Middle Eastern Conflict Shakes Markets: Bitcoin Takes a Hit

The assassination of a Hamas political leader in Iran has sparked fears of retaliation, leading to significant market turmoil. The Middle Eastern conflict “sneezes,” and Bitcoin “catches a cold.”

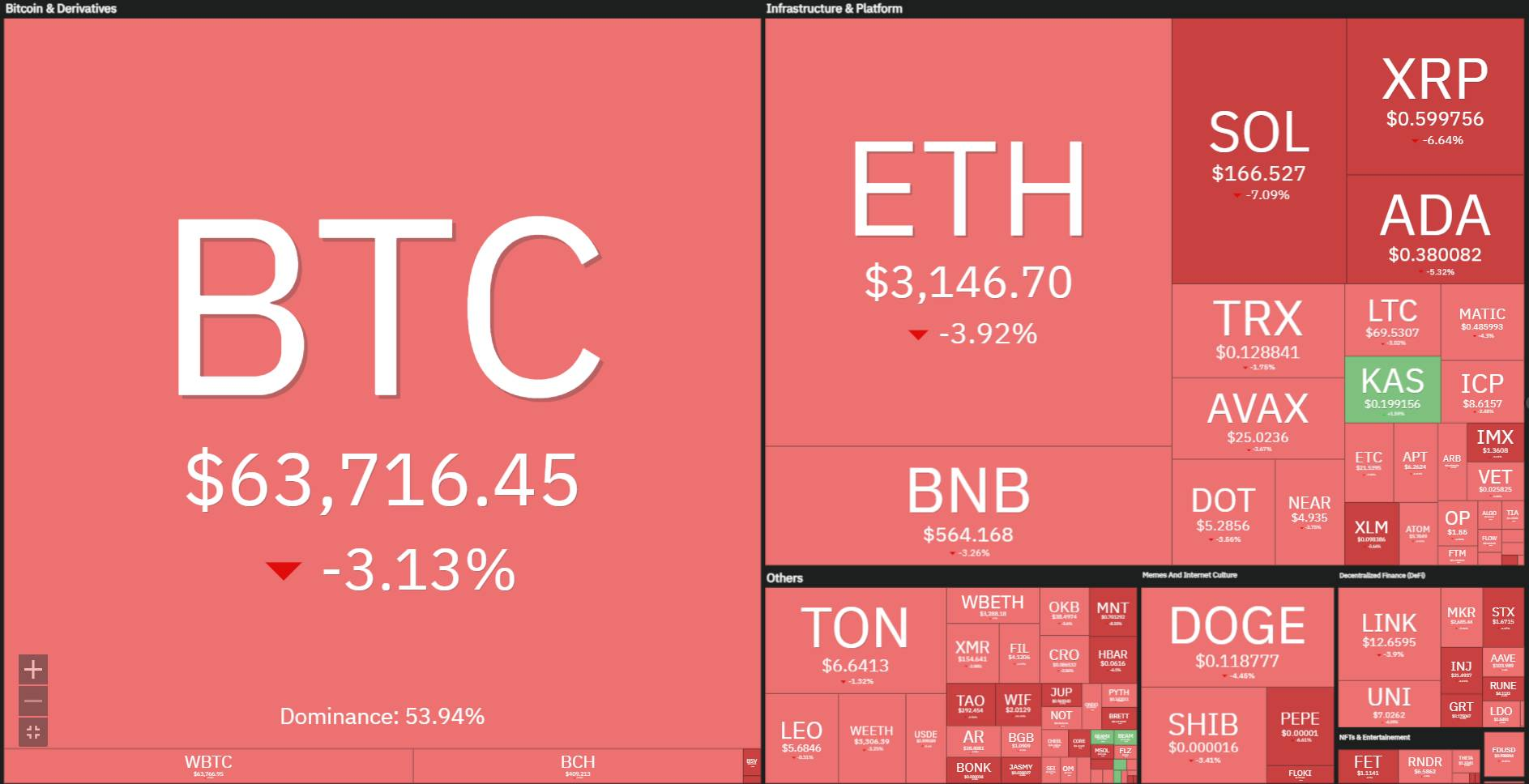

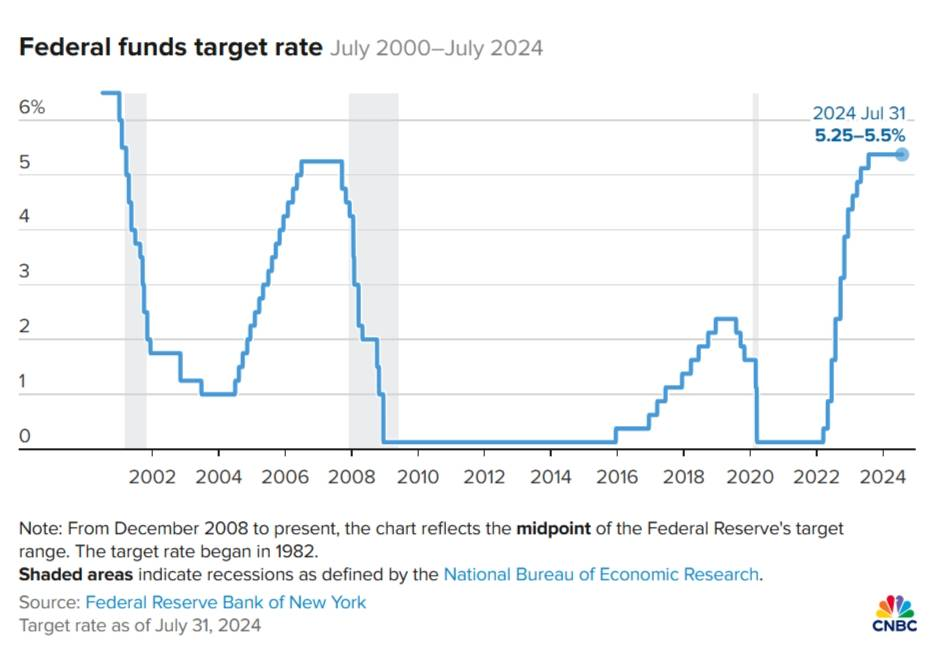

Fed Holds Interest Rates Steady

In the early hours of August 1, 2024, the U.S. Federal Reserve decided to keep interest rates unchanged at 5.25% - 5.5%, the highest level in 23 years.

Historical U.S. Interest Rate Movements. Source: CNBC (01/08/2024)

However, the Federal Reserve did not provide a clear signal for future rate cuts, only noting that inflation is nearing its target. In the press conference following the Fed meeting, Chair Jerome Powell dismissed the possibility of a 0.5% rate cut in September.

Fed Interest Rate Adjustments Since Early 2022. Source: CNBC (01/08/2024)

Middle Eastern Tensions Escalate

