NFT Trader Nets 800 ETH by "Trapping" Automated Bot

Noticing an automated bot copying his trades, NFT trader Hanwe Chang devised a plan to trap the bot into higher prices, resulting in a profit of 800 ETH, equivalent to $1.5 million.

Noticed that someone's bot was copying my bids on Blur, so I decided to trick him...

— Hanwe (@HanweChang) August 5, 2023

Made 800 ETH profit thanksss pic.twitter.com/KlaXKUFUBK

In a Twitter update, Hanwe Chang revealed that after discovering a bot automatically mimicking his trades on the Blur platform, he decided to trap the bot by quickly listing his NFTs at a significantly higher price.

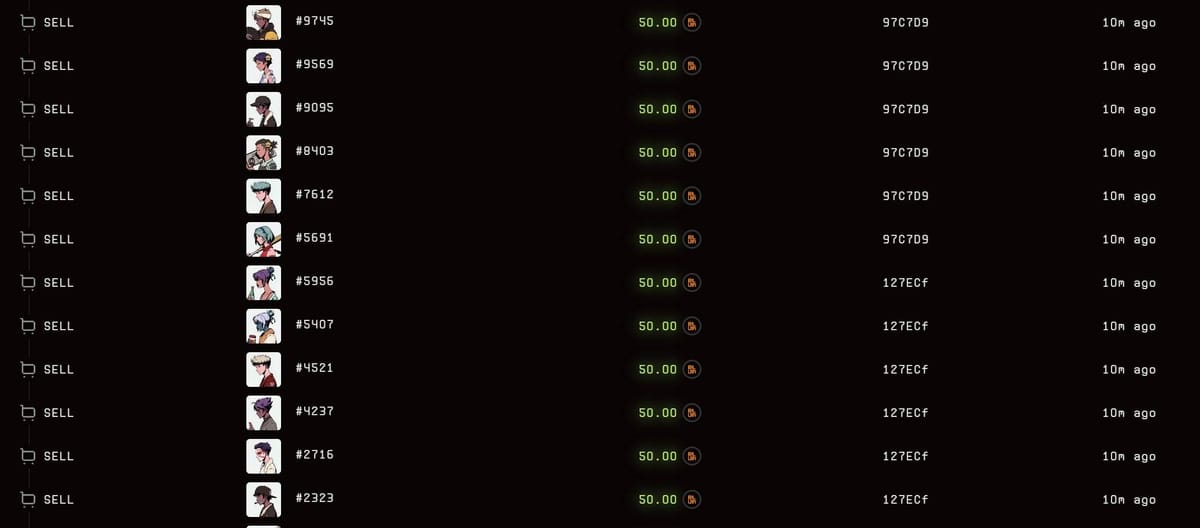

On August 6, Hanwe purchased 12 Azuki “Off White A” NFTs at a starting price of under 5 ETH each, then listed them for 50 ETH (approximately $91,500) each. This move catapulted him to the top of Blur’s trading leaderboard with around 16,000 points for the day.

The owner of the bot, Twitter account Elizab.eth, expressed a willingness to return the money, allowing Hanwe to keep 10% of the profit.

However, the legality of these actions has sparked debate. Some argue that Hanwe’s actions amounted to fraud, as he placed bids he did not intend to have accepted to trigger other bids.

Step 1: Hanwe places fraudulent out-of-market bids they don’t want accepted (this is the defining characteristic) to elicit other bids.

Step 2: Hanwe dumps assets into the other bids.

Placing bids you don’t want accepted solely to trigger other bids is the illegal part.

— DAVE III (@dgoldzz) August 5, 2023

While many view Hanwe’s actions as a clever use of tactics, demonstrating a classic case of player-versus-player (PvP) strategy, the incident underscores ongoing vulnerabilities and risks within the NFT and cryptocurrency markets.

Context on how @HanweChang executed a plan to perfection and made 800e by selling "Off White A - Background color" azuki at 50e each and azuki elementals at 15e each.

— A Raving Ape 🟡 (@a_raving_ape) August 5, 2023

This is an epic case of PvP in the current NFT trading market ⚔️

Hanwe has been coasting at the top spot of… pic.twitter.com/M8Ujm8CquJ