68 Trading Plan (01/30 – 02/05/2023) – Be Cautious of Fed Interest Rate Decision

Following the Lunar New Year holiday, the first week of February 2023 is set to bring a major macroeconomic event for the crypto market: the Federal Reserve’s interest rate decision.

68 Trading Plan (01/30 – 02/05/2023) – Be Cautious of Fed Interest Rate Decision

Review of Last Week’s Trading Plan

Last week, our trading plan was successful, predicting BTC would trade sideways within a range and BTC.D would drop, leading to profitable buy and long opportunities for altcoins.

In addition to successful altcoin trades, the plans for AVAX and DOGE were also fruitful:

- DOGE surged over 10%. Consider taking some profits and moving stop-loss to breakeven to hold further.

- AVAX increased by more than 18%.

Aside from the fixed weekly signals, 68 Trading frequently shares additional high-quality trade setups on Telegram. Don’t forget to join our community to receive free analyses, tips, and trade ideas!

Join the 68 Trading community for more high-quality trades!

Bitcoin (BTC) Analysis and Outlook for Next Week

Weekly Chart Analysis

As seen in the 1W chart of BTC/USDT on Binance Futures (screenshot from TradingView on January 29, 2023), BTC has formed bullish candles for four consecutive weeks. The latest bullish candle has a smaller range compared to the previous two. This contraction in price action is understandable given that the market remains cautious and there’s hesitation to buy at potential highs.

From a technical perspective, the weekly chart indicates BTC is approaching a significant resistance zone at $23,800 – $25,000. This level represents a previous peak that hasn’t been retested.

Personally, I would avoid buying/longing BTC at this stage and instead focus on altcoins with better volatility.

Daily Chart Analysis

The 1D chart shows BTC breaking out of its sideways range from the previous week. However, with 9 hours remaining until the new daily candle closes, patience is key if you plan to scalp long. I will also wait and limit long positions as the price is nearing a sensitive zone.