Following the interest rate news, attention shifted to escalating geopolitical tensions in the Middle East. On July 31, Ismail Haniyeh, a Hamas political leader, was assassinated while attending the inauguration of Iran’s new president, Masoud Pezeshkian.

Suspicion has fallen on Israel, which had previously vowed to eliminate Haniyeh and other leaders due to escalating conflict since October 2023. The assassination also exposed significant security vulnerabilities in Iran.

Iranian leaders have vowed retaliation, raising fears of a broader conflict in the Middle East, which is already tense due to the Israel-Hamas conflict in Gaza and Israel-Hezbollah tensions in Lebanon.

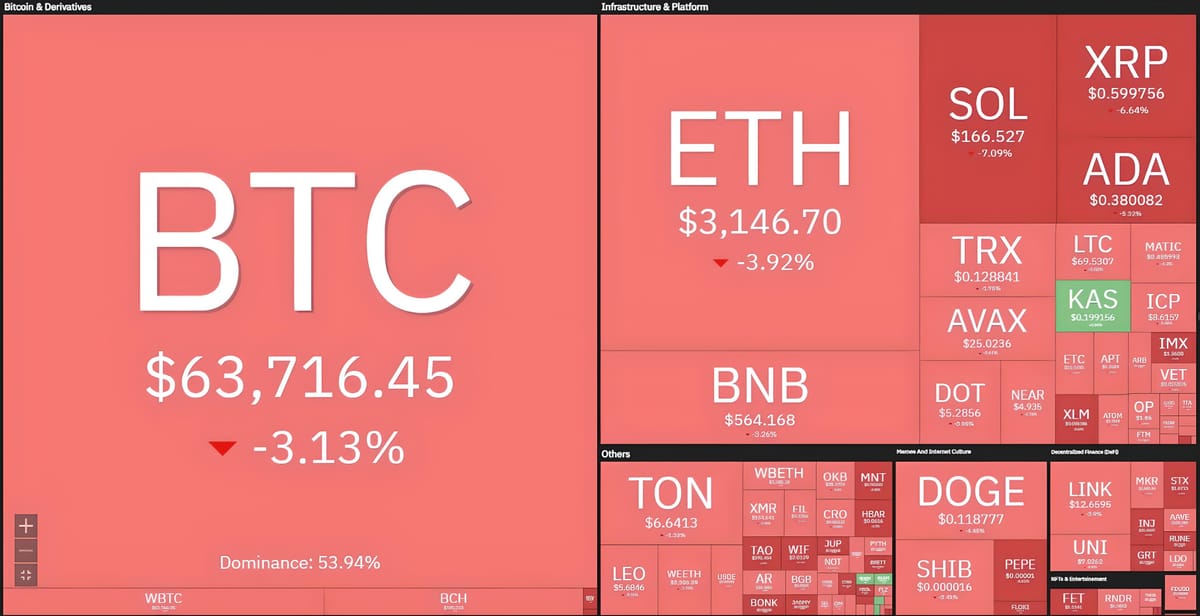

Crypto Market Gets Hammered

Bitcoin and the broader crypto market are reacting negatively. Bitcoin (BTC) plummeted several thousand dollars within a few hours, dropping from around $66,500 to $63,600. In the last 24 hours, the leading cryptocurrency has fallen nearly 4%.

