Bitcoin Rebounds to $18,000 as U.S. Inflation Cools in November

On the evening of December 13, the U.S. released its November Consumer Price Index (CPI) data, a key measure of inflation for the world’s largest economy, leading to a positive bounce in the cryptocurrency market.

Bitcoin Rebounds to $18,000 as U.S. Inflation Cools in November

As reported by Coin68, one of the recurring influences on the crypto market throughout 2022 has been the monthly CPI announcements from the U.S. The CPI is used as a gauge for inflation, which has been at its highest levels in 3-4 decades since mid-year.

According to the latest data, the U.S. CPI for November 2022 was up 7.1% year-over-year, down from 7.7% in October and below the 7.3% forecast by financial analysts.

This marks the fifth consecutive month of declining year-over-year inflation rates in the U.S.

Monthly U.S. Inflation Trends. Source: Trading Economics

Additionally, the Core CPI (excluding volatile items such as food and energy) for November 2022 decreased to 6% from 6.3% in October, another sign that inflation is cooling down.

Bitcoin (BTC) responded positively to the news, rising 5.5% within 24 hours to hit $18,000—its highest level since November 9, when the FTX liquidity crisis became evident.

1H Chart of BTC/USDT on Binance as of 08:45 PM, December 13, 2022

Ethereum (ETH) also surged 7.2% to $1,349, following Bitcoin’s upward momentum.

1H Chart of ETH/USDT on Binance as of 08:45 PM, December 13, 2022

Major altcoins in the market recorded recoveries ranging from 4-6%.

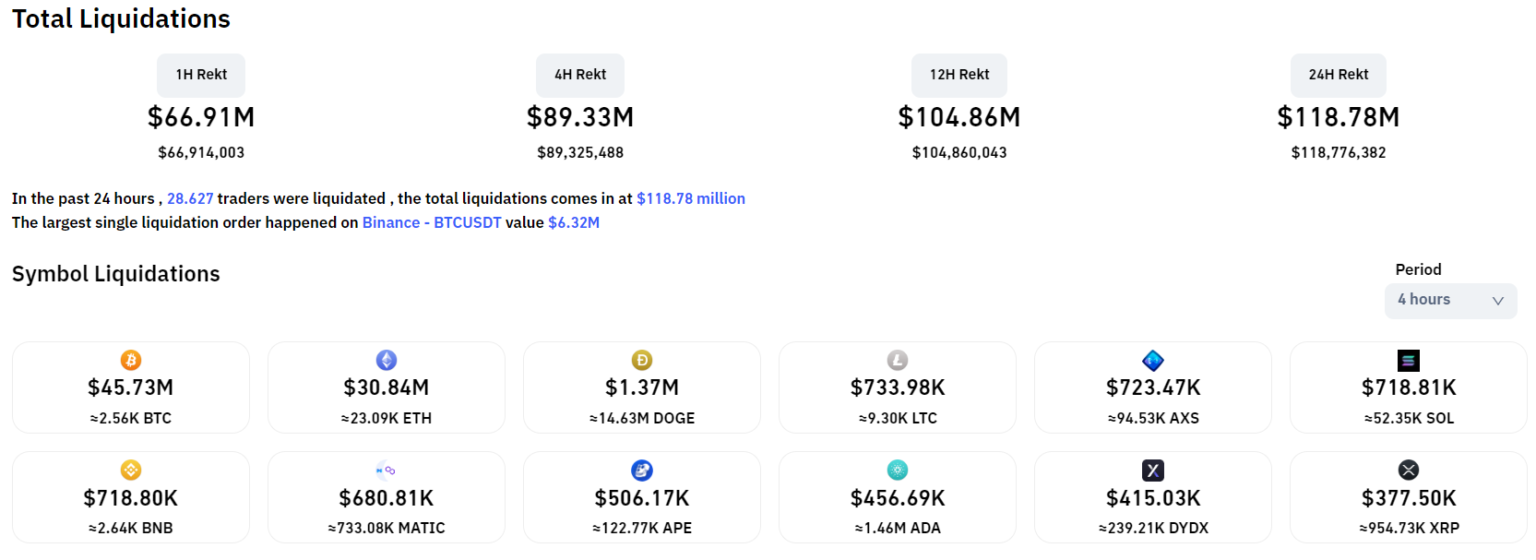

The liquidation rate over the past 4 hours reached nearly $90 million, with BTC and ETH accounting for the majority. Notably, over 94% of the liquidations were short positions.

Cryptocurrency Liquidation Values over the Past 4 Hours, Source: Coinglass as of 08:45 PM, December 13, 2022

Looking ahead, the Federal Reserve is set to announce its final interest rate adjustment for 2022 in the early hours of December 15 (Vietnam time). There are signals that the Fed may slow down rate hikes after a year of significant increases, pushing rates to their highest levels since the 2008 financial crisis, but the outcome remains uncertain.