What ETH Investors Need to Know Before The Merge

The Merge, set to roll out on September 15-16, will bring significant changes to the Ethereum network. ETH holders will receive airdropped ETH PoW tokens. Here’s what you need to do to maximize the benefits of The Merge, according to CoinGecko founder Bobby Ong.

The Ethereum Merge is scheduled to take place on 13 September. Christmas season is here again.

— Bobby Ong (@bobbyong) September 5, 2022

ETH holders will soon be airdropped ETH PoW tokens. What should you do to best position yourself?

Here are 7 steps you may consider to fully take advantage of the Merge:

1. Store ETH in a Wallet Supporting the Fork

To receive ETH PoW tokens, your ETH needs to be in a wallet that supports the fork. The best option is to use a hardware wallet or well-known wallets like MetaMask. Holding ETH on an exchange wallet may result in delays or the exchange not distributing ETH PoW tokens at all. Be sure to check your exchange’s policy regarding this.

2. Transfer ETH from Other Chains to Ethereum Mainnet

You will not receive ETH PoW if your ETH is on other chains like Avalanche, Polygon, or Optimism. Make sure to transfer your ETH back to the Ethereum mainnet to be eligible for the ETH PoW airdrop.

3. Convert WETH Back to ETH

You might need to unwrap WETH PoW into ETH PoW on some DEXs on the ETH PoW chain. To simplify the process, unwrap WETH before The Merge to ensure you receive ETH PoW seamlessly.

4. Withdraw ETH Liquidity from DeFi Platforms

If your ETH is providing liquidity on DeFi platforms, you won’t be able to receive ETH PoW. It’s best to withdraw your liquidity before The Merge and then provide liquidity again once you have received your ETH PoW tokens.

5. Borrow ETH from Aave or Compound

ETH PoW will be airdropped to all ETH stored in your wallet. If you believe the ETH PoW airdrop could be profitable, borrowing ETH from Aave or Compound might be a viable strategy.

6. Monitor the stETH/ETH Trading Pair

Keep an eye on the stETH/ETH pair as market sentiment shifts before The Merge. Typically, investors might sell stETH for ETH to secure ETH PoW airdrops. If selling pressure is high and you missed the boat, consider buying stETH at a lower price.

7. Buy the Rumor, Sell the News

With the positive hype surrounding The Merge, ETH prices are likely to rise. However, remember the investment adage: “Buy the rumor, sell the news.” Be strategic about when to sell your ETH to capitalize on the price movements.

8. Look for Retroactive Opportunities

Post-The Merge, ETH miners will no longer mine ETH, leading to the creation of ETHW as a continuation of the old chain. This means assets on Ethereum will exist on both ETH and ETHW chains, giving investors the chance to receive airdropped assets (like ETHW tokens) on the Ethereum PoW chain. If ETHW holds value, investors could gain free profits.

Retroactive events like these can cause price volatility, so consider using Delta Hedging to protect your position and profit from ETH PoW.

9. Protect Your Assets from Attacks

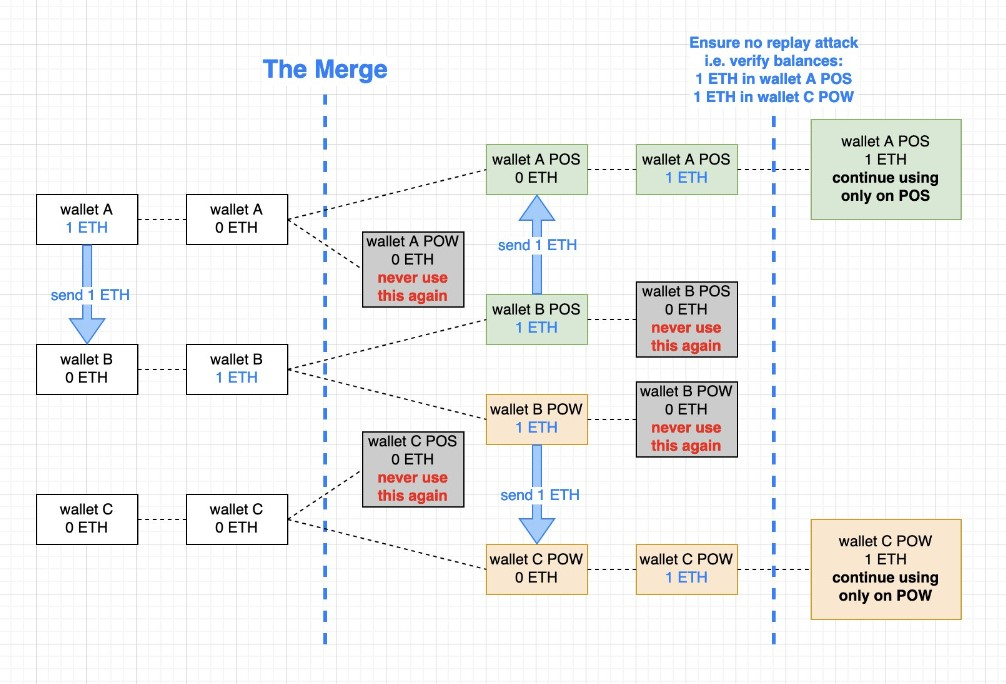

The split into two chains also introduces potential risks, such as Replay Attacks. Since Ethereum PoW will operate on the old version and Ethereum PoS on the new version, transactions valid on one chain could be replicated on the other.

How to Avoid Replay Attacks

- Before The Merge: Transfer your assets from Wallet A (for Ethereum PoS) to a temporary Wallet B and prepare Wallet C (for Ethereum PoW).

- Categorize Assets: Separate Proof of Stake and Proof of Work assets into Wallets A and C. Use Wallet A exclusively for Ethereum PoS and Wallet C exclusively for Ethereum PoW.

- After The Merge: Liquidate or lock in profits from all assets on Ethereum PoW by converting everything to ETHW tokens and transferring them to centralized exchanges supporting ETHW, such as Gate.io or MEXC.

Stay informed and prepared to navigate the changes brought by The Merge to maximize your benefits and secure your assets.