XRP Soars 8% Amid Hopes for Ripple-SEC Lawsuit Resolution

XRP is trading at its highest level since March 25, buoyed by trader optimism that the legal dispute between the SEC and Ripple Labs may be nearing its end.

The optimism from traders has pushed XRP, the payment-focused token, to the forefront of the market, surpassing both Bitcoin (BTC) and Ethereum (ETH).

As reported by Coin68, a filing published on July 30, 2024, reveals that the U.S. Securities and Exchange Commission (SEC) intends to modify its securities allegations against the tokens listed in its lawsuit against Binance, including “Securities in the form of third-party crypto assets.”

In the Binance lawsuit and previous legal documents, the SEC had listed 52 cryptocurrencies as securities, including BNB, BUSD, SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and XRP.

Think this might be related to the Binance/SEC news: SEC no longer want to pursue the claim that some of the altcoins are securities.

— Regarded (@regardedfellow) July 30, 2024

Potentially foreshadowing a dismissal this week for XRP? Glad I longed this, absolutely ripping on the BTC pair as well https://t.co/Hq1gfZB6x9 pic.twitter.com/jnf14ljhQ3

Although the latest filing does not specify which tokens might be removed from the "securities" designation, the trading community views this as a potential indication that the legal battle between the SEC and Ripple Labs might be nearing a resolution.

As a result, XRP has surged over 8% in the past 24 hours, reaching above $0.64, its highest level since March 25, 2024, amid growing confidence in a favorable settlement of the Ripple-SEC case.

XRP/USDT 1-hour Chart on Binance as of 4:30 PM on July 31, 2024

Additionally, the upcoming scheduled unlock of 1 billion XRP (worth over $640 million at current prices) in August is also contributing to the token's recent price spike.

While increasing token supply typically puts downward pressure on prices, one researcher suggests that this action could, in fact, drive current price increases due to increased liquidity.

Large unlocks of tokens are a complex event that interface with market psychology.

— Chris Burniske (@cburniske) April 25, 2021

Simply put, large unlocks can be bullish catalysts in bulls, and bearish catalysts in bears.

They unlock liquidity to continue the prevailing trend.

Data from CoinGecko shows that XRP trading volume is predominantly from South Korea. The XRP/KRW pair on Upbit recorded $386.5 million in volume, compared to $352.5 million for the XRP/USDT pair on Binance.

Historically, South Korean traders have been known for their strong market activity in XRP, driving buying pressure and potentially impacting the price.

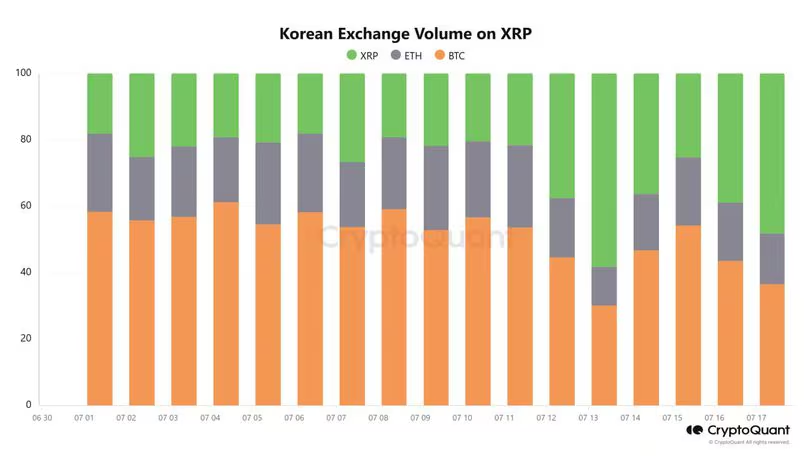

Earlier in the first two weeks of July, XRP trading volumes on South Korean exchanges surpassed leading market coins like Bitcoin and Tether (USDT), contributing to a 20% increase in the token's value.

XRP trading volume surged on South Korean exchanges in the first two weeks of July 2024. Source: CryptoQuant

However, Ripple executives have criticized the SEC's handling of its crypto-related lawsuits.

Stuart Alderoty, Ripple’s General Counsel, stated in a post on X (formerly Twitter):

"When a judge expressed doubt about the SEC's securities claim for 10 tokens on Binance as baseless, the SEC said 'no problem.' But these tokens are left in limbo in the Coinbase lawsuit. This is not how you regulate."

When a judge signals B.S. on the SEC’s claim that 10 tokens on Binance are securities, the SEC says “never mind.” But these tokens are left out to dry in the Coinbase suit. This isn’t how to regulate. https://t.co/xtfLdXWoO8

— Stuart Alderoty (@s_alderoty) July 30, 2024

Ripple CEO Brad Garlinghouse described the SEC’s intention to amend its securities claims against the tokens listed in the Binance lawsuit as “hypocritical,” arguing that “Chair Gensler claims the rules are clear, but his SEC cannot understand them and applies them arbitrarily, adding to the chaos in the crypto space.”

More evidence of SEC hypocrisy.

— Brad Garlinghouse (@bgarlinghouse) July 30, 2024

Chair Gensler testifies the rules are clear, yet his SEC can't figure them out and applies them haphazardly, festering more industry confusion.

A political agenda and/or bad faith litigation tactics. Def not a “faithful allegiance to the law". https://t.co/iX8IdvaW92