Solana: Is the Paint Better Than the Wood?

The ongoing debate between Ethereum (ETH) and Solana (SOL) continues to be a hot topic in the crypto market. Ethereum, as a pioneering smart contract platform, boasts a rich ecosystem and long-term value accumulation. Meanwhile, Solana, though a later entrant, has emerged as a formidable competitor with its low fees, fast speeds, and vibrant memecoin ecosystem.

Solana: Is the Paint Better Than the Wood? Image: Unchained Crypto

Recently, the Ethereum vs. Solana debate heated up again with a detailed post by Flip Research on X, arguing that Solana might be "overrated" and overly hyped.

— Flip Research (@Flip_Research) July 30, 2024

Here’s a summary of the key points from this debate.

Is Solana Overrated?

Flip Research highlights four key metrics often used by SOL advocates for comparison with ETH:

- User Base

- Fees

- DEX Trading Volume

- Stablecoin Trading Volume

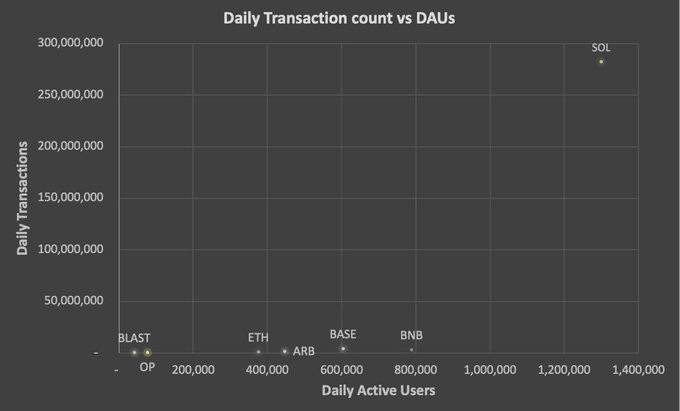

User Base Comparison

According to Token Terminal, Solana’s daily active users (DAU) stand at 1.3 million compared to Ethereum’s 376,300.

