BTC and ETH Experience Volatile Movements After August 2022 U.S. Inflation Data

The cryptocurrency market has plunged sharply following the release of the U.S. Consumer Price Index (CPI) for August 2022, which, while showing a slight decrease, came in higher than expected. This has raised concerns that the Fed might still proceed with its planned 0.75% interest rate hike at the end of September.

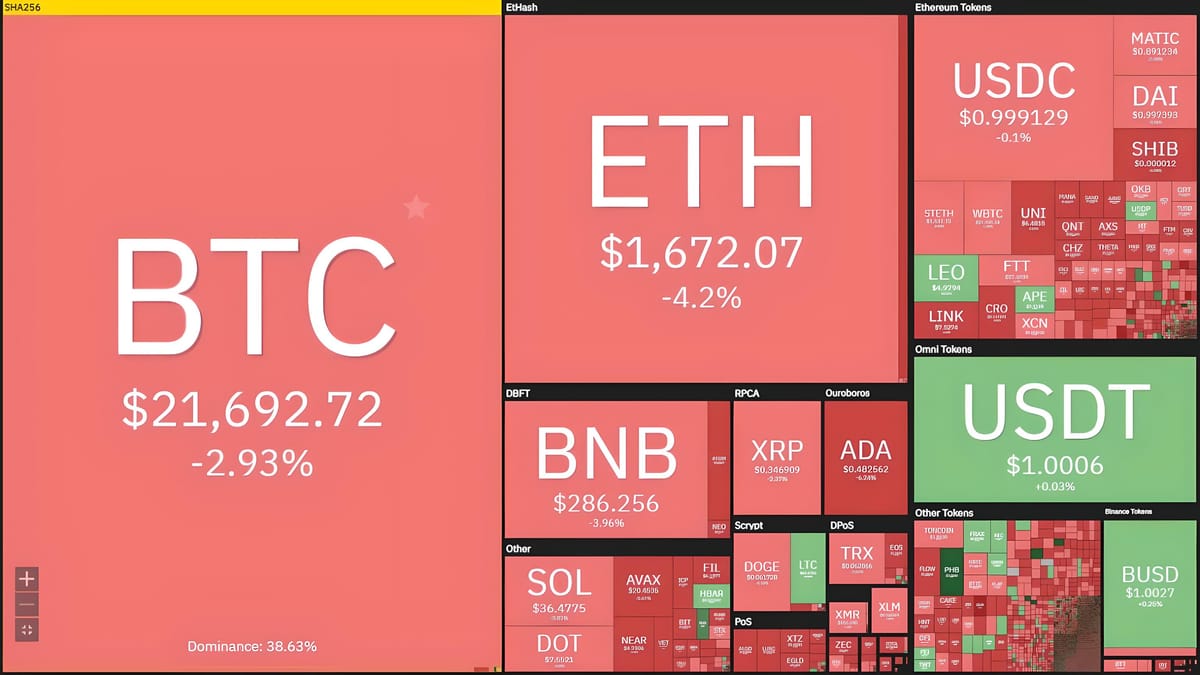

Top Crypto Price Movements at 07:50 PM on 13/09/2022. Source: Coin360

As Coin68 noted in our September 2022 events to watch, the U.S. CPI data for August was released at 7:30 PM on September 13. The CPI, a key indicator of inflation, had reached its highest level in four decades recently.

Historically, Bitcoin and the broader crypto market have shown significant short-term volatility following CPI releases. For example:

– Bitcoin reacted unexpectedly to April's CPI data.

– BTC saw a slight dip due to May’s inflation news.

– Bitcoin and Ethereum experienced volatility with June’s inflation data.

– BTC responded positively to July’s CPI as inflation showed signs of cooling.

The latest data reveals that the August CPI stands at 8.3%, down from 8.5% in July but still higher than the 8.1% forecasted by analysts. This suggests that U.S. inflation has not improved as much as expected and might be worsening according to analysts.

As a result of this disappointing signal, both BTC and ETH have seen substantial declines.