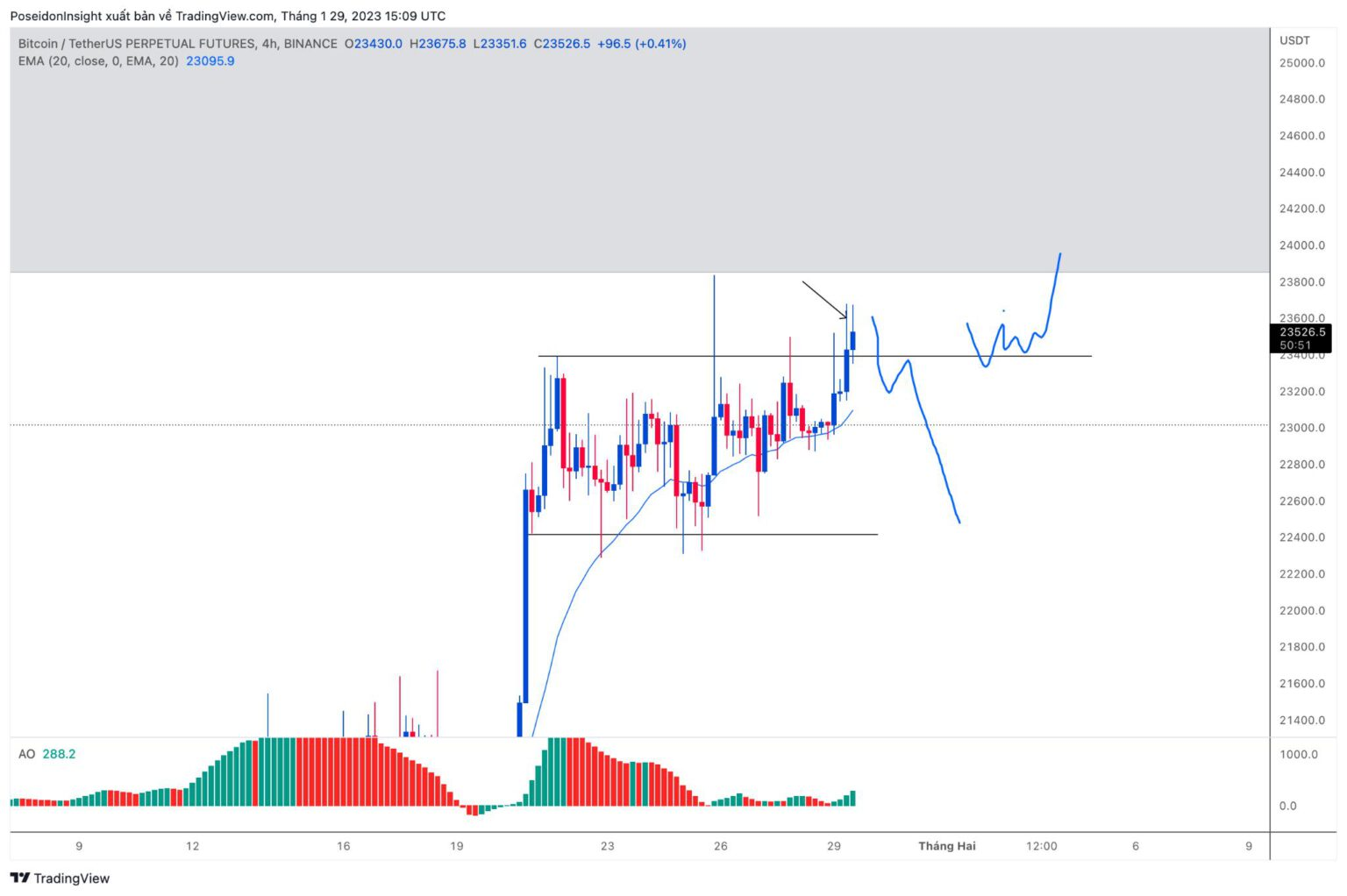

4H Chart Analysis

Given the limited time remaining for the daily and weekly candles to close, it’s advisable to limit trading and wait for the candles to close. For BTC, here are two potential plans:

- If the price continues to respect the recently broken zone, consider going long.

- If the price reverses back into the sideways range, consider going short.

BTC.D Analysis

Finally, after a long period, BTC.D has hit weekly resistance. If you follow Coin68’s plans closely, you’ll recall frequent mentions of this resistance zone. There’s a high chance BTC.D could decline from here, potentially creating conditions for many altcoins to pump if BTC remains sideways.

Altcoin Trading Plans

HOOK

The 4H chart for HOOK/USDT on Binance Futures (screenshot from TradingView on January 29, 2023) shows HOOK remains one of the strongest uptrend coins. You can wait for the price to retest support levels at $3.10 and $3.25 to enter a buy/long position.

ADA

The 4H chart for ADA/USDT on Binance Futures (screenshot from TradingView on January 29, 2023) reveals ADA is forming a classic head and shoulders pattern. The price has broken out of resistance and successfully tested it. Consider buying, with a stop-loss set below $0.38.

Macroeconomic News

Next week is expected to be eventful with several important updates:

- January 31, 2023: At 10 PM, the Conference Board (CB) will release consumer confidence data. Higher figures indicate greater consumer optimism, which will be positive for the USD and vice versa.

- February 1, 2023: The US will release crude oil inventory data. Crude oil plays a crucial role in the energy sector and impacts inflation.

- February 2, 2023: At 2 AM, the Federal Reserve's Board of Governors will meet and announce the first interest rate decision of 2023. A 0.25% rate hike is anticipated, which is relatively modest compared to previous hikes.

Conclusion

The above provides a personal trading perspective. I hope this offers additional insights for better trading next week. Wishing everyone a prosperous and lucky new year!

Don’t forget to join 68 Trading to trade and discuss with us!