Pendle Nears $4 Billion TVL, Becoming the Largest Yield Farming Protocol

Pendle Finance has seen its Total Value Locked (TVL) surge by over 60% in the past month, reaching a record volume of $450 million on April 3.

Pendle Nears $4 Billion TVL, Becoming the Largest Yield Farming Protocol

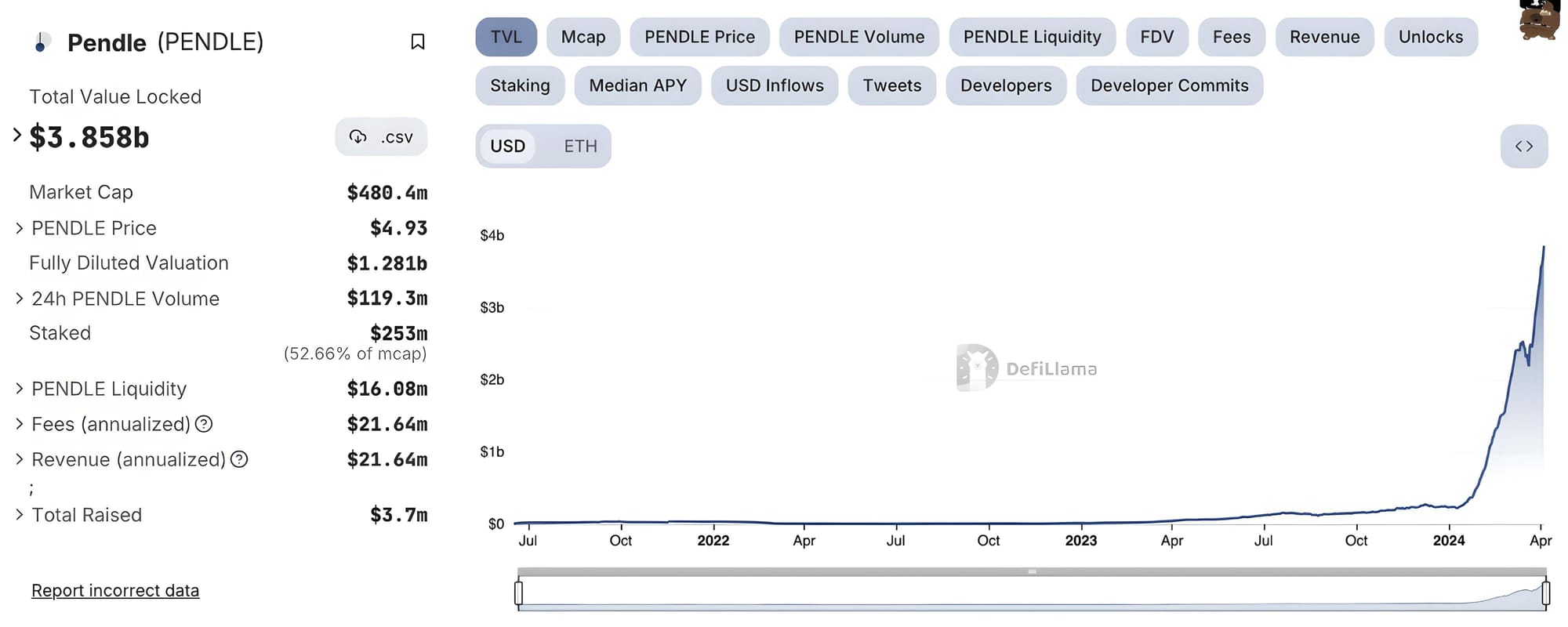

Fueled by the airdrop campaign from the decentralized stablecoin project Ethena, known as the Sats Campaign, Pendle Finance has significantly benefited. The protocol’s TVL has soared to $3.9 billion, marking a 40% increase in just two weeks, according to DefiLlama.

TVL of Pendle Finance. Source: DefiLlama

Following the success of Season 1, traders are flocking to participate in the Sats Campaign, aiming to receive ENA tokens. DeFi investor Thor Hartvigsen notes that investing $10,000 in USDe Yield Tokens (YT) on Pendle can yield ENA tokens worth over $80,000, demonstrating the lucrative returns that have driven activity on Pendle.

Recently, Pendle celebrated reaching a $400 million market cap in the USDe pool of Ethena.

GM, cap raised to 400M for @ethena_labs USDe pool on Ethereum 🌊 pic.twitter.com/9UlpImKobO

— Pendle (@pendle_fi) April 4, 2024

Apart from Pendle, Season 2 of Ethena's airdrop also involves other DeFi platforms such as MakerDAO, Morpho, Mantle, and EigenLayer. For specific criteria for each project, readers can refer to this article.

