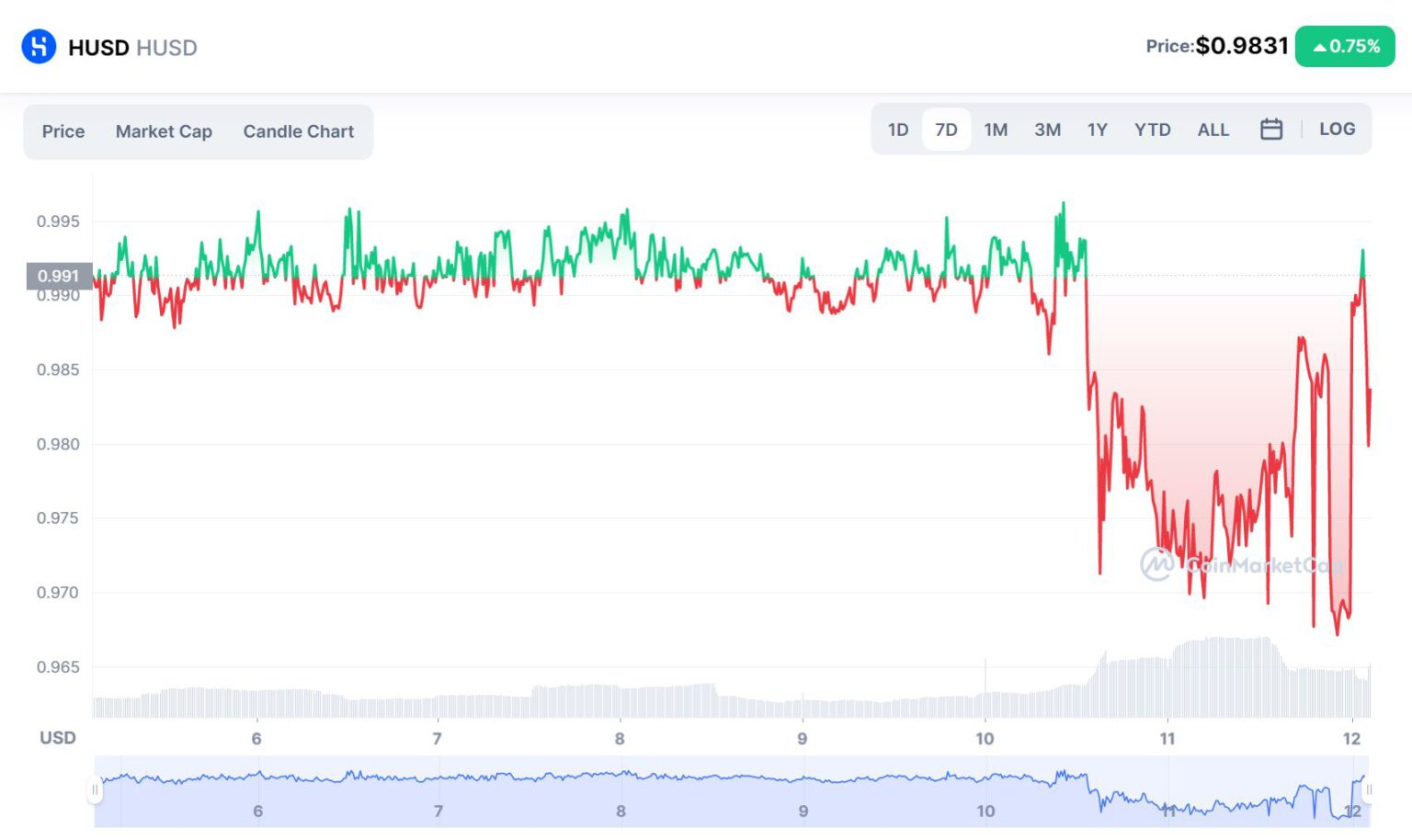

7-Day HUSD Price Chart from CoinMarketCap at 09:40 AM on October 12, 2022

As reported by Coin68 on October 8, Huobi recently announced a major ownership change. The exchange's founder, Leon Li, agreed to transfer approximately 60% of Huobi’s shares to Hong Kong-based investment firm About Capital Management, making About Capital the majority shareholder and effectively the new owner of the exchange.

This deal sparked speculation as About Capital appointed Justin Sun—founder of the TRON blockchain platform, owner of Poloniex, and a controversial figure in the crypto space—as an advisor to Huobi. Sun quickly updated his social media with news about Huobi, leading to widespread conjecture that he might be the actual new owner, orchestrating the acquisition through About Capital to avoid conflicts of interest.

However, in an interview with The Block, Justin Sun denied being the purchaser of Huobi, asserting he is merely an “advisor.”

Huobi Global announced the delisting of 21 HUSD-related trading pairs, including USDC/HUSD, BTC/HUSD, ETH/HUSD, HT/HUSD, etc. HUSD is a stable currency similar to BUSD issued by Huobi, which de-pegged not long ago.https://t.co/9EeyWBhpQK

— Wu Blockchain (@WuBlockchain) October 10, 2022

Nonetheless, Huobi's latest move seems to indicate otherwise. On the evening of October 10, Huobi announced it would delist all trading pairs containing Huobi USD (HUSD)—its in-house stablecoin—except for the USDT/HUSD pair. The number of HUSD trading pairs delisted reached 21. The exchange cited the reason as “to provide a better trading experience.” HUSD had experienced a depeg in August 2022 due to imbalances in the Curve pool, leading FTX to remove it from its currency basket.

Subsequently, in an interview with CoinDesk on October 11, Justin Sun stated that Huobi needs a stablecoin to compete internationally. This is why the exchange decided to replace HUSD with USDD—the algorithmic stablecoin of the TRON network, which Sun launched. USDD is touted by Sun as the “most decentralized” stablecoin and is continuously backed by reserves to prevent depegging.