1-hour Chart of BTC/USDT on Binance at 01:20 PM on August 1, 2024

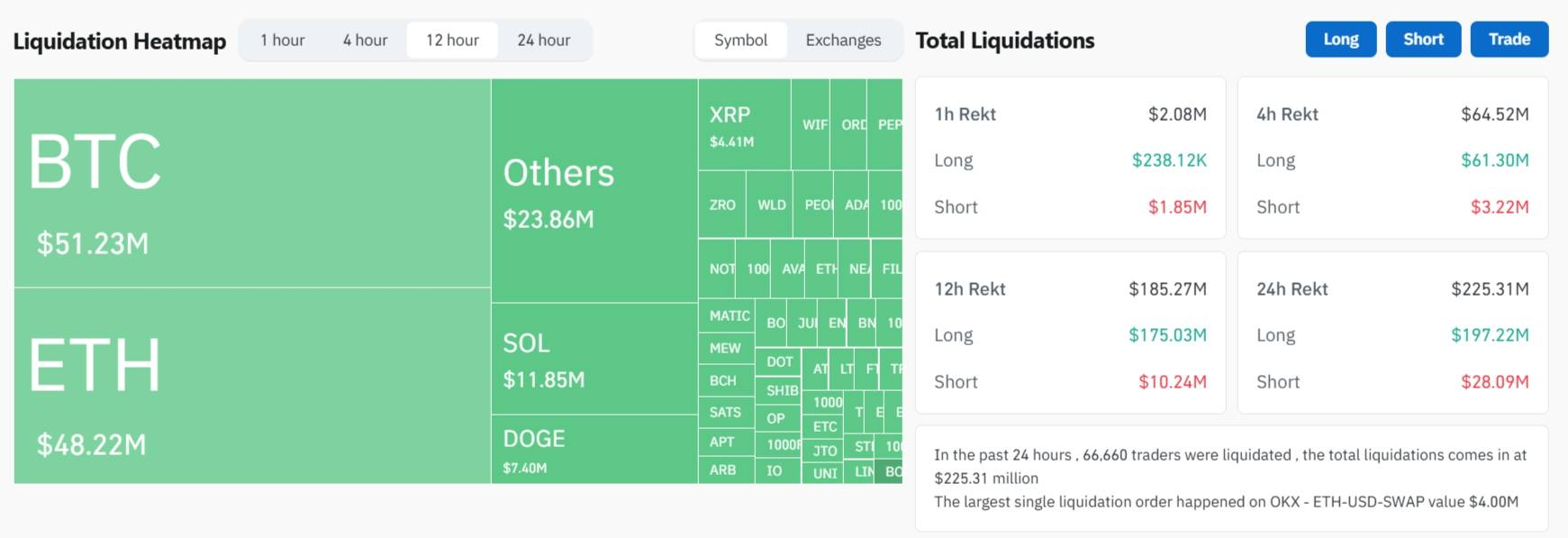

Major altcoins such as Ethereum (ETH), Solana (SOL), Avalanche (AVAX), and Cardano (ADA) are also in the red. In the last 12 hours, $185 million in leveraged positions were liquidated, with nearly 95% of the liquidations occurring in long positions.

12-hour Liquidation Data. Source: CoinGlass at 01:20 PM on August 1, 2024

Bitcoin and Ethereum ETFs also had a rough trading day, with Bitcoin ETFs recording an inflow of less than half a million dollars, while Ethereum ETFs saw outflows of $77 million.

🚨 US #ETF 31 JUL: 🟢$0.3M to $BTC and 🔴$77M to $ETH

— Spot On Chain (@spotonchain) August 1, 2024

🌟 BTC ETF UPDATE (final): +$0.3M

• The net flow turned barely positive after a day of outflow.

• The new #Grayscale Bitcoin Mini Trust (BTC) received an inflow of $19M on its first trading day, preceded by only BlackRock… pic.twitter.com/6iMJdvXP2P

In contrast, traditional assets have generally seen gains. The USD exchange rate and U.S. Treasury bond yields fell, contributing to a rise in gold prices. Gold increased by 1.5% to $2,450, while WTI crude oil jumped by 5%. Equities also surged, with the Nasdaq 100 rising 3% and the S&P 500 closing up 2.2% for the day.