Uniswap Proposes “Diversification” of Its $5 Billion Treasury

In a move to reduce its reliance on its native UNI token amid plans to activate a fee-sharing feature for users, Uniswap, the largest DEX on Ethereum, is looking to diversify its treasury.

Uniswap’s treasury was established when the DEX launched its UNI token in September 2020, with 43% of the total UNI supply allocated to it. The treasury is intended to fund ecosystem development, compensate volunteers, and promote the project.

Historically, Uniswap has held only UNI in its treasury, making it highly susceptible to market fluctuations. At its peak in 2021, the treasury's value soared to $19 billion when UNI hit its all-time high. However, by 2022, this value plummeted to just $1.5 billion.

To prevent a similar scenario, Uniswap DAO is proposing the formation of an advisory committee tasked with diversifying the DEX’s treasury. This committee would also be responsible for turning the treasury into a revenue-generating asset that provides a stable income stream for the protocol.

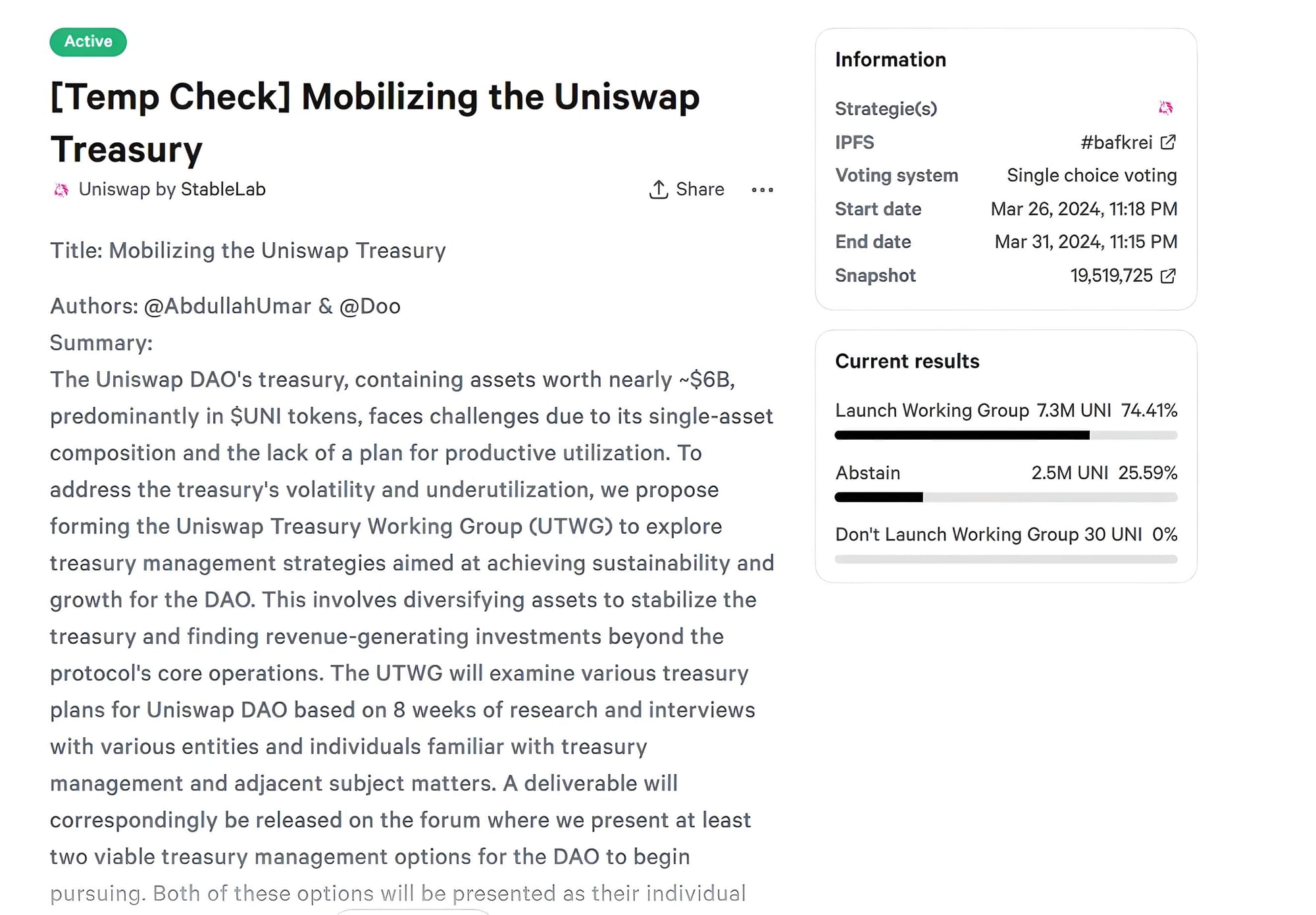

Uniswap Treasury Diversification Proposal. Source: Snapshot (March 28, 2024)

Currently, this proposal is undergoing a preliminary vote (temperature check) within the Uniswap community, with the voting period ending at 06:15 PM on March 31, 2024 (Vietnam time). The proposal has garnered over 74% support. If the preliminary vote is successful, the proposal will undergo a final vote to determine its official adoption.

However, some community members have raised concerns that the “treasury diversification” plan might be a euphemism for Uniswap DAO’s intention to sell a significant amount of UNI, capitalizing on the recent bullish sentiment driven by the upcoming fee-sharing feature. Additionally, such sales could be subject to taxation, potentially leading to legal complications for the US-based DeFi project.

As previously reported by Coin68, the Uniswap community approved a preliminary vote in early March to share transaction fees with users, a key driver behind UNI’s 50% price surge since February. Nevertheless, the official vote to implement the fee-sharing proposal has yet to be scheduled.

UNI/USDT 1D Chart on Binance as of 07:40 AM on March 29, 2024