BUSD Slightly Depegs as Binance Suspends USDC Withdrawals Due to Liquidity Crunch

In response to a significant liquidity drain from its platform, Binance has temporarily halted USDC withdrawals. Meanwhile, Binance's stablecoin, BUSD, has unexpectedly depegged from its $1 value and is yet to fully recover.

BUSD Slightly Depegs as Binance Suspends USDC Withdrawals Due to Liquidity Crunch

Update Late December 13:

As of 12:00 AM on December 14, Binance has resumed USDC withdrawals.

$USDC withdrawals are back online. Thank you for your patience.

— Binance (@binance) December 13, 2022

According to blockchain data aggregated by Glassnode, Binance experienced a record high outflow over the past 24 hours, with 39,637 BTC (over $700 million) and $2.1 billion in stablecoins leaving the platform.

Largest 24h flow of $BTC out of Binance ever:

— Dylan LeClair 🟠 (@DylanLeClair_) December 13, 2022

-39,637 BTC pic.twitter.com/nraXyco6Ai

Update December 13:

Approximately 20 minutes ago, Binance CEO Changpeng Zhao addressed the withdrawal issue. Zhao stated that $1.4 billion had been withdrawn from the exchange today, a precedent-setting figure that he views as a "stress test" for major CEX platforms. This situation, while incurring transaction fees, is necessary for industry-wide cleansing.

We saw some withdrawals today (net $1.14b ish). We have seen this before. Some days we have net withdrawals; some days we have net deposits. Business as usual for us.

— CZ 🔶 BNB (@cz_binance) December 13, 2022

I actually think it is a good idea to “stress test withdrawals” on each CEX on a rotating basis. 💪

1/2 https://t.co/uF9lLPDSyS

Meanwhile, Tether announced it would work with Binance to swap $3 billion USDT from Tron to ERC20. This action will not alter the total supply of USDT.

In few minutes Tether will coordinate with Binance to perform a chain swap, converting from Tron to Ethereum ERC20, for 3B USDt. The #tether total supply will not change during this process.

— Tether (@Tether_to) December 13, 2022

Learn more about chain swaps ⬇️https://t.co/abfgnELSvi

According to The Block, Tether's CTO Paolo Ardoino explained that this transaction aims to help Binance rebalance its USDT reserves in cold storage.

Original Article:

