Nearly $180 Million Short Positions Liquidated as BTC Surpasses $44k Mark

Bitcoin's breach of the $44,000 mark has led to the liquidation of approximately $178 million in short positions across centralized cryptocurrency exchanges (CEX) in the past 24 hours.

Close to $200 Million Short Positions Liquidated as BTC Surpasses $44k

Bitcoin's surge past the $44,000 mark has resulted in a significant increase of over 48% in just 1.5 months, rising from $30,000 to $44,488 on Binance - its highest level since early April 2022, following the May crashes of LUNA/UST and FTX in November of the same year. This has spurred positivity in the market with many Bitcoin whales returning to large-volume buying trades.

Bitcoin is at over 41,000! 🚀$BTC has reached a new year-to-date high thanks to a massive buying wall, a shift in the future markets and a wipe out of shorts. Read the latest Bitfinex Alpha to find out more:https://t.co/6ho86Hvejl pic.twitter.com/HiKucRHzzf

— Bitfinex (@bitfinex) December 4, 2023

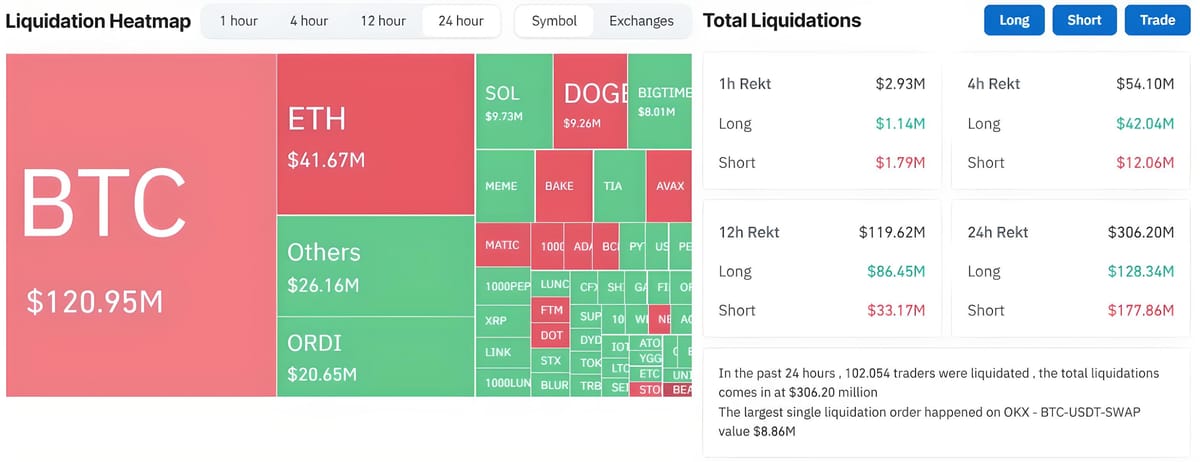

This also translates to many investors anticipating a negative trend in liquidated short positions. According to Coinglass data, nearly $200 million in short positions were liquidated across centralized cryptocurrency exchanges in the past 24 hours, including over $100 million in BTC short sales and over $40 million in ETH short sales, with a short ratio of 58.07%.

However, this figure still falls short of the $260 million in derivative orders liquidated in mid-November 2023 during the crypto market correction, with an 89.62% long order ratio.

Heatmap showing liquidated positions of multiple cryptocurrencies on CoinGlass. Photo taken at 08:30 PM on 06/12/2023

December 2023 has also witnessed a significant increase in liquidations across the entire cryptocurrency market. Since the beginning of the month, exchanges have recorded over $614 million in short liquidations.

Chart depicting total liquidation volume across the entire cryptocurrency market from 08/09 - 02/12/2023. Source: Coin