Puffer Finance Becomes Top 4 Liquid Restaking Platform by TVL Within 24 Hours of Launch

Puffer Finance, a project recently announced to have received investment from Binance Labs, has quickly risen to become the fourth-largest liquid restaking platform by Total Value Locked (TVL) within just 24 hours of its launch.

As the "liquid staking" market becomes increasingly dominated by major players, the industry is shifting its focus to the emerging and potentially lucrative segment of liquid restaking.

Restaking involves reusing Liquid Staking Tokens, such as stETH, to participate in staking with other network validators. Most projects in this space do not yet have tokens, presenting significant growth potential. Restaking has recently garnered considerable attention from the community, especially with the upcoming Dencun upgrade on Ethereum.

One notable name in this segment is Puffer Finance, which has just announced investment from Binance Labs. Leveraging the hype around this announcement, the project has begun allowing users to deposit stETH into the protocol.

Hungry Puffy here!

— Puffer Finance 🐡 (@puffer_finance) February 1, 2024

Quick, toss me your stETH carrots 🥕 and help make the Ethereum sea more decentralized, NOW! 👇https://t.co/35kRJHQ2WN pic.twitter.com/Q6G9CtiT2r

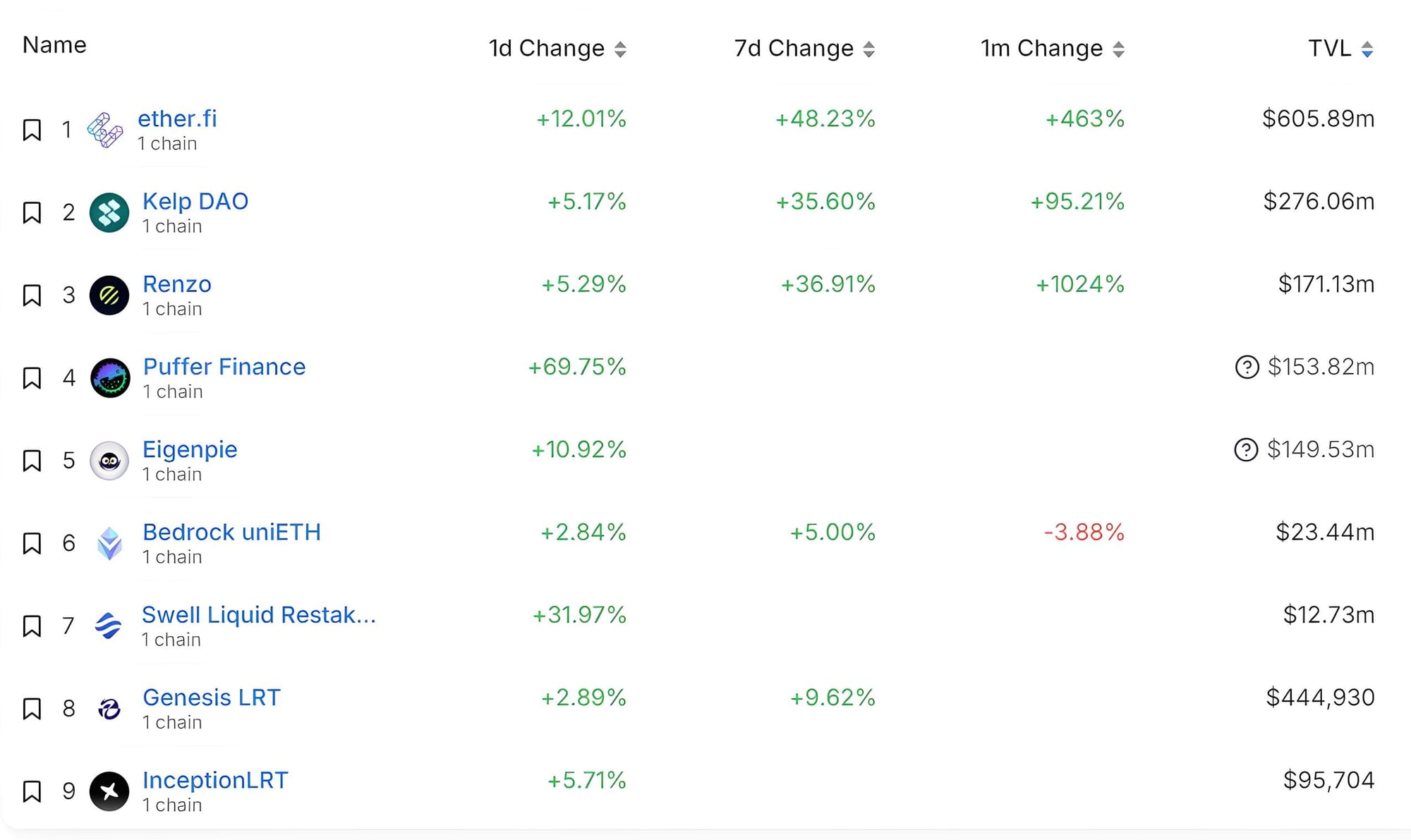

As a result, Puffer Finance attracted $153 million worth of staked ETH within 24 hours of launch, positioning itself as the fourth-largest liquid restaking protocol. The top competitors, according to TVL data from DefiLlama, are ether.fi, Kelp DAO, and Renzo.

Top Liquid Restaking Platforms by TVL. Source: DefiLlama

Puffer Finance is a liquid restaking protocol built on EigenLayer. The protocol uses anti-slashing mechanisms and a secure signer tool to prevent validator misconduct, aiming to diversify the validator set and reduce the centralization of Ethereum's Proof of Stake system while addressing the challenges faced by individual validators.

Puffer Finance targets two main customer groups:

- General Users: Allows users to stake ETH to receive pufETH and earn returns.

- Validators: Instead of staking 32 ETH to run an Ethereum node, validators only need 2 ETH to run a Puffer node.

Currently in its early launch phase, Puffer Finance is expected to fully launch by the end of the year. At that time, users will need to lock Lido's stETH to mint pufETH, which can then be converted back to ETH and restaked with validators. This plan aims to reduce Lido's dominance and increase the number of native ETH stakes, not just staked ETH.

Puffer Finance has also attracted attention due to its reward points system, which is perceived by the crypto community as a potential token airdrop strategy. Similar to other projects hinting at airdrops through points systems like friend.tech, Blast, MarginFi, and Rainbow Wallet, users anticipate Puffer Finance might also airdrop tokens.

Currently, users can deposit stETH into the protocol to earn reward points and gain additional points by depositing stETH from EigenLayer.

As previously announced, if you bring your stETH (🥕) from EigenLayer and deposit it into Puffer using the same address before February 9th, you'll earn 3x Puffer Points and secure your Eigen Points.https://t.co/ISW9lZtXhL

— Puffer Finance 🐡 (@puffer_finance) February 1, 2024

11/12