Binance Unexpectedly Halts USDC Withdrawals

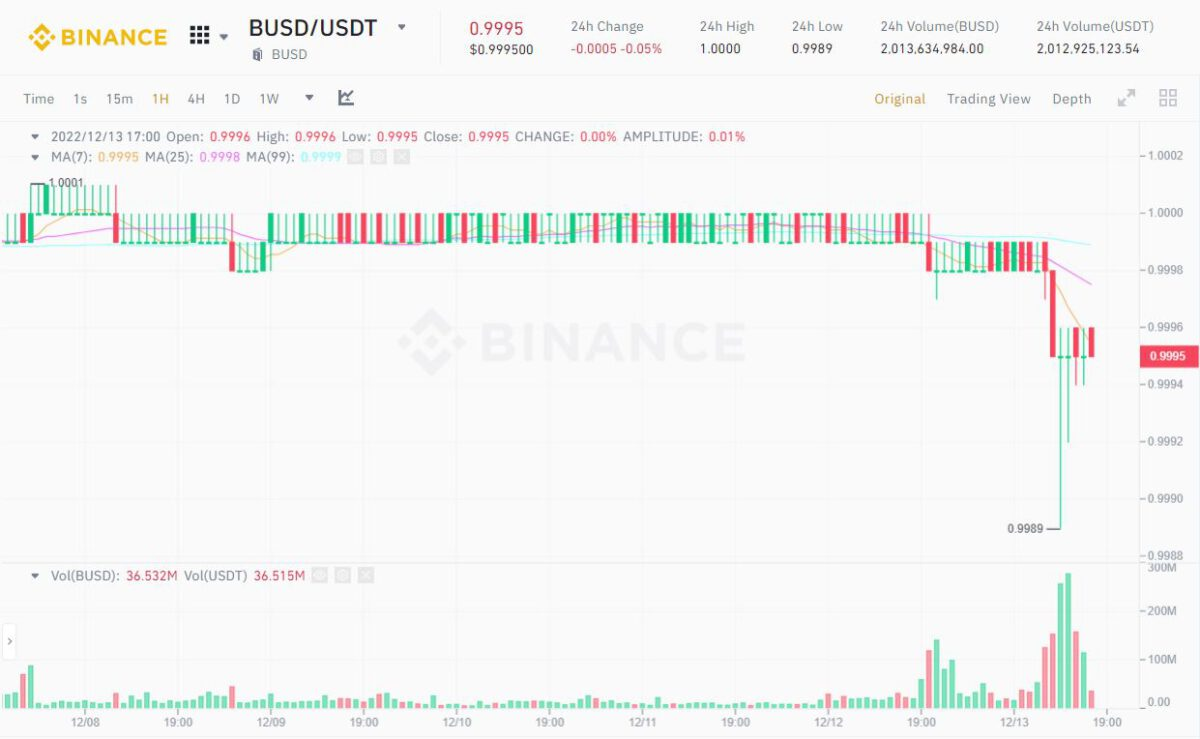

The crypto community, already rattled by recent FUD, has seen a rush to withdraw funds from Binance. This surge in swapping BUSD for other stablecoins caused Binance's stablecoin to depeg slightly from its $1 value, dropping to $0.9989 at one point on December 13.

1H Chart of BUSD/USDT on Binance as of 05:30 PM, December 13, 2022

Shortly after, Binance took the surprising step of halting USDC withdrawals. CEO Changpeng Zhao cited that the swap channel from PAX/BUSD to USDC required processing through a New York bank, which was not operational at that time. The 1:1 conversion from stablecoins to USDC is expected to resume in a few hours once the bank opens. Withdrawals of BUSD and USDT are still proceeding normally.

On USDC, we have seen an increase in withdrawals. However, the channel to swap from PAX/BUSD to USDC requires going through a bank in NY in USD. The banks are not open for another few hours. We expect the situation will be restored when the banks open. 1/2

— CZ 🔶 BNB (@cz_binance) December 13, 2022

As of now, BUSD is trading around $0.9995 and has yet to fully restore its peg. The 24-hour trading volume of the BUSD/USDT pair on Binance stands at $2 billion, making it the second-highest pair after BTC/USDT and five times the volume of ETH/USDT.

Justin Sun’s Unexpected Moves

Market sentiment remains uneasy as the new week progresses. Part of this unease stems from Justin Sun's unexpected withdrawal of $50 million from Binance. However, Sun also deposited $100 million USDC back into the exchange.

According to Lookonchain, Sun withdrew $34 million BUSD and $15.4 million USDT from Binance about 11 hours ago, transferring them to Paxos Treasury and Circle.

Justin Sun(0x9f84) withdrew 33,911,530 $BUSD and 15,432,715 $USDT from #Binance 9 hours ago.

— Lookonchain (@lookonchain) December 13, 2022

Then he transferred 33,911,530 $BUSD to Paxos Treasury.

And exchanged 15,432,715 $USDT for 15,435,455 $USDC and transferred to #Circle. pic.twitter.com/SCSPcjYVTC

By around 3 PM on December 13 (Vietnam time), a Huobi advisor announced the reinjection of $100 million into Binance from Circle, describing the transactions as “normal adjustments.”

I just deposited 100 million USD into @binance. 我刚刚给币安充值1亿美元。 https://t.co/tTCyiEBsXW

— H.E. Justin Sun 孙宇晨 (@justinsuntron) December 13, 2022

Yet, by around 6 PM, Sun withdrew $100 million BUSD to his private wallet.

Justin Sun withdrew ~100M $BUSD from #Binance 30 mins ago.

