Key Revelations in Binance's Latest Asset Report

Binance's Proof of Reserves (PoR) shows that users continue to hold significant amounts of crypto assets on the exchange despite recent legal challenges.

Key Revelations in Binance's Latest Asset Report

Following the U.S. Securities and Exchange Commission's (SEC) conclusion of its investigation into Paxos over the BUSD stablecoin issued by Binance, questions arose regarding the impact on the exchange. In reality, the impact appears minimal, at least judging by the amount of cryptocurrency users are storing on the platform.

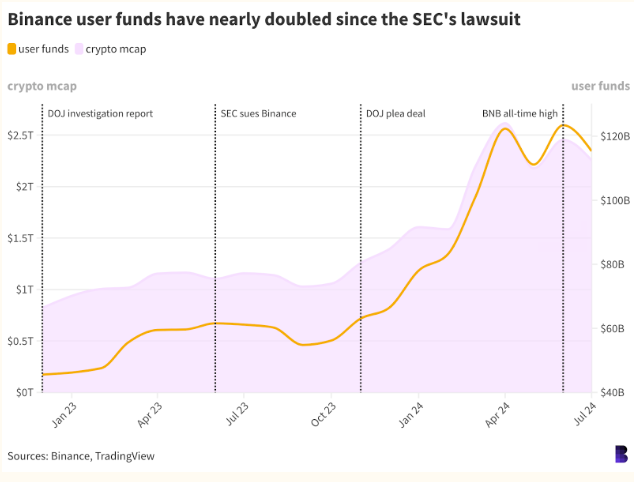

Binance's July 2024 PoR report reveals the exchange currently holds approximately $115 billion USD in user crypto funds, nearly doubling from $61 billion USD reported a year ago. When reports of the U.S. Department of Justice's (DOJ) years-long investigation into Binance surfaced in December 2022, the PoR figure then stood at only $45.6 billion USD.

At that time, BUSD was the seventh-largest stablecoin by market capitalization, valued at $16.1 billion USD before the SEC sent a Wells Notice to Paxos in February 2023. This led Paxos to halt BUSD issuance and burn $700 million USD of the stablecoin associated with Binance's reputation. Subsequently, various exchanges and CEO Changpeng Zhao gradually distanced themselves from BUSD. By January of this year, only $100 million USD of BUSD remained in circulation.

Following the loss of its flagship stablecoin, Binance began promoting new stablecoins like TrueUSD and FDUSD, headquartered outside the United States. Seizing the opportunity, USDT quickly filled the void left by BUSD. Over time, TrueUSD lost favor as Binance shifted its preference towards FDUSD, leading the exchange to delist trading pairs involving TUSD and distancing itself from this stablecoin.

Binance's July 2024 Proof of Reserves Asset Report

Comparing with the chart below, user deposits from January 2023 onward continue to rise to new highs despite ongoing legal challenges directed at Binance over the past year, demonstrating customers' unwavering trust in the exchange.

Total value of assets held by users on Binance at various milestones. Source: Blockworks

Despite former CEO Changpeng Zhao serving a 4-month prison sentence, total user assets deposited on Binance show no signs of decline, merely shifting in the proportion of cryptocurrency holdings.

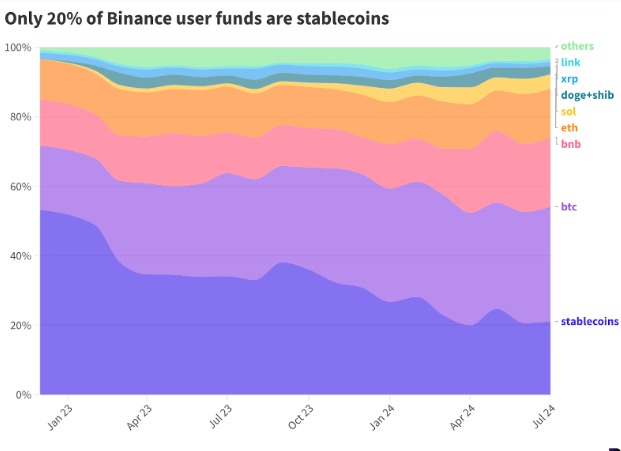

While Bitcoin (BTC) represented only 18% of users' funds in December 2022, this proportion has now increased to over 30%. Similarly, users increased their holdings of BNB from 14% to 20%, while ETH remained largely unchanged, fluctuating around 14%.

Notably, stablecoins now represent only about 20% of user deposits on Binance - equivalent to $24.4 billion USD - a decrease of more than 50% compared to pre-CZ legal troubles. This means 80% of user assets on Binance are held in Bitcoin and altcoins - the highest proportion recorded.

Fluctuation in user-held asset proportions on Binance. Source: Blockworks

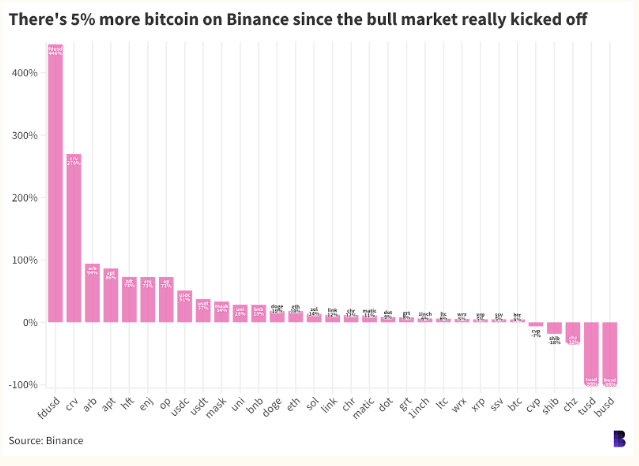

Users' favored cryptocurrencies have increased in their proportion of holdings compared to the period before legal issues surged, such as Curve (CRV), Arbitrum (ARB), Aptos (APT), Hashflow (HFT), Enjin (ENJ), and Optimism (OP) - all showing increases exceeding 70%, with CRV notably up by 270%, suggesting investors trust that this token's founder, Michael Egorov, has continuously supported its value despite market turmoil.

Chiliz (CHZ) and Shiba Inu (SHIB) rank at the bottom, experiencing declines of 32% and 18%, respectively. Meanwhile, USDT and USDC balances have grown by 51% and 37%, respectively.

Increase in holdings by Binance users by asset type. Source: Blockworks

These figures reflect the stable operation of the exchange and customer trust remaining steadfast in the face of actions by the SEC and U.S. Department of Justice directed at Binance.

However, Binance still faces numerous upcoming challenges due to ongoing conflicts with Nigeria, which have yet to be resolved. Under CEO Richard Teng's tenure, Binance has made changes and new directions aimed at strengthening its position.