Huobi’s HT Token Crashes 93% Before Recovering

New Huobi owner Justin Sun claims that HT’s 93% crash is “normal” price volatility and has pledged to implement measures to prevent a repeat.

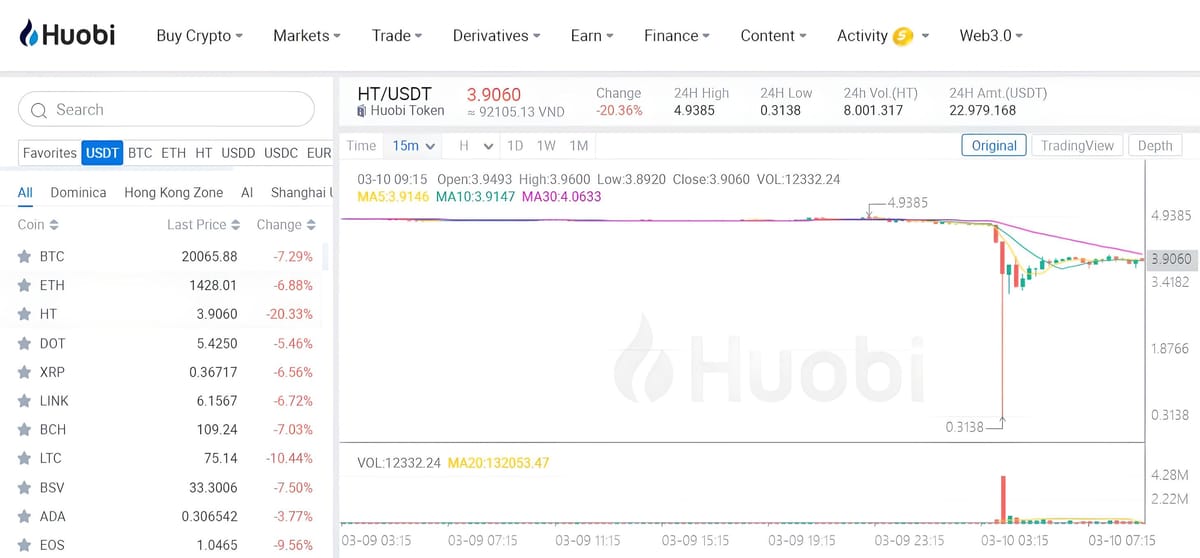

15m Chart of HT/USDT on Huobi at 09:15 AM on March 10, 2023

Update at Noon on March 10, 2023:

Huobi’s new owner, Justin Sun, has deposited $100 million USDC onto Huobi to bolster liquidity on the exchange, as previously promised.

We have transferred 100 million #USDC to @HuobiGlobal. Done. https://t.co/0TbCsH2ixn https://t.co/XWeHI3FriZ

— H.E. Justin Sun 孙宇晨 (@justinsuntron) March 10, 2023

Sun’s swift action aims to calm user concerns following the HT token's dramatic price movement on the morning of March 10.

Original Article:

In the crypto market dump early on March 10, Huobi’s native HT token plummeted from $4.71 to $0.31 on the exchange platform, surprising investors.

As the broader crypto market was in decline, HT’s price on Huobi began to drop from around 03:30 AM. However, by approximately 04:00 AM, HT’s price crashed from $4.71 to $0.31 in just 15 minutes before quickly recovering to its previous levels.

bruh pic.twitter.com/ixoDYwTc2r

— db (@tier10k) March 9, 2023

As of the time of this writing, HT is still down about 20% compared to 24 hours ago.

The 93% crash in HT was also recorded on other platforms listing the token, such as KuCoin and Gate.io, but the price drops were less severe, stabilizing around $1 before recovery, unlike the drastic fall seen on Huobi.

Read More: What is Archway?

According to data analytics firm Kaiko, the crash was caused by an imbalance between buy and sell orders for HT on Huobi. Specifically, in the 5 minutes before the drop, the buy wall for HT was only $600,000, while the total sell orders amounted to $2 million.

In the 5 minutes leading up to the $HT crash there was $2mn worth of sales compared to just $600k of buys on the main HT-USDT pair on Huobi pic.twitter.com/Z6sbgugSit

— Riyad Carey (@riyad_carey) March 9, 2023

TRON founder Justin Sun, who is rumored to have spent $1 billion to acquire Huobi in October 2022, addressed the situation on Twitter. Sun stated that HT’s crash was a result of market volatility, leading to the liquidation of a number of HT derivative positions and causing a “snowball effect.” He assured that all of Huobi’s functions remain secure and that there were no platform errors.

The operation of @HuobiGlobal exchange is #SAFE, the wallets are SAFE, and the backend is SAFE. The recent market fluctuations and the leveraged liquidations were caused by few users triggering a cascade of forced liquidations in the spot and HT contract markets.

— H.E. Justin Sun 孙宇晨 (@justinsuntron) March 10, 2023

Sun apologized to affected users and promised to take measures to improve liquidity on Huobi, starting with the establishment of a $100 million fund to support HT and other top cryptocurrencies, as well as enhancements to the liquidation warning system.

Justin Sun has withdrawn ~$60 million in ethereum stablecoins from Huobi in the last 24 hours pic.twitter.com/4PE4iimp9z

— Nansen 🧭 (@nansen_ai) March 10, 2023

On-chain data tracker Nansen later discovered that Sun had withdrawn $60 million in stablecoins from Huobi over the past 24 hours and transferred it to the DeFi protocol Aave. However, Sun clarified that this was merely a coincidence and part of a routine capital rotation strategy.

HT is currently the 67th largest cryptocurrency by market cap, standing at $635 million, with a 24-hour trading volume of $47 million.

In contrast, Huobi's spot trading volume over the past day reached $741 million, placing it 16th in the market. For futures, the exchange ranks 18th with a 24-hour trading volume of $2.8 billion.