Polymarket Predicts 11% Chance of Binance Defaulting by End of 2023

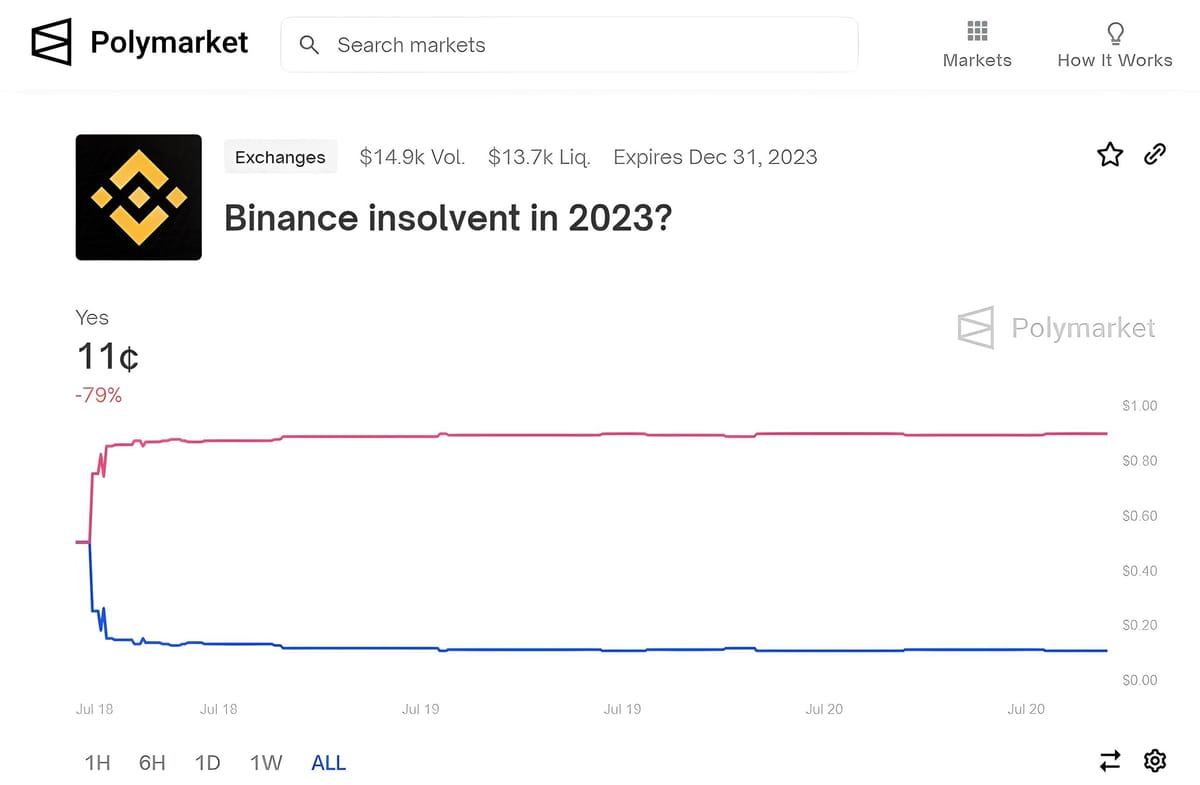

The crypto prediction market Polymarket has updated on the likelihood of Binance facing bankruptcy by the end of 2023, estimating it at approximately 11%. While this figure appears relatively low, trading activity on this market has garnered significant attention.

Polymarket Predicts 11% Chance of Binance Defaulting by End of 2023

Image source: Polymarket

According to Polymarket, this prediction market was established on July 17th and will conclude on December 31st, 2023, with the condition set as "Binance.com declares bankruptcy or files for any bankruptcy-related petition."

Furthermore, the market will resolve to "Yes" if the above condition occurs or if "BTC and/or ETH withdrawals from Binance.com are halted for a majority of users for at least 7 consecutive days (168 hours)" before December 31st, 2023. In the event neither condition is met, the market will resolve to "No."

As of the current period, the trading volume for this betting event has reached nearly $15,000 USD, with an 11% leaning towards the scenario of Binance defaulting.

Polymarket's prediction market allows traders to bet on outcomes of 'Yes' or 'No' for most events. The likelihood of each outcome is quantified by the majority opinion of traders, with trading assets ranging from 0% to 100%, representing $0 to $1 USD. When an event occurs, correct bettors receive $1 USD per share they own.

For further clarity on the Binance betting example: if someone bets $100 USD on the 'Yes' outcome (indicating Binance will default), they would receive approximately 833 shares (equivalent to $833 returned). Conversely, betting 'No' (the least likely outcome) would yield around 113 shares, equivalent to $113.

However, prospective bettors should carefully consider whether to participate in this platform, as Polymarket has previously faced scrutiny from the CFTC. Moreover, in January, the platform was reported for violating provisions of the Commodity Exchange Act (CEA), resulting in a $1.4 million USD fine.

Although we maintain that the SEC's request for emergency relief was entirely unwarranted, we are pleased that the disagreement over this request was resolved on mutually acceptable terms.

— CZ 🔶 BNB (@cz_binance) June 17, 2023

User funds have been and always will be safe and secure on all Binance-affiliated…

Binance Faces Challenges in 2023

The reason behind this predicted market presence is due to Binance's recent legal troubles across multiple countries, notably lawsuits from the SEC in the United States, along with investigations by authorities in countries such as the United Kingdom, Netherlands, Belgium, Cyprus, Brazil, Austria, France, Germany, and Australia.

Furthermore, the exchange has been rumored to have terminated a significant number of staff positions, reportedly up to 1,000, and has cut back on employee benefits citing decreased profits. Several high-level Binance executives have also resigned amid legal pressures.

In a June post, Binance CEO Changpeng Zhao declared, "... users' funds are always safe and secure across all platforms associated with Binance."