Tokenomics Research #15: Perpetual Protocol (PERP) - Change or Die?

1. Overview of the Protocol

Perpetual Protocol is a decentralized derivatives protocol built on Ethereum, considered one of the pioneers of DeFi. The project allows third parties to issue perpetual futures contracts, enabling users to trade them in a decentralized manner. Essentially, Perpetual Protocol is the decentralized version of Binance Futures, competing with projects like dYdX and GMX.

2. Protocol Mechanism

Perpetual Protocol’s initial mechanism comprises two main components:

Virtual Automated Market Makers (vAMMs): Inspired by Uniswap's automated market-making model.

Liquidity Reserve: Serves as collateral for the vAMMs.

Diving Deeper into vAMMs:

DEXs connect buyers and sellers via liquidity pools, allowing users to swap tokens in a decentralized manner, without third-party management, using Automated Market Maker (AMM) technology. While AMMs are effective for token swaps, they fall short for perpetual futures contracts.

Perpetual Protocol introduced the Virtual Automated Market Maker (vAMM), leveraging the same x * y = k formula as Uniswap with key distinctions:

- vAMMs are used for price determination, not token swaps.

- No real assets are stored within vAMMs; assets are held in separate pools managed by smart contracts.

- No liquidity providers are needed for vAMMs.

- The constant "k" can be manually adjusted.

Recently, Perpetual Protocol has undergone several operational changes, which will be detailed later.

3. Tokenomics of PERP

Overview

- Maximum Supply: 150 million tokens

- Circulating Supply (as of 10/04/2024): 72.6 million tokens

- Market Capitalization (as of 10/04/2024): 106 million USD

Initial Token Distribution

Like many DeFi 1.0 projects, Perp allocated a significant portion of tokens as incentives for initial liquidity providers and users to develop the ecosystem, leading to prolonged token inflation post-launch.

Token Vesting Schedule

According to Cryptorank, team, strategic round, and seed round allocations (holders with very low-cost tokens) have all been distributed. This marks a return to "fair" token ownership for retail investors.

Token Utility

Initially, PERP had two main utilities:

- Staking: PERP holders could stake tokens in a staking pool to receive rewards (in PERP) and a share of trading fees (50% distributed to stakers, 50% to an insurance fund). Stakers also bear some risk as their tokens in the staking pool can be used as an insurance fund during unforeseen losses.

- Governance: PERP tokens are used for governing the Perpetual Protocol ecosystem.

To enhance the utility of PERP and retain holders, the project introduced vePERP, which allows stakers to earn a share of protocol profits through the Lazy River 2.0 program. Holders can further lock vePERP to increase their rewards.

4. Protocol Performance

Total Value Locked (TVL)

