GBTC Sees First Positive Net Inflow Day as Bitcoin ETFs Draw $380 Million Inflow - BTC Price Recovers to $63,600

Bitcoin has surged strongly over the past 12 hours, climbing to $63,500 USD fueled by buying pressure from returning Bitcoin spot ETFs.

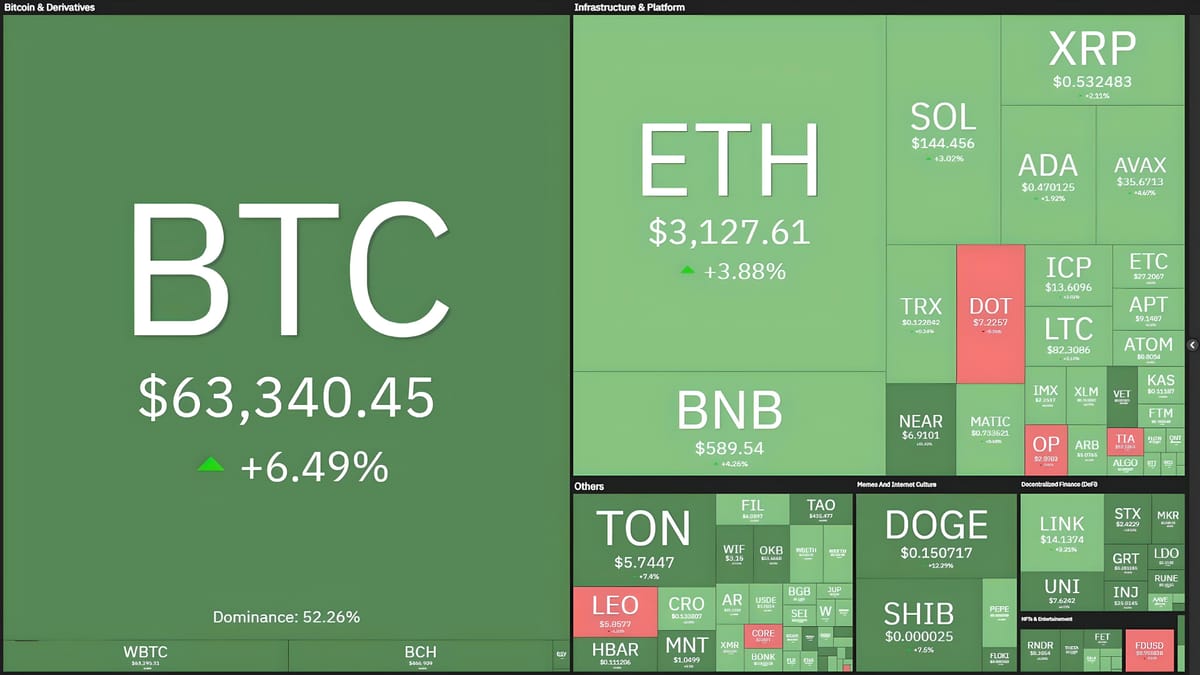

Market fluctuations of top cryptocurrencies at 08:50 AM on 05/04/2024

Preliminary statistics indicate that 11 Wall Street Bitcoin spot ETFs had a strong trading day on May 3 (US time), breaking a streak of 7 consecutive days of outflows.

Specifically, inflows into Bitcoin spot ETFs on the previous day totaled nearly $380 million USD, led by Fidelity's FBTC fund with $102 million USD.

Inflow/outflow data for Bitcoin spot ETFs on 05/04/2024. Source: Farside Investors

Notably, this also marks the first day in 78 trading sessions since the approval of Bitcoin spot ETFs that Grayscale's GBTC fund has experienced positive net inflows. Previously, GBTC had recorded outflows totaling $17.4 billion USD, averaging $224 million USD per day over the past 3 months.

[Tree] BlackRock (IBIT) Daily BTC Flows: +12.9m

— Tree News (@News_Of_Alpha) May 4, 2024

Historical transaction record of total GBTC outflows. Source: Farside Investors (05/04/2024)

Other ETFs also turned green after a long "red-hot" week. BlackRock's IBIT, though no longer a frontrunner with only $13 million USD in inflows, remained the best-performing fund with only 1 outflow day since May 1. Other funds recorded inflows ranging from $8 million to $60 million USD, potentially marking the first day where all 11 Bitcoin spot ETFs saw no outflows.

Thanks to this positive news, Bitcoin has recovered from $58,500 USD to $63,600 USD over the past 12 hours, reclaiming losses incurred during the April 30 - May 1 dump. Earlier, significant outflows exceeding half a billion USD within 24 hours had caused the world's largest cryptocurrency to plummet from $60,100 USD to as low as $56,600 USD - its lowest since late February.

[Tree] Grayscale (GBTC) Daily BTC Flows: +63.1m

— Tree News (@News_Of_Alpha) May 3, 2024

1-hour chart of BTC/USDT pair on Binance at 08:50 AM on 05/04/2024

Another important detail often overlooked is the buying pressure from Hong Kong-based crypto ETFs. Despite trading for only a few days with volumes of just tens of millions USD per day, the issuing units of these funds have pre-purchased a large amount of crypto in preparation for investor demand in the East Asian region, with estimated inflows ranging from $210 to $290 million USD in BTC and ETH forms.

However, BTC's prospects remain uncertain as it just ended a 7-month consecutive growth streak, compounded by investor sentiment reflecting the "Sell in May" adage.

Other altcoins in the market have seen gains ranging from 3% to 10% over the past 24 hours. Ethereum (ETH) has recovered slightly to $3,100 USD after dropping to as low as $2,817 USD.

1-hour chart of ETH/USDT pair on Binance at 08:50 AM on 05/04/2024

Total liquidation value in the derivatives market over the past 12 hours reached $77 million USD, with 86% in the short position. This figure for the 24-hour timeframe was $170 million USD liquidated, with 77.7% in shorts.

The clear recovery in price without significant liquidations suggests market participants are not overleveraging their trading strategies.

Liquidation statistics in the cryptocurrency market over the past 12 hours, screenshot from CoinGlass at 08:55 AM on 05/04/2024