"In the next three months, we probably will list all the cryptocurrency against USDD on Huobi," says @trondao Founder @justinsuntron, who was recently named a global advisor following About Capital's acquisition of Huobi.

— CoinDesk (@CoinDesk) October 11, 2022

More on his plans with $USDD: https://t.co/lQ7ywaMGck pic.twitter.com/VV2U6At4C3

Sun commented:

“In the next three months, we might create USDD trading pairs for all coins listed on Huobi.”

Additionally, Sun expressed optimism about Huobi potentially resuming operations in China, a key market for the exchange before China’s crypto ban in September 2021. He noted:

“Crypto is a global trend and cannot be isolated. That’s why China will become a major player in the blockchain industry, even if it faces short-term legal barriers. Long-term, I’m extremely optimistic.”

Sun also hinted that he might consider acquiring Huobi in the future, although not at present—another statement suggesting he might be the “true” owner behind Huobi.

The HUSD stablecoin's price briefly dropped below $1 following Huobi’s delisting announcement.

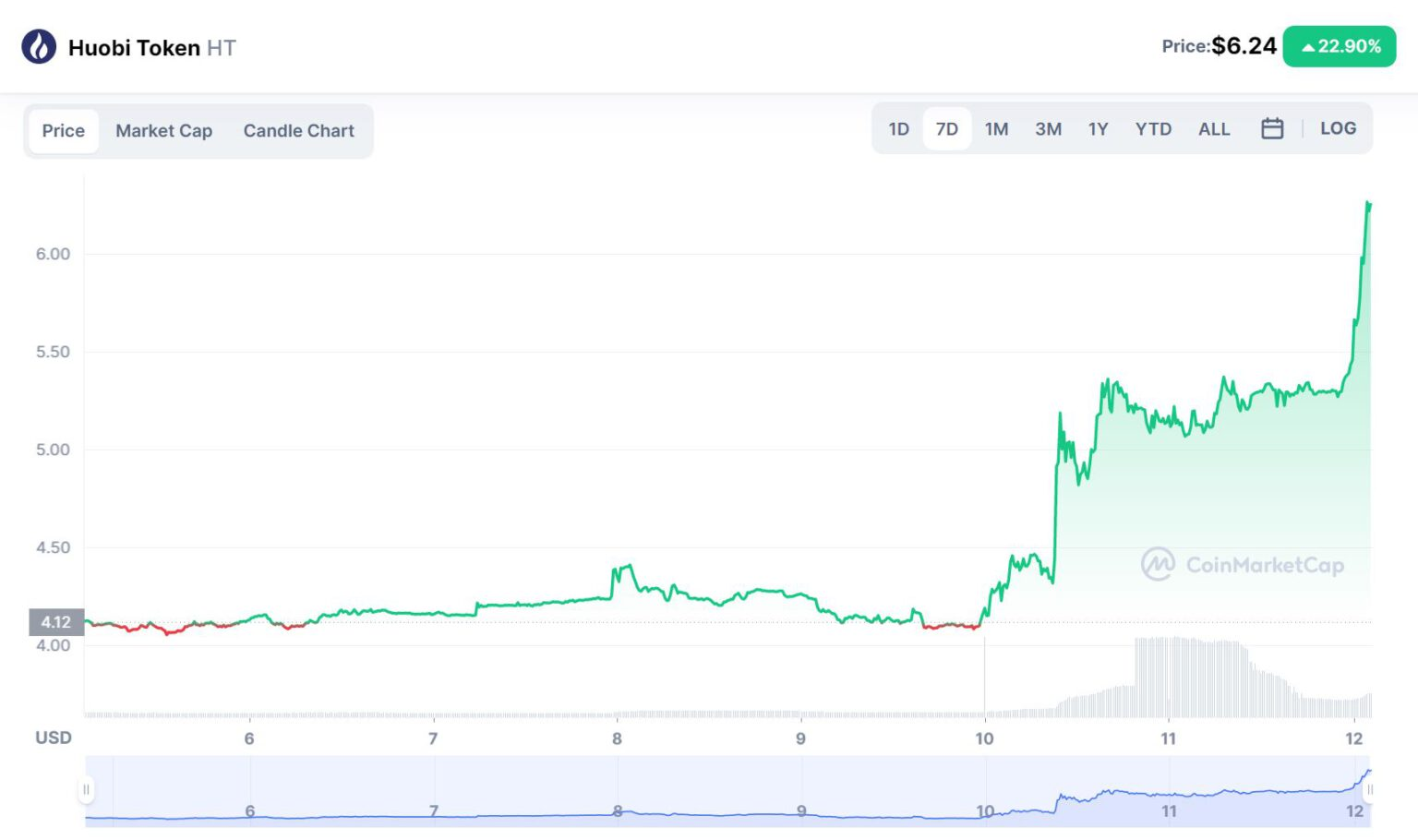

7-Day HT Price Chart from CoinMarketCap at 09:40 AM on October 12, 2022

Conversely, Huobi’s HT token has continued to experience impressive gains over recent days. TRON ecosystem tokens also saw a simultaneous increase when Huobi announced the ownership change.

The stablecoin battle continues amid the downtrend, with several new entrants emerging despite the collapse of the LUNA-UST model in May. New stablecoins introduced this year include USN from NEAR Protocol, USDD from TRON, GHO from Aave, and CUSD from Coin98. Additionally, Curve is rumored to be developing a stablecoin, while Binance controversially consolidated all stablecoin balances except USDT into BUSD, its own stablecoin, and expanded BUSD to various new blockchain ecosystems.