Over $260 Million Liquidated as Crypto Sell-Off Persists

The crypto market has witnessed a significant sell-off from large-scale users over the past two days, resulting in a sudden surge in liquidations.

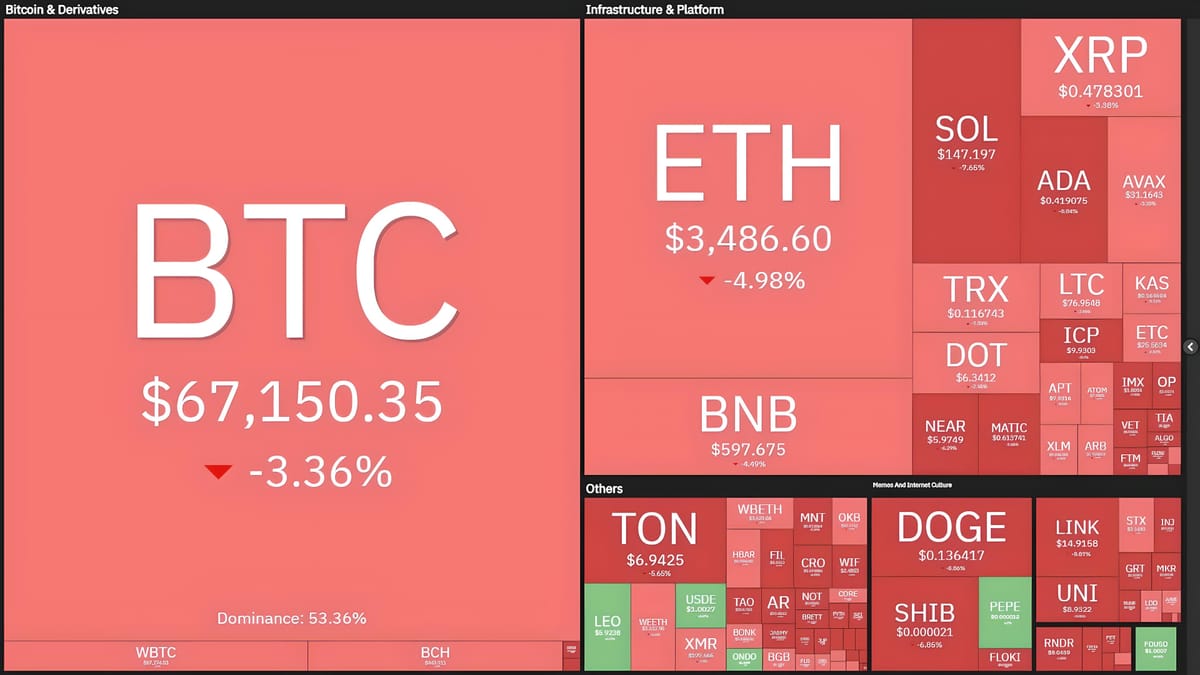

Value Fluctuations of Leading Cryptocurrencies as of 08:35 AM on 12/06/2024.

Source: Coin360

According to CoinGlass, this sell-off has led to approximately $260.13 million USD in liquidations across leveraged positions within the last 24 hours, with a substantial portion, $223.08 million USD, coming from long positions.

Data on Liquidations in the Last 24 Hours.

Screenshot from CoinGlass at 08:35 AM on 12/06/2024

At the time of writing, long positions account for nearly 86%, amounting to $223.08 million USD, while short positions are minimal, at $37.06 million USD. The top two tokens favored for liquidation remain Ethereum and Bitcoin. Ether leads with a liquidation sum of $71.2 million USD, with $61.87 million USD from long orders. Following closely is Bitcoin, with $68.1 million USD liquidated, including $52.83 million USD from long orders.

CoinGlass reports that over 100,000 investors have exited their positions, contributing to the $260.13 million USD liquidation. Binance, the world's largest centralized exchange, witnessed significant liquidation orders for the ETH-USDT pair, totaling $6.6 million USD.

Binance continues to lead the list of CEX exchanges with the highest liquidation volumes, totaling over $94 million USD in trading. Other significant positions include OKX with $86.83 million USD, HTX with $35.27 million USD, and Bybit with $23.45 million USD in liquidations.

This phenomenon is partly attributed to the upcoming dual macroeconomic data announcement from the Federal Reserve (Fed), including the monthly Consumer Price Index (CPI) and interest rate announcements.

Additionally, selling pressure from U.S.-based Bitcoin spot ETFs continued for a second consecutive day, with outflows totaling $200 million USD, led by Grayscale's GBTC fund. No ETFs recorded inflows during the trading session on June 11th, as reported by Coin68. Previous records showed 19 consecutive days of inflows for Bitcoin ETFs, yet they failed to push BTC to new highs.

Inflow/Outflow Statistics of Bitcoin Spot ETFs.

Source: Farside Investors (12/06/2024)

Speaking to The Block on June 11th, Luuk Strijers, Chief Operating Officer at Deribit, highlighted Bitcoin's heightened correlation with risk assets.

"Traders should exercise caution, considering reducing exposure to Bitcoin or utilizing options strategies for risk management until economic conditions become clearer. Implied Volatility (IV) has decreased across Bitcoin and Ether supply-demand curves. Despite short-term uncertainties, basis yields and trading spreads remain high across all order terms," Mr. Strijers commented.

Bitcoin, the largest cryptocurrency by market capitalization, has declined by 3.31% over the past 24 hours, trading at $67,000 USD.

1-hour Chart of BTC/USDT Pair on Binance at 08:40 AM on 12/06/2024

The second-largest cryptocurrency by market capitalization, Ethereum, has decreased by 4.88%, trading at $3,473 USD at the time of writing.

1-hour Chart of ETH/USDT Pair on Binance at 08:40 AM on 12/06/2024