MakerDAO to Allocate 600 Million DAI into Ethena's USDe Lending Pool

MakerDAO believes that utilizing DAI to support USDe and sUSDe will open up more DeFi opportunities for users.

According to a proposal posted on April 1st, the MakerDAO community is considering allocating an additional 600 million USD in stablecoin DAI to the liquidity pool of Ethena’s stablecoin USDe and its locked version sUSDe on Morpho Blue, the lending protocol of Morpho.

This proposal comes just days after Maker launched the USDe/DAI and sUSDe/DAI lending pools on Morpho Blue, allowing users to collateralize Ethena’s assets to borrow DAI. Initially, 100 million DAI was provided for the pool, which was quickly depleted, indicating high user demand.

Seraphim Czecker, Growth Director of Ethena Labs, stated that if the proposal is approved, it will help Ethena's TVL grow at the expected rate.

Maker has deployed a 100-million DAI Direct Deposit Module to Spark's sUSDe/DAI and USDe/DAI markets on Morpho Blue, enabling overcollateralized scalable liquidity for users interested in increasing their exposure to Ethena’s assets.

— Maker (@MakerDAO) March 29, 2024

Through @sparkdotfi, we collaborated with… pic.twitter.com/AEZlUASGsT

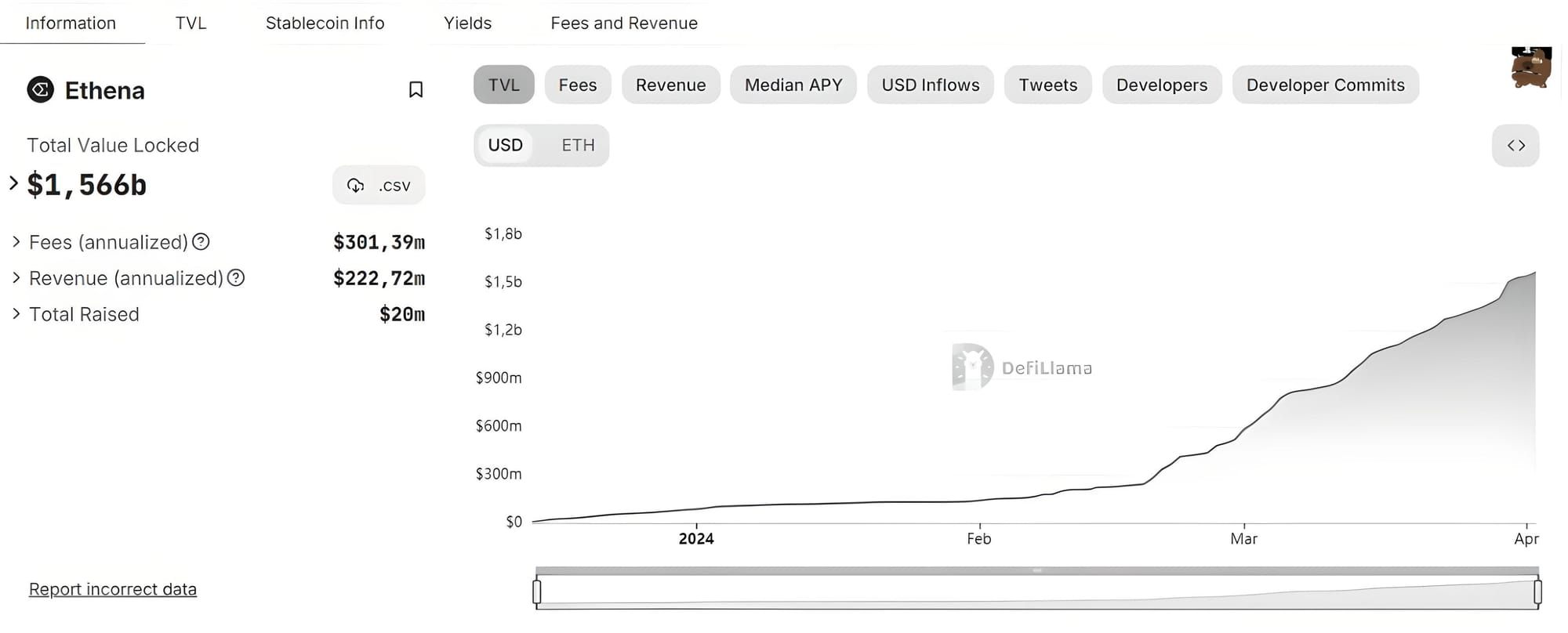

As reported by Coin68, although Ethena only launched in February 2024, it has already attracted 1.5 billion USD in TVL thanks to its unique model.

Not a joke: @MakerDAO considering allocating up to $600m DAI into sUSDe and USDe via @MorphoLabs with possibility to go up to $1 billion

— Seraphim (@MacroMate8) April 1, 2024

Ethena TVL growth is on track with internal expectationshttps://t.co/kKEhPoDwQm pic.twitter.com/F1QP1xPBFW

Ethena issues the USDe stablecoin backed by Ethereum (ETH). To hedge against the risk of ETH price drops affecting the stablecoin’s value, Ethena establishes short ETH positions on major exchanges, forming a delta-hedging strategy. The project also pays ETH staking interest and ETH futures funding fees to holders of the locked version, sUSDe, with an APR currently reaching 35.4%. Ethena’s ETH futures contracts account for 16.38% of the global ETH futures open interest.

TVL fluctuation of Ethena. Source: DefiLlama (April 2, 2024)

Recently, Ethena announced an airdrop of the governance token ENA based on shards (reward points) collected by users since the project’s mainnet launch in February. The ENA token is set to be listed on major exchanges on the afternoon of April 2nd.

Additionally, on April 1st, Ethena unveiled phase 2 of the shard program, now supporting Bitcoin (BTC) as collateral for USDe. The program will also award shard points to users who collateralize USDe/sUSDe on Morpho Blue to borrow DAI from Maker.

— Ethena Labs (@ethena_labs) April 1, 2024