Nearly $700 Million Wiped Out from Solana Ecosystem

Statistics reveal that hundreds of millions of dollars have been wiped out from Solana’s DeFi ecosystem following the catastrophic collapse of FTX.

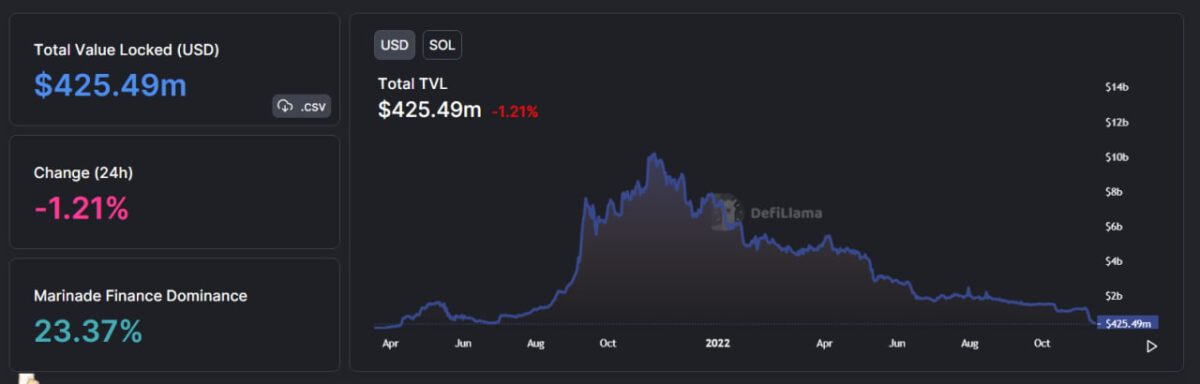

In its peak period in November 2021, the DeFi ecosystem on Solana boasted over $10 billion in assets, thriving under the leadership of billionaire Sam Bankman-Fried, the founder of FTX, Multicoin Capital, Sino Global Capital, and several other firms.

A year later, the total value locked (TVL) in this ecosystem has plummeted to just over $400 million. The downfall of FTX has caused immense disruption in the cryptocurrency market, leaving lasting impacts. Multicoin and Sino Global have reported losses in the millions, and the Solana Foundation itself has suffered tens of millions in damages.

See also: What’s Next for the Solana Ecosystem After the FTX Collapse?

Total Value Locked (TVL) on Solana. Source: DeFi Llama

Sam Bankman-Fried had famously boasted to a trader, “I will buy all the SOL you have right now at $3… then you can get lost.” Now, these words are a painful memory.

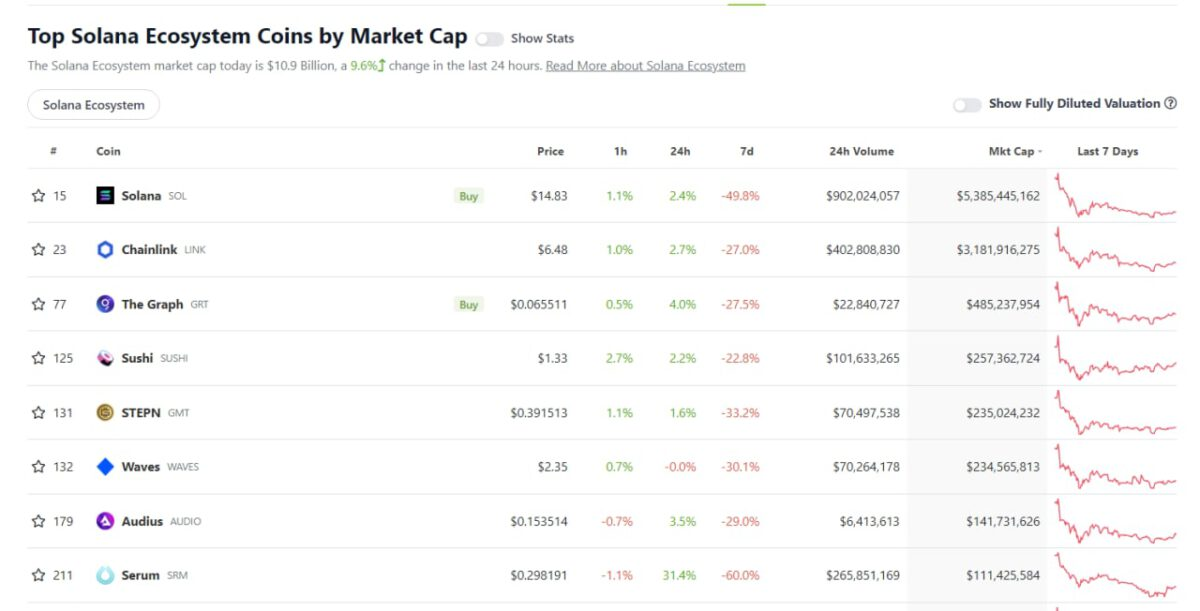

Not only has over $700 million in TVL vanished, but SOL’s price has also struggled, losing 50% in value over recent days. Related DeFi tokens are also struggling to recover.

1H Chart of SOL/USDT on Binance as of 07:45 PM on 11/15/2022

Price Movements of Top Solana Coins/Tokens. Source: CoinGecko

The lending platform Solend has been hit hardest, with its TVL now down to $30 million, a significant drop from its November peak of $280 million.

Data from DeFiLlama shows that over 40% of liquidity on decentralized exchanges (DEXs) Raydium and Orca has exited the platforms over the past week, with both having held over $150 million just a few weeks ago.

“Solana has suffered a much more severe and painful blow compared to other blockchains,” said Alexei Kulevets, co-founder of Walken.