Over $200 Million in Crypto Liquidated as Bitcoin Reaches $66,000

A sudden Bitcoin dump and crypto market crash on the morning of April 2 left many investors caught off guard.

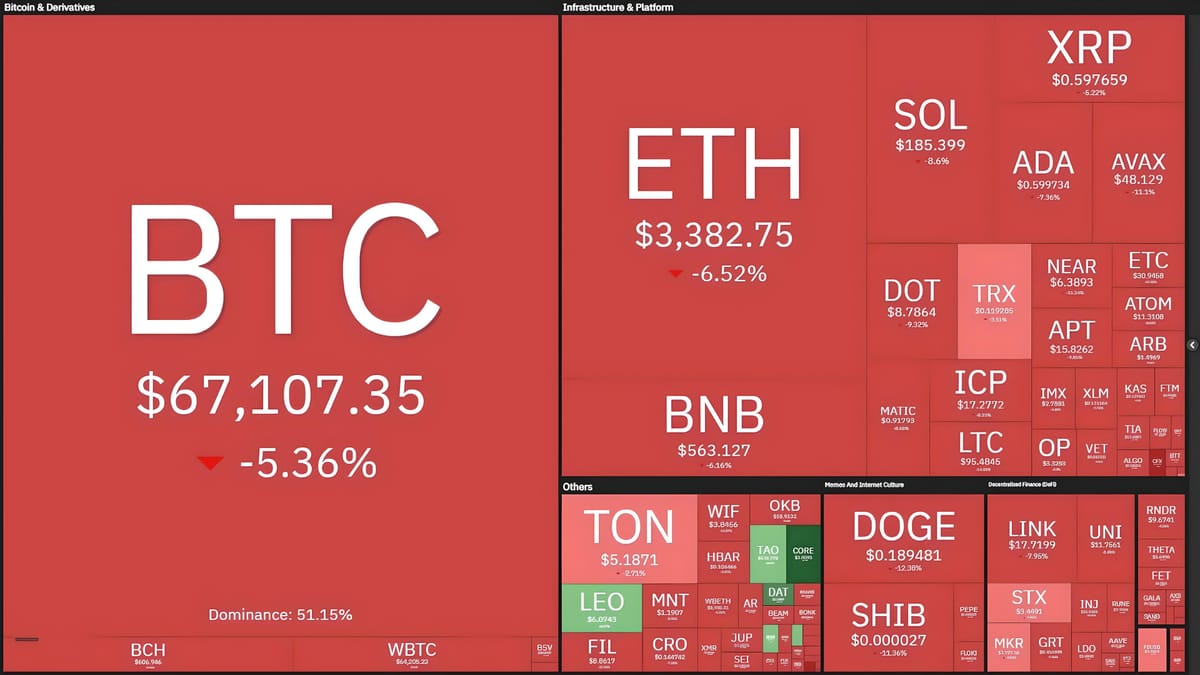

Market fluctuations of top cryptocurrencies at 10:35 AM on April 2, 2024. Source: Coin360

Around 09:15 AM on April 2, 2024, Bitcoin (BTC) unexpectedly plummeted from $69,000 to as low as $66,000 on Binance, marking a 5.4% drop over the past 24 hours.

Previously, on noon of April 1, BTC also experienced a dump from $70,400 to $69,000.

1-hour chart of BTC/USDT pair on Binance at 10:35 AM on April 2, 2024

Other leading cryptocurrencies at the time of writing this article also saw declines ranging from 6% to 12%.

Data from CoinGlass shows that in the past 4 hours, over $200 million in derivative positions were liquidated across the cryptocurrency market, predominantly focusing on BTC, ETH, and various altcoins. Among these, long positions accounted for 84.5% of the liquidations.

Screenshot of recent cryptocurrency market liquidations on CoinGlass at 10:40 AM on April 2, 2024

Currently, there is no specific information regarding the cause of the latest downward movement in the top cryptocurrency. However, according to statistics from Farside Investors, Bitcoin spot ETFs recorded $85.7 million in outflows on April 1 (US time), led by Grayscale's GBTC which saw BTC sell-offs amounting to $302 million.

This suggests that Bitcoin ETFs have broken a streak of 4 consecutive days of inflows last week, potentially signaling a return to a dominance of outflows seen during the period from March 18 to March 22.

Statistics of Bitcoin spot ETF inflows/outflows. Source: Farside Investors (April 2, 2024)

As reported by Coin68, Bitcoin has recently set record monthly and quarterly candle closes amidst the upcoming Bitcoin halving event scheduled for April 20, just three weeks away.