SEC Claims Jurisdiction Over All Ethereum Transactions

In a civil complaint, the U.S. Securities and Exchange Commission (SEC) asserts that it has jurisdiction over all Ethereum transactions.

On September 19, the SEC charged crypto investor and YouTuber Ian Balina with violating U.S. Securities laws for being involved in an unregistered ICO offering in 2018.

In a bold and unprecedented move hidden in Section 69 of the complaint, the SEC argues that it has the authority to prosecute Balina not only because his transactions involved activities in the U.S., but also because, fundamentally, the entire Ethereum network falls under U.S. jurisdiction.

There it is

— laurence (@functi0nZer0) September 19, 2022

The supermassive black hole sized bad take at the heart of the Balina filing

h/t @LordBogdanoff https://t.co/ZopOGQchU4 pic.twitter.com/ucn5sZkK5b

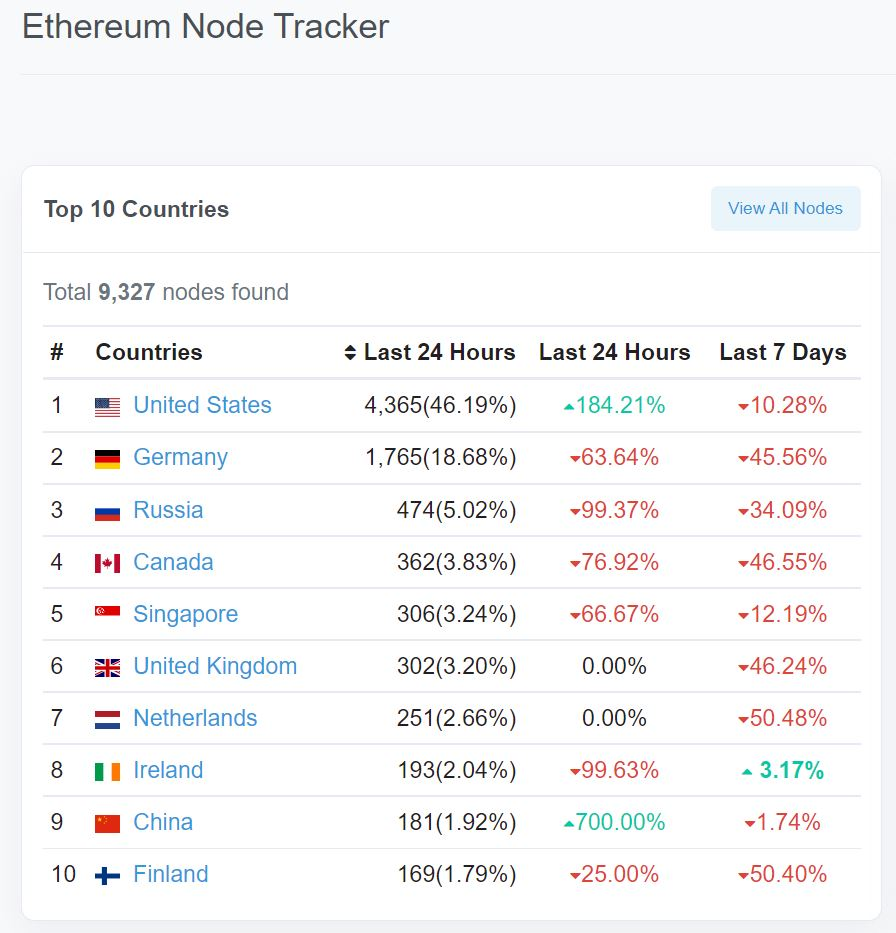

The SEC noted in the filing that ETH sent to Balina was "validated by a network of nodes on the Ethereum blockchain, with a significant concentration in the U.S. compared to any other country."

According to Etherscan, the U.S. dominates with 45.85% of Ethereum nodes as of September 20, 2022. The SEC appears to suggest that with many Ethereum validation nodes operating in the U.S., all Ethereum transactions globally should be considered as originating from there.

The U.S. Leads in Ethereum Nodes

Data from Etherscan as of September 20, 2022

“This allows the SEC to characterize operations on the Ethereum blockchain as doing business on a U.S. securities exchange,” commented Brian Fyre, a law professor at the University of Kentucky. “From a regulatory perspective, this is convenient. It makes everything much simpler.”

If successful, this could lead to the SEC asserting jurisdiction over all activities on the Ethereum network, significantly increasing its oversight role over Ethereum—where much of the NFT and DeFi activity occurs—and the broader crypto industry.

Fyre notes that while this complaint may lack legal weight and is aimed specifically at Balina, caution is advised regarding these claims.

Last week, just hours after Ethereum's successful Merge, SEC Chairman Gary Gensler hinted that the transition might bring the network closer to being classified as a security under government definitions.

Read more: Could Ethereum Become a “Security” After The Merge?

Speaking before the Senate Banking Committee, Gensler expressed views on the "staking" model, where assets are locked into the network for passive rewards. Cryptocurrencies or intermediaries allowing users to stake assets might pass the Howey test to be classified as securities. However, he did not refer to any specific cryptocurrencies.

1/2

— Adam Cochran (adamscochran.eth) (@adamscochran) September 19, 2022

Wow, the SEC had an easy potential win here that none of crypto would of complained about. Going after a token pumper for promoting to US customers.

Instead, they shoe horned in an argument that all ETH transactions are "in the US" because of higher node density there. https://t.co/7xW0MxLNc3

Under Gensler's leadership, while the SEC continues its crackdown on the broader crypto industry, Bitcoin has repeatedly been excluded from this scope. No official stance has been taken yet on Ethereum being classified as a security. Previous leadership even considered Ethereum "sufficiently decentralized" and thus not a security.