Over $280 Million Liquidated in Morning Dump on 11/12

The crypto market experienced significant volatility on the morning of December 11, resulting in a sharp increase in liquidated derivative positions.

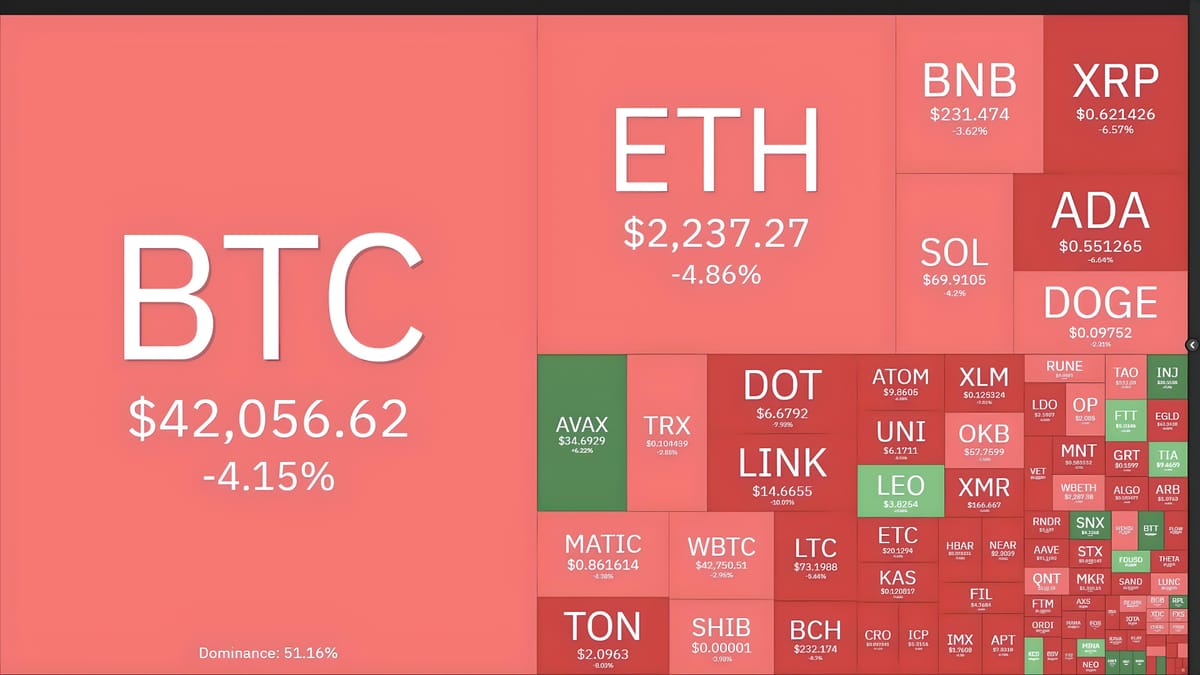

Volatility among leading cryptocurrencies at 09:50 AM on 11/12/2023. Image: Coin360

Around 09:10 AM on December 11, Bitcoin unexpectedly saw a major drop, plummeting from $42,600 to $40,400, erasing gains made earlier in the week. However, BTC later recovered back to $42,000.

1-hour chart of BTC/USDT pair on Binance at 09:50 AM on 11/12/2023

Similarly, Ethereum also felt negative impacts from the correction, dropping over 5% from $2,310 to $2,161 before rebounding to around $2,240.

1-hour chart of ETH/USDT pair on Binance at 09:50 AM on 11/12/2023

Meanwhile, Solana (SOL), which had seen significant growth recently, "free fell" from $72 to $64. However, unlike BTC and ETH, SOL bounced back strongly and is now approaching $70, recovering most of its losses.

1-hour chart of SOL/USDT pair on Binance at 09:50 AM on 11/12/2023

Other major caps like AVAX, ADA, XRP, BNB, etc., also recorded corrections ranging from 3% to 5% during the morning of 11/12.

Data from CoinGlass shows over $280 million in derivative liquidations within just half an hour during the recent dump, with long positions accounting for nearly 96%. Notably, unlike typical scenarios where BTC and ETH dominate the assets being liquidated, this chart prominently features SOL and other altcoins.

Liquidation data in the past hour, screenshot from CoinGlass at 09:55 AM on 11/12/2023

This week will witness two crucial macroeconomic announcements that could impact Bitcoin specifically and the cryptocurrency market in general:

- December 12, 08:30 PM: The US will release inflation data for November, reflected through the Consumer Price Index (CPI).

- December 14, 01:30 AM: The Fed will announce its final interest rate decision of 2023, with many predicting the Federal Reserve to begin rate cuts in 2024.