Shanghai Hard Fork for ETH Staking Unlock Delayed to March 2023

Ethereum developers have decided to prioritize the unlocking of ETH staked in Ethereum 2.0 by pushing the Shanghai upgrade to March 2023.

According to CoinDesk, Ethereum developers have scheduled the Shanghai hard fork, the next major network upgrade, for March 2023. This upgrade will include EIP-4859, which will release a significant amount of ETH currently locked in Ethereum 2.0's staking contract.

As reported by Coin68, in October, Ethereum developers activated the Shandong testnet to trial the Shanghai codebase.

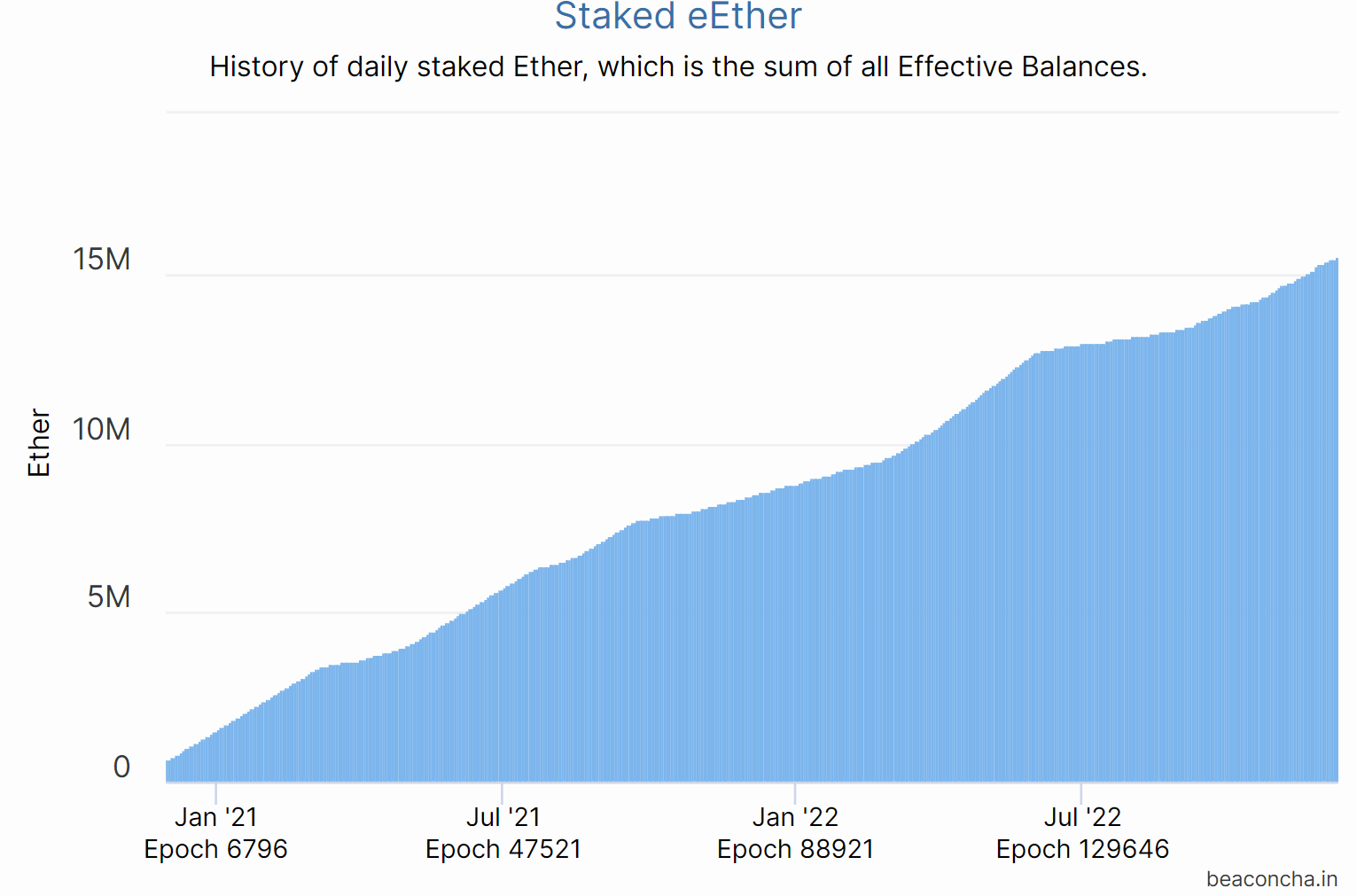

Shanghai has garnered considerable attention as it will incorporate EIP-4895, allowing those who have staked ETH into the Ethereum 2.0 contract to withdraw their funds and staking rewards. The ETH 2.0 staking contract has been open since November 2020 in preparation for The Merge. As of this writing, over 15.5 million ETH, worth $19.3 billion, is locked in the contract.

ETH Locked in Ethereum 2.0 Staking Contract. Source: Beaconcha.in

In addition, Shanghai is expected to include the “EVM Object Format (EOF)” proposal, which consists of EIPs 3540, 3670, 4200, 4570, and 5450, aimed at enhancing the Ethereum Virtual Machine (EVM). The Ethereum development team has stated that if EOF evaluation takes too long, they are prepared to postpone this upgrade to fall 2023 to avoid delaying the ETH staking unlock.

Moreover, developers have agreed to execute another hard fork in fall 2023 to deploy the significant EIP-4844 upgrade, which will enable proto-danksharding to boost throughput and reduce transaction fees on Ethereum's Layer-2 rollup solutions.

Splitting the upgrades into two major hard forks in 2023 is expected to give the Ethereum team more time to address each issue specifically, rather than cramming everything into a single upgrade as originally planned.

However, some voices in the crypto community argue that the March 2023 timeline for unlocking ETH staking might be overly optimistic, given the technical challenges involved and Ethereum's past history of delaying upgrades related to The Merge due to unforeseen issues.

ETH has been trading sideways in the $1,100 - $1,300 range since mid-November, following the severe impact of the FTX exchange collapse. The recent low network activity has also led to an oversupply of newly minted ETH compared to the amount burned, causing Ether inflation to resurface.

ETH/USDT 1D Chart on Binance as of 11:55 PM on 12/08/2022

Despite this, Ethereum is still considered to have had a successful 2022, achieving the historic Merge upgrade and maintaining its position as the leading blockchain for DeFi, GameFi, NFTs, and more.