SEC Sues Justin Sun, Accuses TRX and BTT of Being Securities

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against TRON founder Justin Sun, alleging the illegal sale of securities.

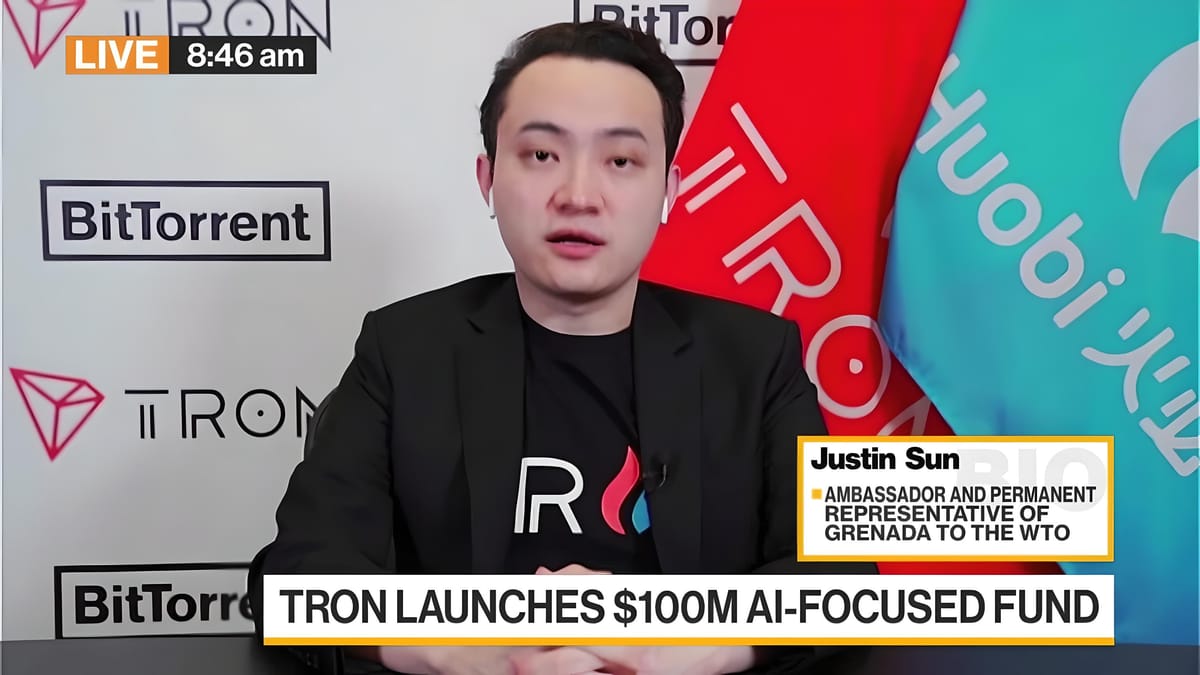

SEC Sues Justin Sun, Claims TRX and BTT Are Securities. Image: Bloomberg

Update March 23, 2023:

On the morning of March 23, TRON founder Justin Sun issued his first statement following the SEC’s lawsuit, which accuses TRX and BTT of being securities and alleges market manipulation.

The SEC’s civil complaint earlier today is just the latest example of actions it has taken against well known players in the blockchain and crypto space. We believe the complaint lacks merit, and in the meantime will continue building the most decentralized financial system.

— H.E. Justin Sun 孙宇晨 (@justinsuntron) March 23, 2023

Sun stated that the SEC’s focus on TRON is merely a continuation of its recent legal actions against various entities in the crypto space. He criticized the SEC’s argument as unconvincing, noting the lack of a clear regulatory framework for crypto and dismissing the lawsuit as a "civil complaint."

TRON expressed willingness to collaborate with regulators to establish transparent crypto regulations, highlighting that the Commonwealth of Dominica recognized TRX and BTT as legal payment methods at the end of 2022.

Original Article:

SEC Files Suit Against Justin Sun

The SEC has charged Justin Sun and his affiliated entities—Tron Foundation Limited, BitTorrent Foundation Ltd., and Rainberry Inc.—with the illegal sale of securities.

Today we charged crypto entrepreneur Justin Sun and three of his wholly-owned companies for the unregistered offer and sale of crypto asset securities Tronix and BitTorrent.

— U.S. Securities and Exchange Commission (@SECGov) March 22, 2023

Read more:https://t.co/4tXgKNof6Q

The securities in question are TRON’s TRX and BitTorrent’s BTT tokens.

The lawsuit alleges that Sun and the associated companies unlawfully issued and sold TRX through social media campaigns, encouraging followers to promote the token and join TRON communities. BTT was allegedly sold via airdrops to TRX holders.

Additionally, the SEC accuses Sun of engaging in wash trading of TRX—conducting buy and sell transactions on secondary markets to create a misleading impression of high trading volume. The lawsuit cites over 600,000 instances of wash trading, with daily volumes ranging from 4.5 million to 7.4 million TRX between April 2018 and February 2019.

The SEC also charges eight celebrities—Lindsay Lohan, Jake Paul, Ne-Yo, Soulja Boy, Akon, Austin Mahone, and others—with promoting TRX, many of whom have agreed to pay $400,000 in fines to avoid further legal action.

SEC Chairman Gary Gensler stated:

“Sun and his companies targeted U.S. investors with disguised securities offerings, accumulating millions in investor funds, and engaged in wash trading on unlicensed platforms to falsely inflate TRX demand. Sun also lured investors into TRX through celebrity endorsements without disclosing that these individuals were compensated for their posts.”

It remains unclear how the SEC will prosecute Justin Sun, as he currently serves as an Ambassador for Grenada at the World Trade Organization (WTO) and holds legal immunity.

TRON Token Prices Decline Sharply

TRX’s price has dropped by 13% following news of the SEC lawsuit.

Price Movement of TRX in the Last 24 Hours, Screenshot from CoinMarketCap at 03:00 AM UTC on March 23, 2023

Other tokens in the TRON ecosystem are also experiencing significant losses.

Price Movement of Major TRON Ecosystem Tokens, Screenshot from CoinMarketCap at 03:30 AM UTC on March 23, 2023

HT, the token of Huobi—a platform acquired by Justin Sun late last year—has also been affected.

Price Movement of HT in the Last 24 Hours, Screenshot from CoinMarketCap at 03:30 AM UTC on March 23, 2023

SEC Targets Crypto Industry with Securities Claims

Over the past three months, the U.S. Department of Justice, SEC, and state financial agencies have taken legal actions against individuals and entities involved in major crypto market collapses in 2022, frequently using the term “securities.” Recent cases include:

- December 22, 2022: Former CEO Sam Bankman-Fried and FTX’s FTT token;

- January 13, 2023: Lending unit Genesis and Gemini Exchange;

- January 21, 2023: Hacker Avraham Eisenberg and Mango Markets’ MNGO token;

- February 10, 2023: Kraken’s staking service;

- February 13, 2023: Paxos and Binance’s BUSD stablecoin;

- February 17, 2023: Do Kwon and Terraform Labs’ LUNA-UST collapse;

- February 23, 2023: Voyager and Binance.US;

- March 10, 2023: KuCoin and Ethereum securities allegations;

- March 14, 2023: Signature Bank, which has many crypto clients;

- March 22, 2023: SushiSwap DEX;

- March 23, 2023: Justin Sun and accusations against TRX and BTT;

- March 23, 2023: Coinbase’s staking service.

Additionally, SEC Chairman Gary Gensler has recently claimed that nearly all cryptocurrencies are securities, except Bitcoin, and has urged crypto firms to register and report their activities to the agency.