The Merge Officially Completes: Ethereum Transitions to Proof-of-Stake

After months of anticipation, the most awaited event in the Ethereum community for 2022—the Merge—has officially taken place!

The Merge Successfully Executed

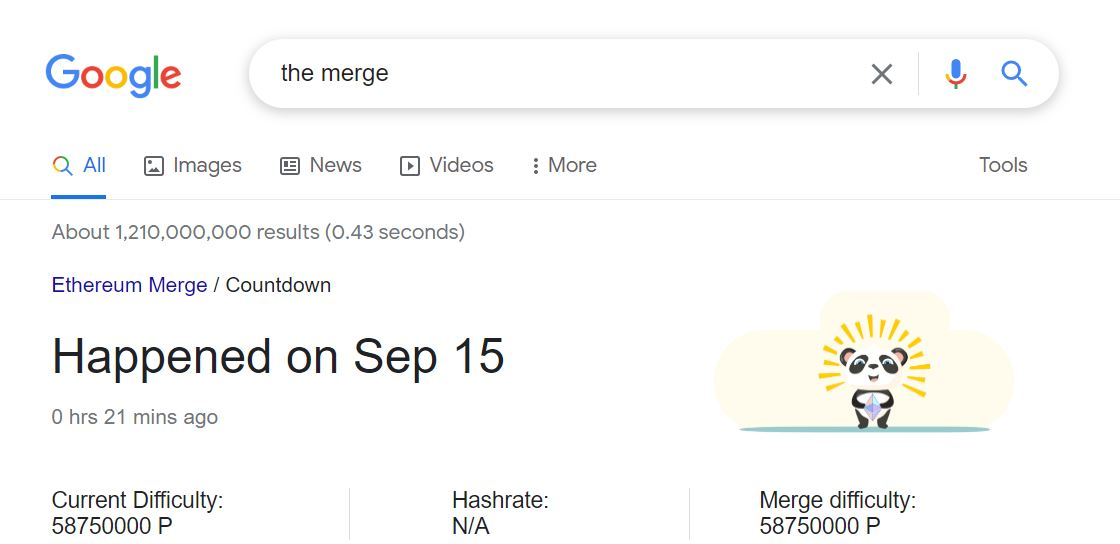

The total difficulty of Ethereum blocks has reached 58,750,000,000,000,000,000,000, the threshold needed to merge the Proof-of-Work (PoW) blockchain—responsible for processing Ethereum transactions previously—with the Beacon Chain, a Proof-of-Stake (PoS) blockchain that coordinates consensus across the Ethereum network.

we merged! pic.twitter.com/5wyOMZokam

— banteg (@bantg) September 15, 2022

MERGE ACTIVATED! pic.twitter.com/YWSGdvIb3N

— RYAN SΞAN ADAMS - rsa.eth 🦄 (@RyanSAdams) September 15, 2022

Ethereum founder Vitalik Buterin tweeted to confirm the successful completion of The Merge:

And we finalized!

— vitalik.eth (@VitalikButerin) September 15, 2022

Happy merge all. This is a big moment for the Ethereum ecosystem. Everyone who helped make the merge happen should feel very proud today.

“And everything has been legitimized. Congratulations on a successful Merge. This is a monumental moment for the Ethereum ecosystem. Everyone who contributed to making The Merge happen today should feel incredibly proud.”

Google’s Merge countdown clock also celebrated the event with the merging of two bears—black and white—into a panda, the mascot of The Merge.

The Significance of The Merge

Post-Merge, Ethereum will become a blockchain with significantly reduced energy consumption, as the consensus mechanism will no longer rely on miners. This lower energy usage means rewards for validators on the PoS blockchain will be less than those for miners on the PoW blockchain, contributing to deflationary pressure on ETH, especially when combined with the EIP-1559 coin burn mechanism.

According to Ultrasound.money, within half an hour of The Merge, Ethereum’s supply decreased by over 100 ETH, demonstrating a clear deflationary impact.

LFG pic.twitter.com/ohOuse6RYQ

— Darren Lau (@Darrenlautf) September 15, 2022

Additionally, eliminating mining helps the world’s second-largest blockchain cut its energy consumption by over 99%. CryptoQuant reports that immediately after The Merge, both the hashrate and mining difficulty on the Ethereum network dropped to zero, marking the end of a seven-year Proof-of-Work era.