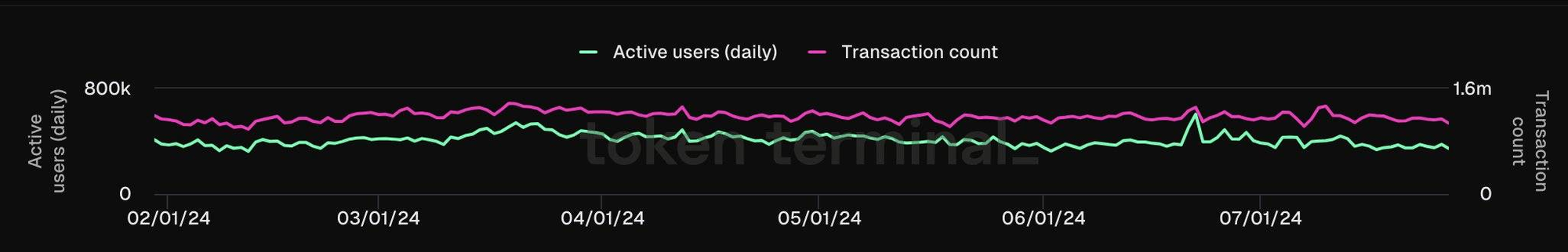

DAU and Transaction Volume on Ethereum

Source: Token Terminal

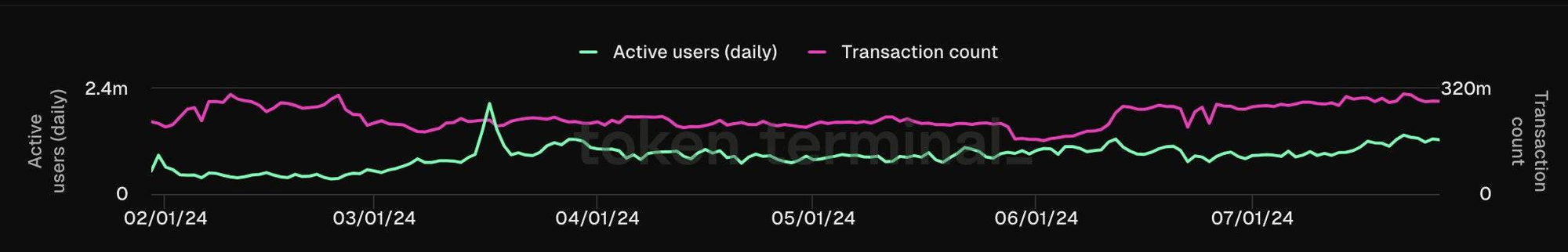

DAU and Transaction Volume on Solana

Source: Token Terminal

On July 26, ETH processed 1.1 million transactions with 376,300 active users, averaging 2.92 transactions per user. In contrast, SOL had 282.2 million transactions with 1.3 million users, averaging 217 transactions per user.

This disparity is partly due to Solana’s significantly lower transaction fees compared to Ethereum’s mainnet. Thus, Flip Research compared Solana with other low-fee L1 networks like Arbitrum, Base, and Optimism Mainnet, where Solana’s transaction/user metrics were superior.

DEX Trading Volume

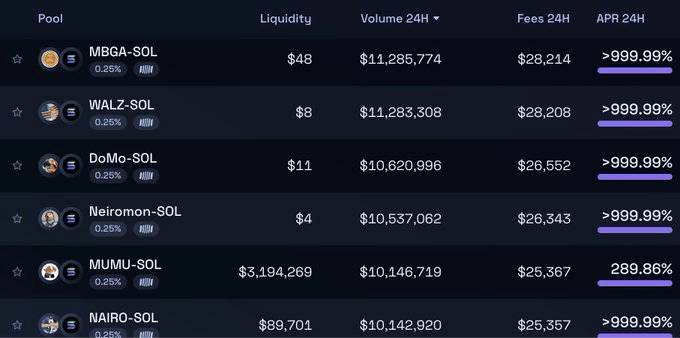

Solana’s DEX volumes are impressive, but Flip Research questions their authenticity. For instance, on the Raydium DEX:

- Many liquidity pools (LPs) have 24-hour volumes in the tens of millions of USD but show very low liquidity, indicating potential rug pulls.

- For example, the MBGA/SOL pair had 46,000 transactions with $10.8 million volume and 2,845 trading wallets. These wallets appeared linked, suggesting bot activity to inflate volume and attract users, only for the project to exit with the funds.

- According to Flip Research, over 50 projects on Raydium with volumes above $2.5 million were identified as rug pulls, contributing to a total trading volume of $200 million with $500,000 in fees. These figures inflate Solana’s DEX statistics, mixing spam with genuine transactions.

- While Orca and Meteora DEXs have fewer rug pulls, they still can’t match Uniswap on Ethereum, where rug pulls with high volume are rare.

Solana’s high volume figures are attributed to low fees and ease of project deployment, encouraging spam and wash trading. In contrast, Ethereum’s higher deployment costs often outweigh potential scam profits.

