TVL Lido Hits $20 Billion for the First Time Since April 2022, Community Suspicions of Overinflation

In its November report, Lido Finance announced that its Total Value Locked (TVL) had surpassed $20 billion for the first time since April 2022, setting several new records. However, the substantial figure has raised suspicions within the community about potential inflationary practices.

TVL Lido Finance Hits $20 Billion for the First Time Since April 2022, Community Suspicions of Overinflation

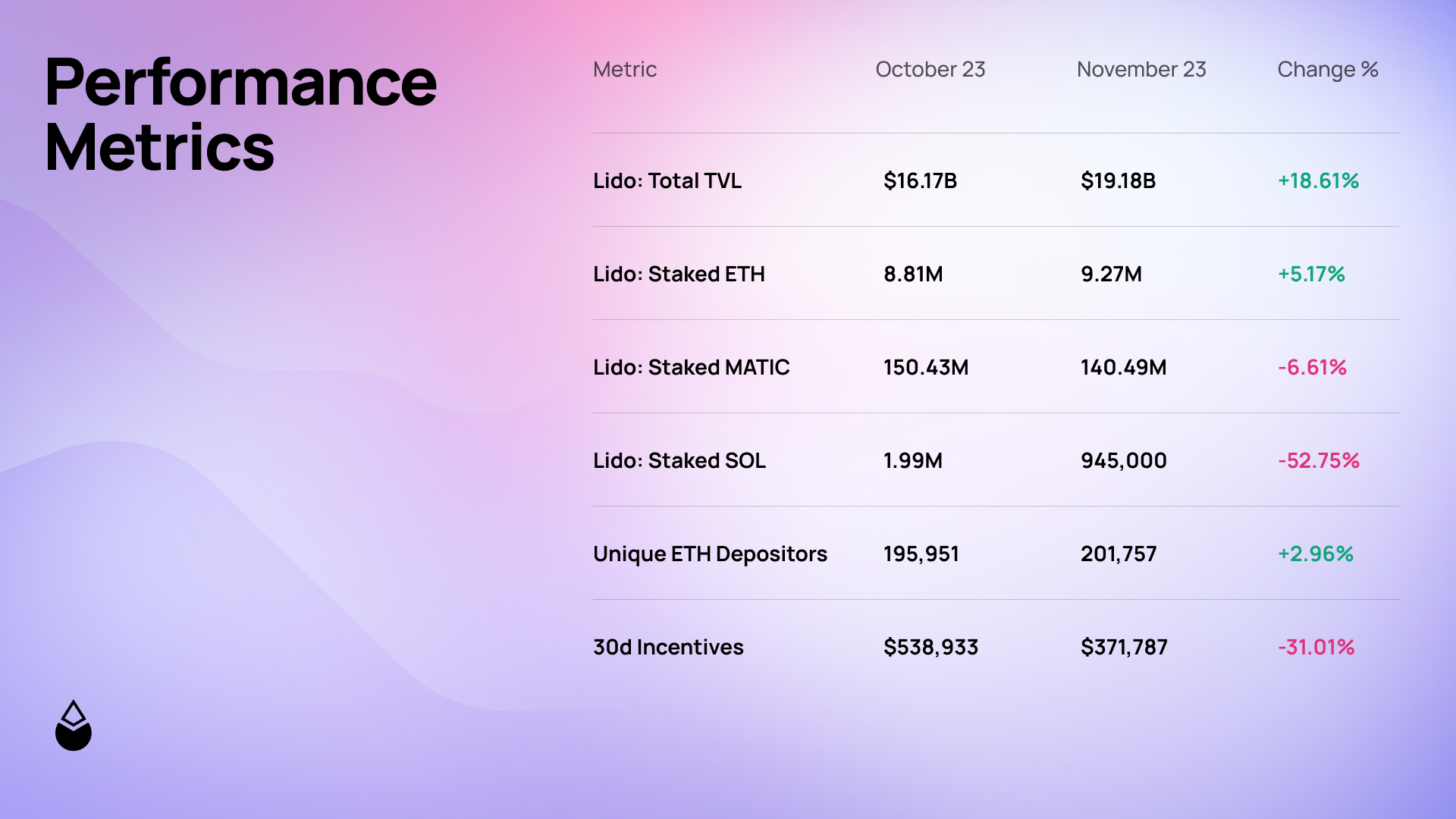

According to Lido Finance's monthly report, the staking protocol achieved several milestones in November:

- TVL crossed $20 billion for the first time in 20 months since April 2022, marking an 18% increase from October.

- The number of stakers exceeded 200,000 for the first time.

- stETH (including wstETH) rose by 10.34% to 3.52 million tokens.

Monthly Metrics Report from Lido Finance in November

However, these statistics have been met with skepticism within the community due to concerns that Lido may have artificially inflated the numbers. Despite benefiting from recent market growth and Ethereum-based tokens seeing significant price surges, the staking protocol did not witness substantial activities to justify such large inflows.

Last month, the protocol also experienced a decline in Solana (SOL) staked assets by over 50%, potentially due to FTX-related wallets unstaking SOL and transferring funds to centralized exchanges (CEX).

In its report, Lido also highlighted recent protocol developments such as consensus on DAO proposals, notably the DVT trial proposal, and the listing of LDO and wstETH on Aave V3 on Base.

Lido Finance remains a leading Ethereum staking provider in the market. At the time of writing, Lido's TVL stands at $20.789 billion, with the LDO token trading at $2.3, reflecting a 2% increase for the day.

TVL Lido Finance. Source: DefiLlama

LDO/USDT 1D Chart as of 12:45 PM on December 12, 2023, on Binance