Latest Updates on GUSD Stablecoin

After a period of market recovery, it seems that the issues surrounding DCG, Genesis, and GUSD (the stablecoin developed by Gemini) have temporarily settled. However, new developments this week suggest investors need to stay alert regarding GUSD.

Negative News

On the evening of January 30, OKX exchange announced it would delist the GUSD stablecoin. Specifically:

Delisting UPDATE 🔴

— OKX (@okx) January 30, 2023

Starting from 8:00 am on Feb 1 (UTC), #OKX will delist $GUSD.

⛔ OKX Convert will no longer be available for $GUSD products.

Learn more ⤵️https://t.co/xGxvWVY4cY pic.twitter.com/rOyb3xJDG3

“OKX will start delisting GUSD from 5 PM on February 1. The OKX Convert feature will no longer support GUSD-related products.”

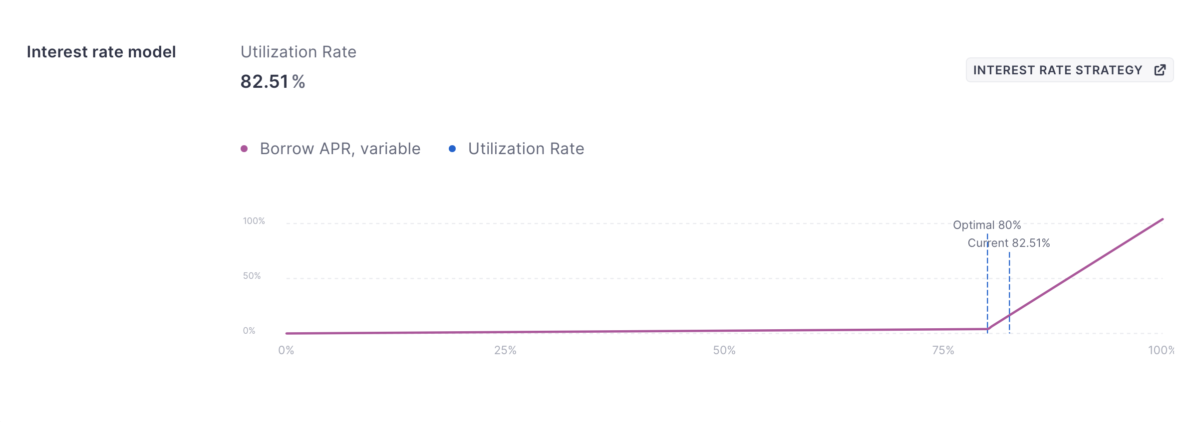

The demand for borrowing GUSD on Aave (likely for shorting the stablecoin) has surged. The Utilization Rate on Aave is now 82%, surpassing the optimal threshold of 80%.

However, the market size for GUSD on Aave is relatively small, under $10 million. Most of the GUSD supply is currently deposited into MakerDAO's PSM (Peg Stability Module) to support the peg for DAI.

Additionally, the price data for GUSD on CoinMarketCap and CoinGecko has been fluctuating recently, with no clear reason for these movements.

#PeckShieldAlert $GUSD at 0.988 pic.twitter.com/KNMAwvviPZ

— PeckShieldAlert (@PeckShieldAlert) January 31, 2023

CoinMarketCap has recorded GUSD dropping to around $0.98 at times. On CoinGecko, GUSD's price has also shown volatility, reaching up to $1.08.

On the DeFi front, MakerDAO has initiated DAO votes to mitigate risks associated with GUSD.

Gearbox DAO has used GUSD as a case study to discuss collateral management and the risk of de-pegging for this stablecoin.

Positive News

Earlier, MakerDAO provided clarifications regarding GUSD's collateral assets and the partnership between Gemini and MakerDAO.

Read More: MakerDAO Addresses Recent Issues with Gemini Earn

In January, the MakerDAO community voted to keep the GUSD debt ceiling at $500 million, maintaining the current limit.

.@Gemini sending first payment to Maker as part of the GUSD partnership.

— Sam MacPherson (@hexonaut) December 21, 2022

I expect revenue to reach 100m / yr quickly as we monetize the balance sheet.

Revenues which can:

- Be forwarded to DAI holders

- Reward MKR holders with a burn

- Buy stETH to increase protocol resilience pic.twitter.com/Nb4z3aHaOh

Moreover, Sam MacPherson – a MakerDAO developer – shared updates on GUSD’s payments to MakerDAO (specifically, the PSM pool operations).

Nevertheless, it remains challenging to predict the future of this stablecoin. Moving forward, especially with numerous bankruptcy filings now public, new data could significantly impact the market.