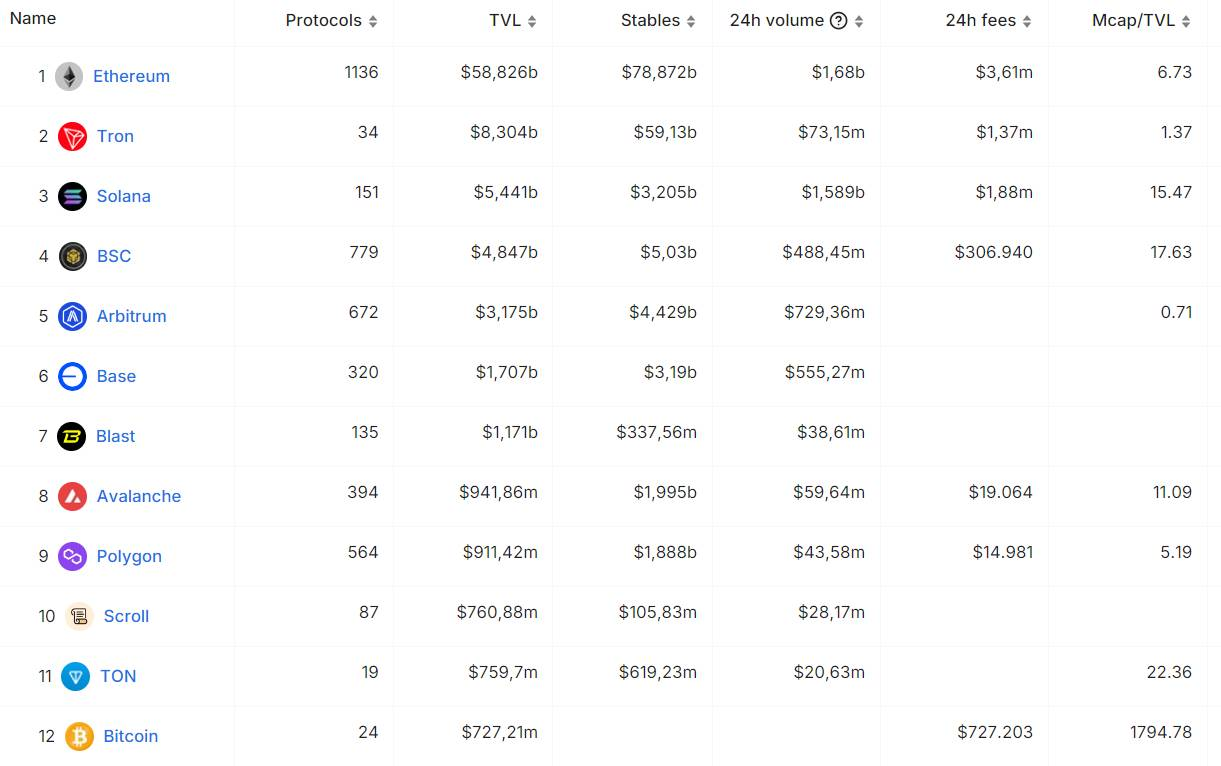

Stablecoin Usage

Recent data suggest that Solana’s stablecoin trading volume relative to its market cap is higher than Ethereum’s, implying more active users on Solana. However, Ethereum’s stablecoin market cap far exceeds Solana’s, with Ethereum holding $80 billion versus Solana’s $3.2 billion.

Memecoins from Celebrities

Solana faces criticism for its memecoins, which often suffer from rug pulls or significant dumps. Tokens associated with celebrities are frequently launched on Solana via easy-to-use platforms like pump.fun.

we checked how much of the supply was sniped by insiders in those celebrity coins

— Bubblemaps (@bubblemaps) July 26, 2024

supply control is bullish 🤡 https://t.co/TtPPnWN0mI pic.twitter.com/Csr8SJGw86

According to Bubblemaps, among the 30 most well-known celebrity coins, none have seen price increases. Moreover, insider trading issues plague the space.

Conclusion

Flip Research argues that Solana is overhyped and that its metrics are embellished. Key issues include:

- Instability: Frequent network downtimes.

- High Failure Rates: Numerous unsuccessful transactions.

- Developer Barriers: Rust is less user-friendly compared to Solidity.

- Integration Issues: Difficulties with EVM chains.

Counterarguments

Solana proponents have responded:

- DAU Metrics: DAU is not the most effective measure of a network’s user base.

- DEX Trading Volume: While Solana has bot spam, this issue is common across blockchains. Bot transactions also incur fees, and addressing spam is a universal challenge.

- Memecoin Issues: Solana’s value lies in its ability to provide opportunities for innovation and experimentation. Memecoins are just a small part of its ecosystem, not a reflection of its overall quality.

— Flip Research (@Flip_Research) July 30, 2024

Let's break down how wrong this post is, shall we?

— ◢ J◎e McCann 🧊 (@joemccann) July 30, 2024

First, let's Quentin Tarantino this, start at the end, and work back to the beginning (movie aficionados, I see you).

The author ends his rant with typical ETH maxi talking points that have been disputed ad nauseam. https://t.co/AmtNoz7Mkh pic.twitter.com/aZSMVbcnaa