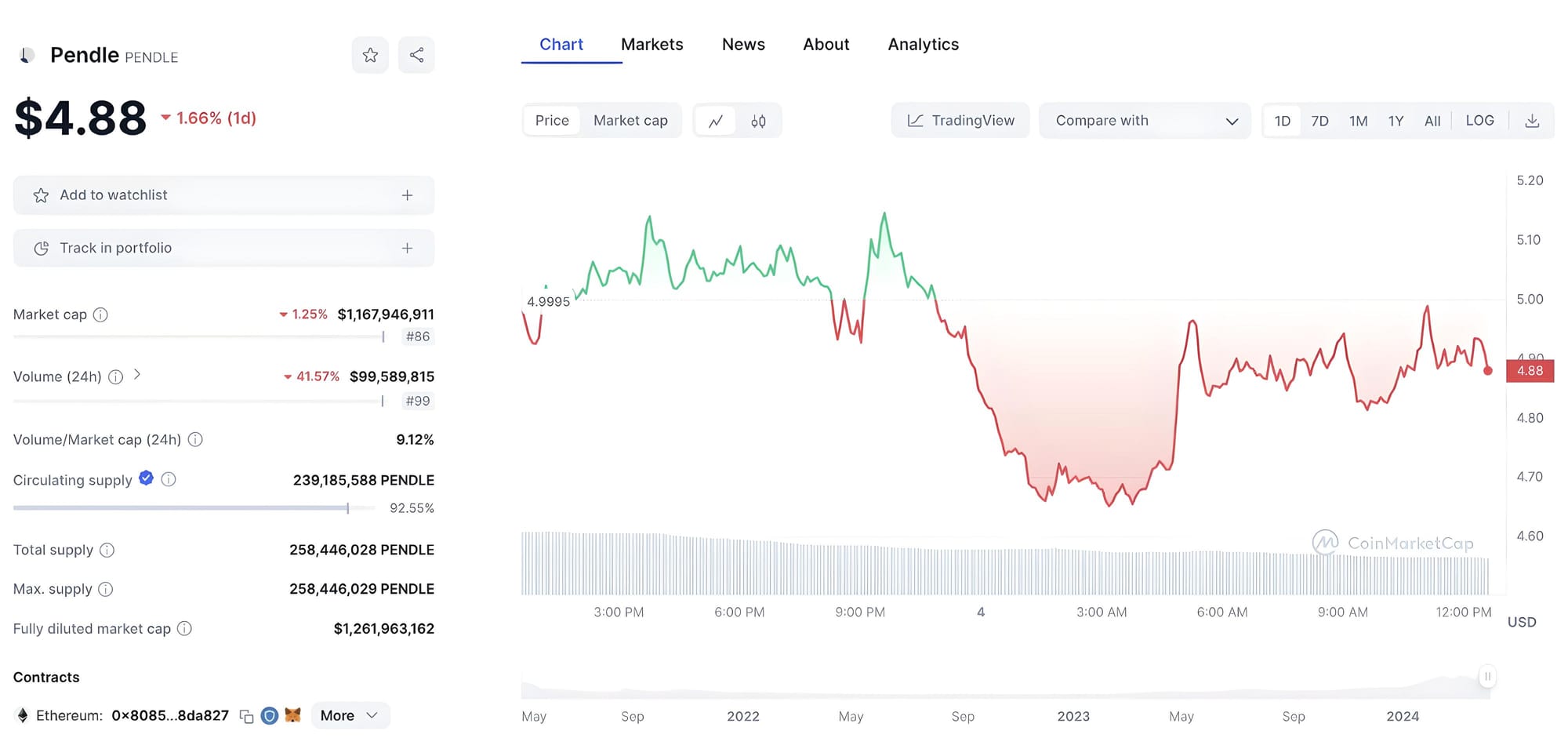

Pendle's native token, PENDLE, has seen an explosive increase, growing fivefold since the beginning of the year, currently trading around $5.

PENDLE Price Chart on a Daily Frame as of April 4, 2024, on CoinMarketCap

Pendle Finance is a DeFi protocol built on Ethereum that allows users to tokenize and trade future yields of assets through its AMM mechanism. With Pendle Finance, users can employ various strategies to optimize their asset returns.

Pendle Finance has garnered significant attention for its unique yield generation model and is backed by major investment funds, including Binance Labs. With recent developments, Pendle Finance has cemented its position as the largest yield farming protocol in DeFi.