— Lookonchain (@lookonchain) December 13, 2022

Withdrew only 3 hours after depositing.https://t.co/VSzfhjzX0Dhttps://t.co/zstkb71Qkb pic.twitter.com/VhGb8eJTwP

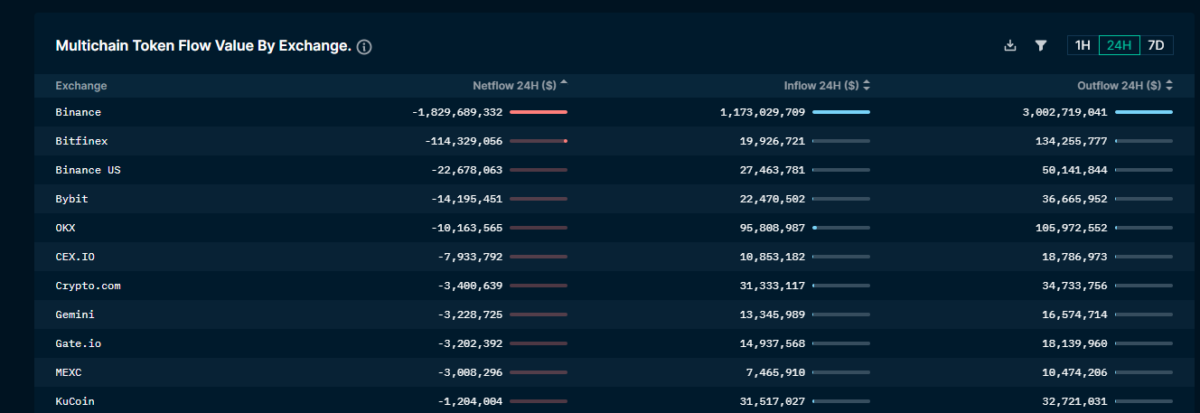

On-chain data reveals billions of dollars have fled exchanges across all chains in the past 24 hours. As Coin68 reported earlier, Binance alone saw up to $1.8 billion in outflows.

Flow of Funds Out of Top Exchanges in the Past 24 Hours. Source: Nansen

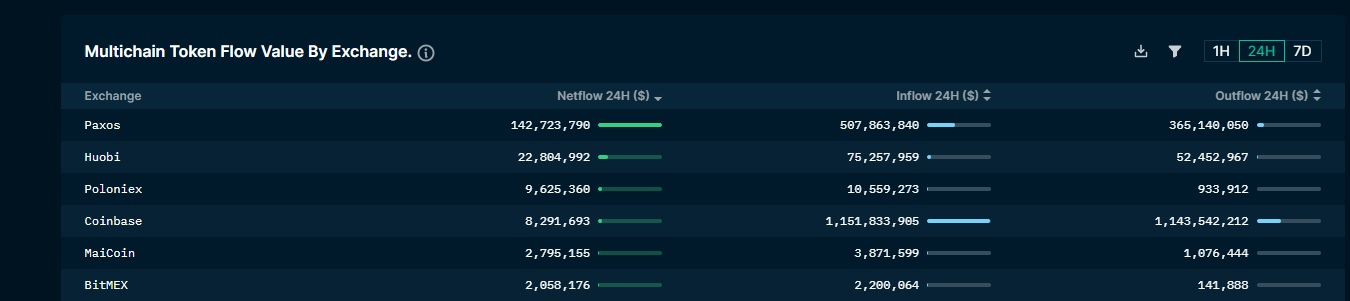

Nansen data shows that Paxos and Huobi have seen capital inflows, with around $162 million flowing back. Coinbase also recorded strong inflows, with about $124 million added to the exchange in the past 24 hours.

Capital Inflows to Exchanges in the Past 24 Hours. Source: Nansen

The reasons behind these movements remain unclear. However, recent withdrawal activity follows concerns raised by Reuters regarding Binance’s alleged violations of sanctions and involvement in money laundering since 2018.

BNB’s price has also been significantly impacted, dropping to $255.6 at the time of reporting.

1H Chart of BNB/USDT on Binance as of 05:30 PM, December 13, 2022

According to DeFiLlama, the total value locked (TVL) on BNB Chain’s DeFi protocols has decreased by 4.5% over the past day.

Total Value Locked on BNB Chain as of 05:00 PM, December 13, 2022