$ETH difficulty and hashrate are now at 0

— CryptoQuant.com (@cryptoquant_com) September 15, 2022

Live Chart https://t.co/RH8VHcyoBX pic.twitter.com/4MniUc4xOh

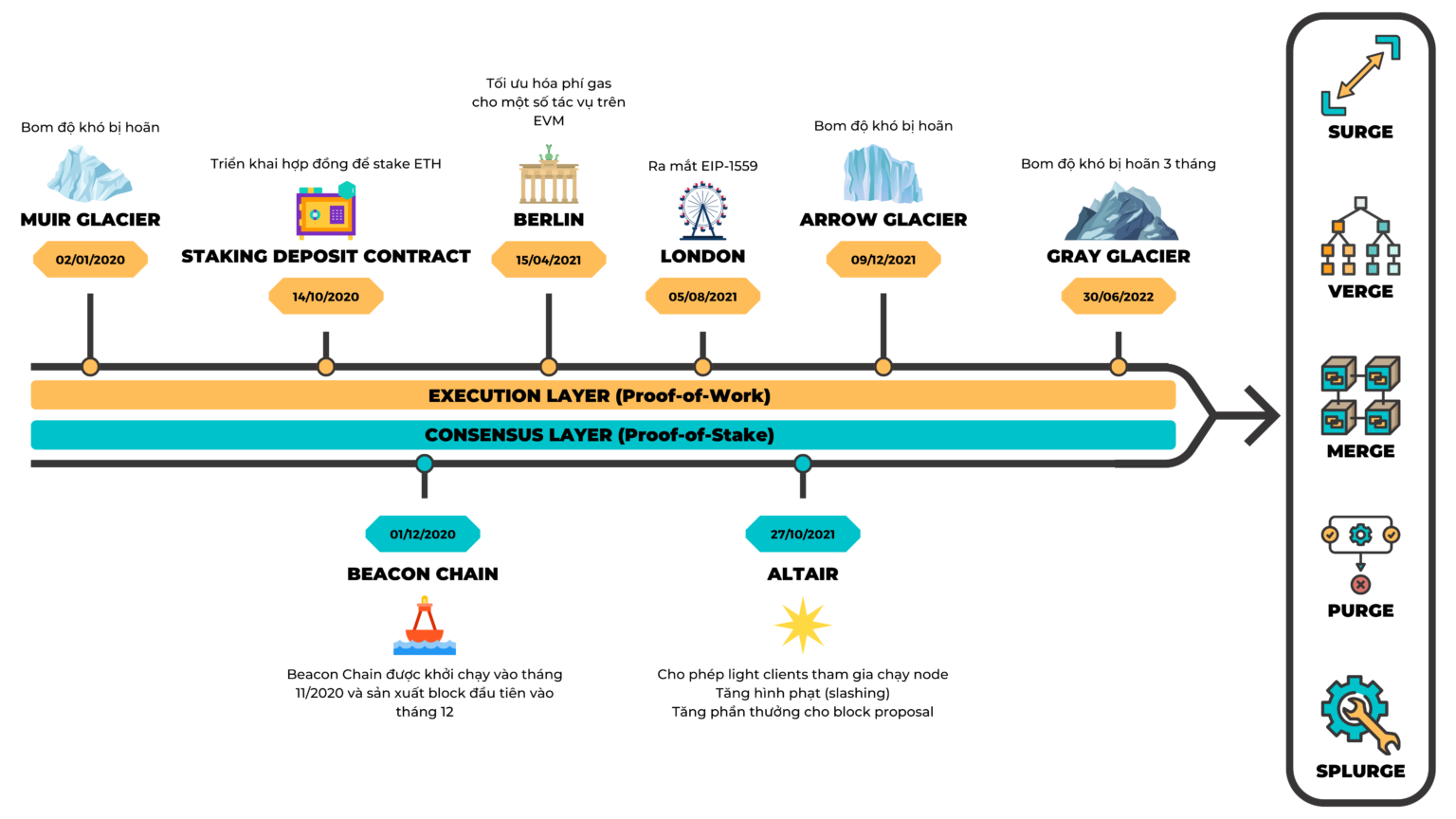

However, gas fees on Ethereum will not decrease, and transaction speeds will not improve post-Merge. Improvements in gas fees and transaction speeds will depend on sharding, which is being implemented as part of The Surge—a crucial update happening alongside The Merge. Other updates such as The Verge, The Purge, and The Splurge are also being developed by the Ethereum team to make the blockchain faster, more decentralized, and more accessible to the public

- Read more: All About The Merge

The Road to The Merge

A key point for users is that ETH staked on Beacon Chain cannot be withdrawn yet. The stETH will remain locked until the Shanghai update, scheduled for the next 6-12 months as originally planned.

- Read more: 5 Misconceptions About The Merge

Price Fluctuations Post-Merge

Since the official Merge schedule was announced in mid-August, ETH experienced a short-term bull run, reaching $2,000—its highest level since June this year—before returning to around $1,600–$1,700 by late August to early September.

ETH price on Binance’s ETH/USDT 15-minute chart at 01:48 PM on 15/09/2022

Currently, ETH is trading at $1,632, slightly above the $1,600 mark before the Merge event. Given the recently announced US inflation data, this flash dump was somewhat anticipated, reflecting past significant Ethereum updates where key moments prompted investors to quickly “exit” before deflationary pressures on ETH could fully materialize.

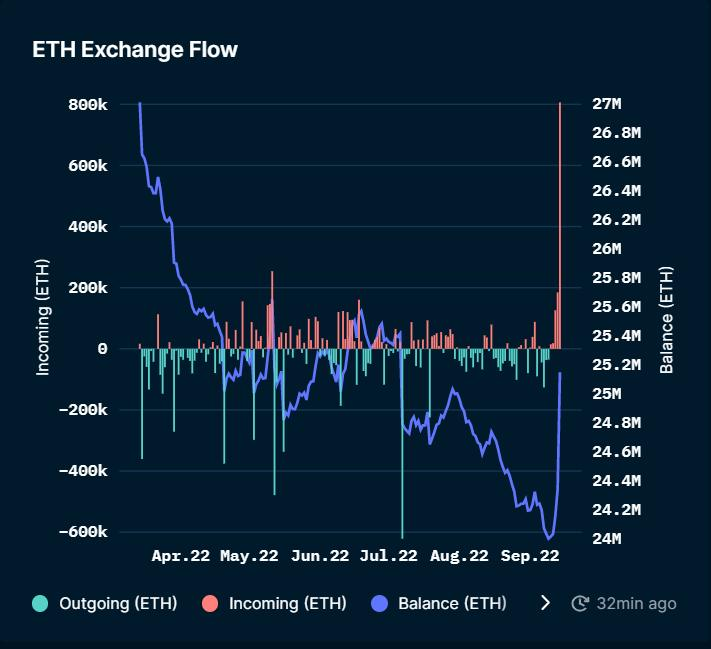

On-chain data somewhat confirms this prediction. A few hours before The Merge, a large amount of ETH was withdrawn to centralized exchanges, indicating investors' readiness to sell ETH following the event.

ETH Price Movements on Exchanges, Data from Nansen on 15/09/2022