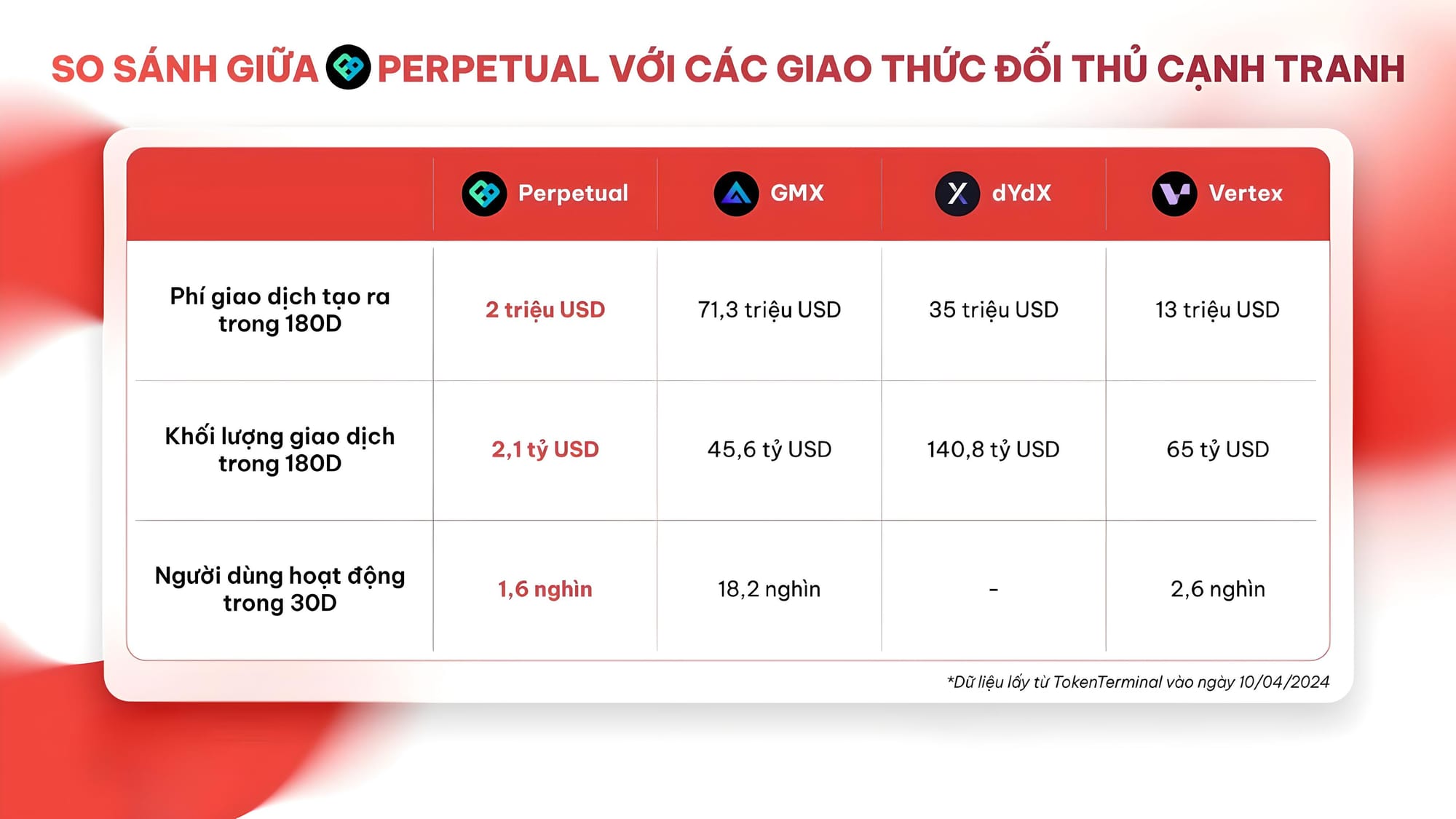

As of now, Perpetual Protocol has around $7.4 million in TVL, a modest figure compared to GMX's $557 million and dYdX's $506 million.

Perpetual appears to be lagging significantly behind its competitors in transaction volume, fees, revenue, and active users.

5. Key Updates

Lazy River

In December 2022, the protocol launched Lazy River 2.0, distributing protocol profits (in USDC) to vePERP holders.

Two conditions must be met to activate USDC fee distribution:

- Insurance Fund Threshold: Determined as 10% of the average open interest over 30 days across all markets, displayed and updated every 30 days.

- Positive Protocol Revenue: Defined as the insurance fund balance exceeding the activation balance, updated weekly.

Perp V3

Perp V3 introduces significant enhancements focused on:

- Improved User Experience:

- Enhanced Security: Introducing biometric security for wallets, similar to fingerprint or FaceID, supported by standard Passkeys.

- Seamless Integration: V3 allows easy Web3 access via email or social media accounts without browser extensions or transaction approvals, making the DeFi experience comparable to CEX.

- All-in-One Solution: Perp V3 aims to offer a complete crypto experience with leveraged trading up to 50x, advanced trading tools (limit orders, stop-loss, etc.), and low-risk yield products.

- Smart Liquidity Framework:Router Layer: Automatically selects the best strategy for optimal pricing, similar to 1inch or Uniswap.Pricing Mechanic Layer: Diverse pricing strategies determine how liquidity is provided. Each strategy includes:Settlement Layer: Executes settlements, maintaining position records, collateral safety, and managing liquidations.

- The framework includes Router Layer, Pricing Mechanic Layer, and Settlement Layer.

- Pricing: Mechanism for providing liquidity quotes, e.g., using Oracles or on-chain pricing curves (AMM).

- Hooks: Optional features enhancing strategies, e.g., customizing fees or order types (like Uniswap V4).

Benefits:

- For Liquidity Providers (LPs): Simplifies liquidity provision, catering to all user types with diverse strategies.

- For Traders: Ensures access to the best pricing and liquidity, offering various tools for different market conditions.

- For the Protocol: Enhances adaptability and competitiveness, allowing for future DApp Chain development without significant changes.

6. On-Chain Data

Recent on-chain data from Nansen shows some whales accumulating PERP:

Amounts range from $100,000 to $1.7 million. While not huge, this is noteworthy given PERP's current market cap of $100 million.

Top holders data from Etherscan:

- Wallet #2: Used for ecosystem development and future rewards. Mismanaged token unlocks could lead to significant selling pressure.

- Binance: Dominates PERP's market with top 3 and 4 wallets. Wallet #9 (Binance Labs) holds $4.7 million in PERP.

7. Conclusion

Key Takeaways:

- Revenue Sharing vs. Market Performance: Despite sharing revenue, Perpetual Protocol's lackluster revenue hampers token performance.

- Competitive Lag: The protocol is significantly trailing competitors, necessitating major changes like Lazy River and Perp V3.

- Success Metrics: TVL, trading volume, and fees will indicate Perp V3's success and long-term investment viability.

- Market Moves: Recent whale activity and Binance's influence suggest potential strategic movements.

Overall Assessment:

- PERP Rating: 6.5/10 - A promising low-cap project.

Stay tuned for more insights in future Tokenomics Research articles!