Bitcoin is currently trading at $21,900, having dropped sharply from around $22,800 just minutes before the CPI data was released. The price briefly touched $21,600, and selling pressure shows no signs of abating.

1-Hour Chart of BTC/USDT on Binance at 07:50 PM on 13/09/2022

Ethereum is trading at $1,665, also down significantly from approximately $1,760 minutes prior.

1-Hour Chart of ETH/USDT on Binance at 07:50 PM on 13/09/2022

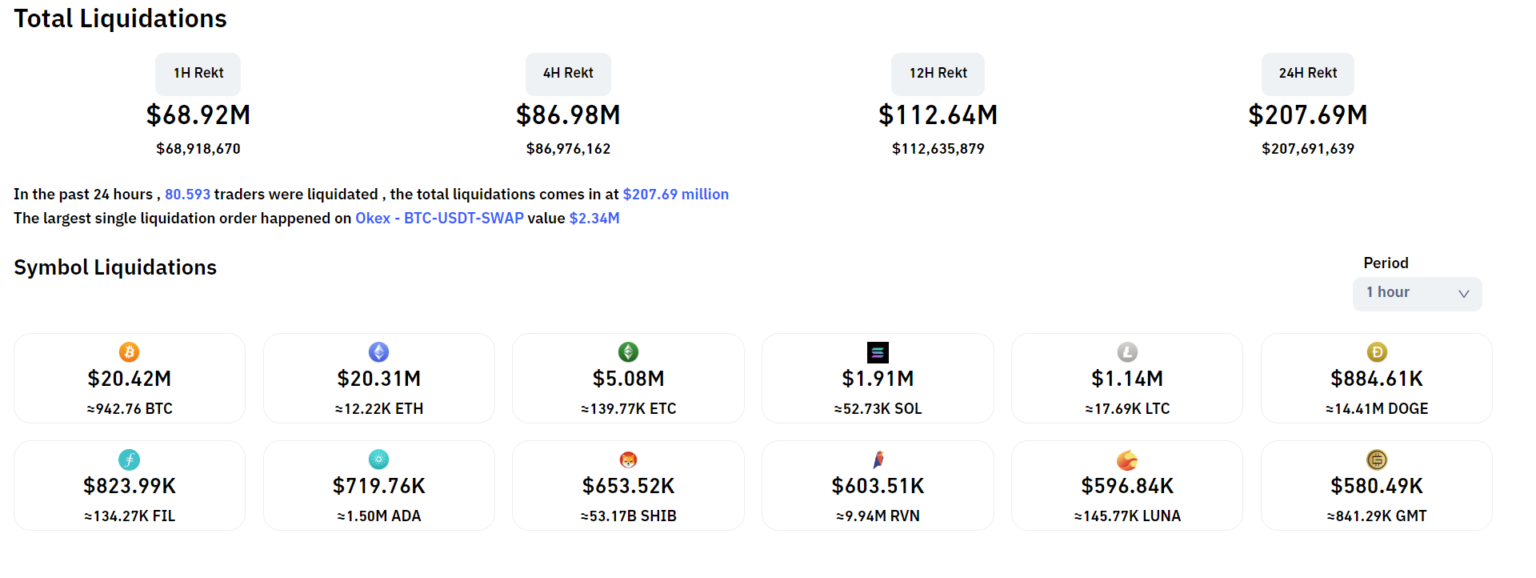

With these red candles, $50 million in derivatives positions were liquidated in the past hour, predominantly long positions. This includes $13 million in liquidated long BTC positions.

Value of Liquidated Cryptocurrencies in the Past Hour, Data from Coinglass at 07:50 PM on 13/09/2022

In the coming days, the crypto community is holding its breath for the Paris Hard Fork—the final step for Ethereum to complete The Merge.

Additionally, with the CPI data falling short of expectations, it is highly likely that the Fed will proceed with its planned 0.75% rate hike during its intervention on September 22.

Important Events to Watch in September 2022

This aligns with Fed Chair Jerome Powell's statement that the Fed remains “hawkish” and will not compromise on inflation control for the sake of growth. The Fed plans to continue raising rates to achieve its 2% inflation target by the end of the year.