What’s Next for the Solana Ecosystem After FTX's Collapse?

Update as of November 25:

As of the morning of November 22, the Solana Foundation provided the latest update on their exposure to the collapse of FTX.

Solana Foundation stated that ~3.24m shares of FTX Trading LTD common stock ~3.43m FTT tokens ~134.54m SRM tokens cannot be withdrawn on FTX. Before the FTX crash, these tokens were worth over $160 million. https://t.co/beabWrxE0C

— Wu Blockchain (@WuBlockchain) November 25, 2022

The Solana Foundation had assets on FTX.com that have been stuck since November 6, when FTX halted withdrawals. Prior to the incident, these assets were valued at over $160 million and included:

- ~3.24 million FTX Trading Ltd. common shares

- ~3.43 million FTT tokens

- ~134.54 million SRM tokens

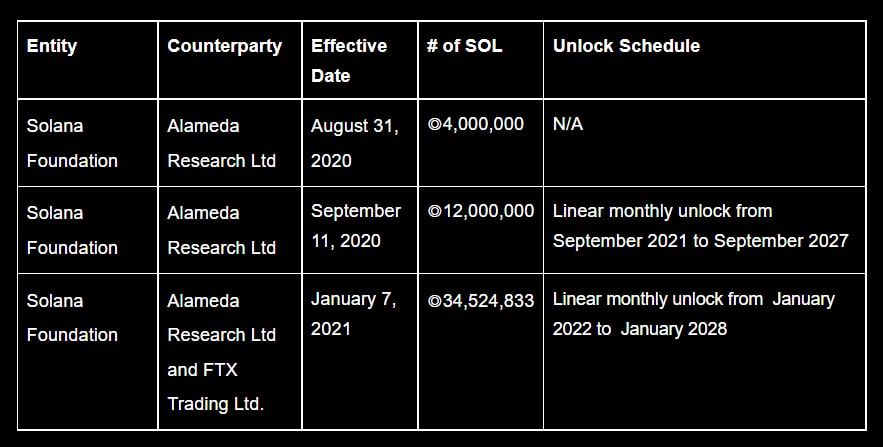

FTX/Alameda first purchased SOL from the Solana Foundation in August 2020, six months after the launch of Mainnet Beta. Here’s a summary of the SOL holdings the Solana Foundation had with FTX/Alameda.

SOL Holdings of the Solana Foundation with FTX/Alameda

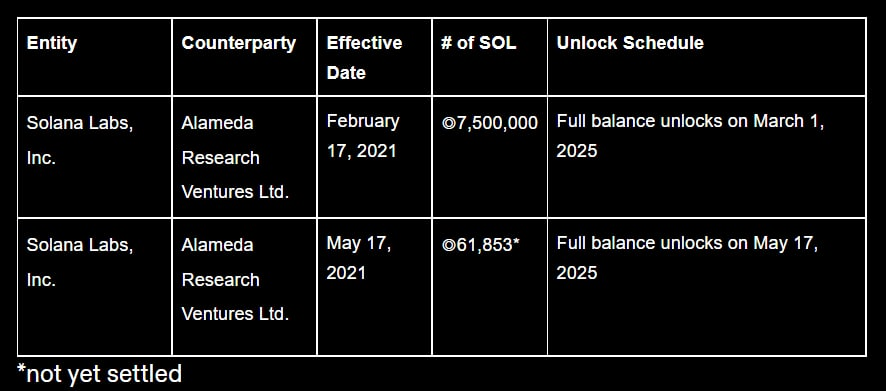

Additionally, here's the agreement between Solana Labs and FTX/Alameda:

Solana Labs Transactions with FTX/Alameda

Original Post:

On the evening of November 10, the Solana Foundation addressed users and provided a general update on the ecosystem.

The Foundation wanted to answer some questions about what is happening at the boundary of Epoch 370, and provide a place to get updated information.

— Solana Foundation (@SolanaFndn) November 10, 2022

This post will continue to update this with additional information as needed.https://t.co/ugCnSp7YSt

Solana Network Remains “Intact”

Despite the turmoil, the Solana network continues to operate normally in terms of performance and uptime.

Solana Foundation's Exposure to FTX/Alameda

The Solana Foundation had approximately $1 million on FTX.com since November 6, the date when FTX suspended withdrawals. This amount represents less than 1% of the Foundation’s cash and cash equivalents, causing minimal impact on the Foundation. Additionally, the Foundation did not have SOL deposited on FTX.com.

Wrapped Assets on Solana

As of November 10, the total exposure of wrapped assets on Sollet with FTX was valued at around $40 million. However, detailed reports have not yet been released.

The Wrapped Bitcoin on Sollet has traded at a 10x discount compared to the market price of Bitcoin (BTC).

Price Volatility of Wrapped Bitcoin (Sollet) Over 24 Hours. Source: CoinGecko

Serum Plans a Fork

Following a security breach, Solana founder Anatoly Yakovenko mentioned that developers are working to fork the Serum code and restart the protocol without FTX’s involvement.

Projects like Magic Eden, Mango Markets, and Phantom are also minimizing their reliance on Serum and are temporarily suspending operations due to security risks.

DeFi Status on Solana

Most of the major DeFi projects on Solana have limited or no exposure to FTX, based on a recent assessment by the Solana Foundation.

Liquidity Support/Market Making

Many market makers are still providing liquidity for DeFi applications on Solana.

Large Unlocking of SOL After Epoch 370

As previously warned, a large number of Solana validators stopped staking SOL and requested to withdraw 47 million SOL, equivalent to $845 million, as of 3:30 PM (Vietnam Time) on November 10.

The collapse of FTX has created panic, leading to a wave of market sell-offs, and SOL has not been spared, especially during this "flood" of withdrawals.

SOL's price has seen continuous declines in recent days, dipping as low as $12.07 and currently hovering around $12.51.