Zircuit Layer-2 Sees TVL Surge by $140 Million on First Day of Launch

Zircuit, a newly launched layer-2 platform, has attracted a staggering $140 million in staked ETH within just 24 hours of its mainnet launch. Alongside staking rewards, users will also earn Zircuit points.

A Boom in Restaking and Liquid Restaking

The restaking and liquid restaking sectors are drawing significant capital inflows in the crypto market. With the rise of EigenLayer, restaking staked ETH has become a hot trend within the community.

Notably, most projects in this sector have yet to release tokens, offering users opportunities for "airdrop farming" and earning points.

The immense appeal of this sector is evidenced by Zircuit’s rapid success, garnering $140 million in deposits shortly after its launch.

Investment and Launch Details

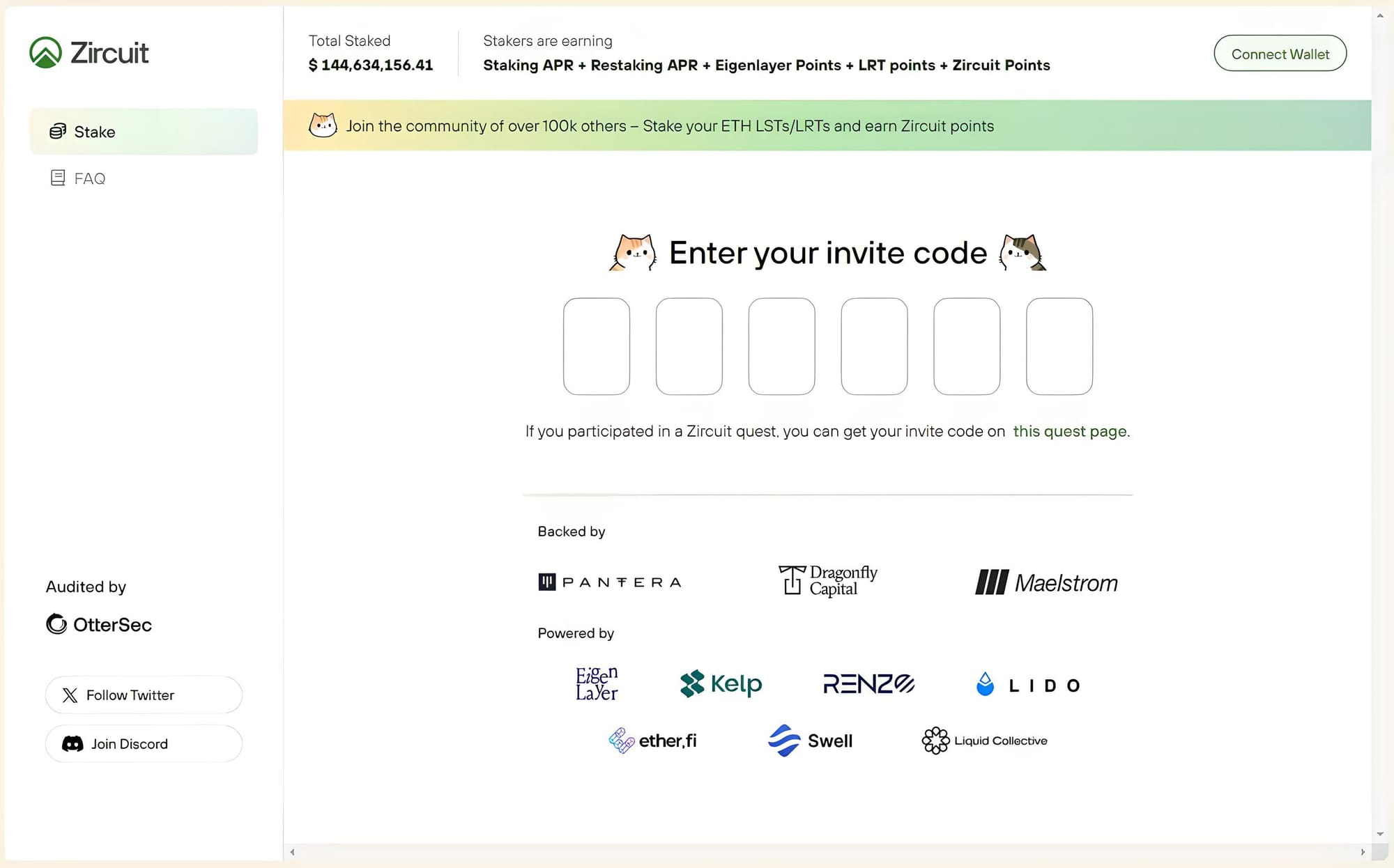

Zircuit’s funding round saw backing from prominent investment funds, including Pantera, Dragonfly Capital, and Maelstrom.

Chapter 3: Zircuit Staking

— Zircuit (@ZircuitL2) February 22, 2024

BEGINS NOW!

More frens, more rewards 💚 We're bringing extra bonuses to the communities of @LidoFinance, @RenzoProtocol, @swellnetworkio, @KelpDAO, and @liquid_col!

Learn how to maximize your Zircuit Points 👇

D pic.twitter.com/iZuyObjXyE

The project’s mainnet launched on February 23, allowing users to stake ETH from Lido Finance, Kelp DAO, Liquid Collective, Swell, and Renzo.

Beyond the staking yields, users can also earn Zircuit points – a new trend in the market for calculating airdrop eligibility, as previously reported by Coin68.

Significant Deposits and Strategic Backing

According to on-chain data, the highest deposit came from the wallet 1ef2, which staked over $22 million worth of stETH and rsETH.

Meanwhile, EigenLayer, a leading project in this space, recently raised $100 million from a16z, ranking among the top 5 DeFi projects by TVL.

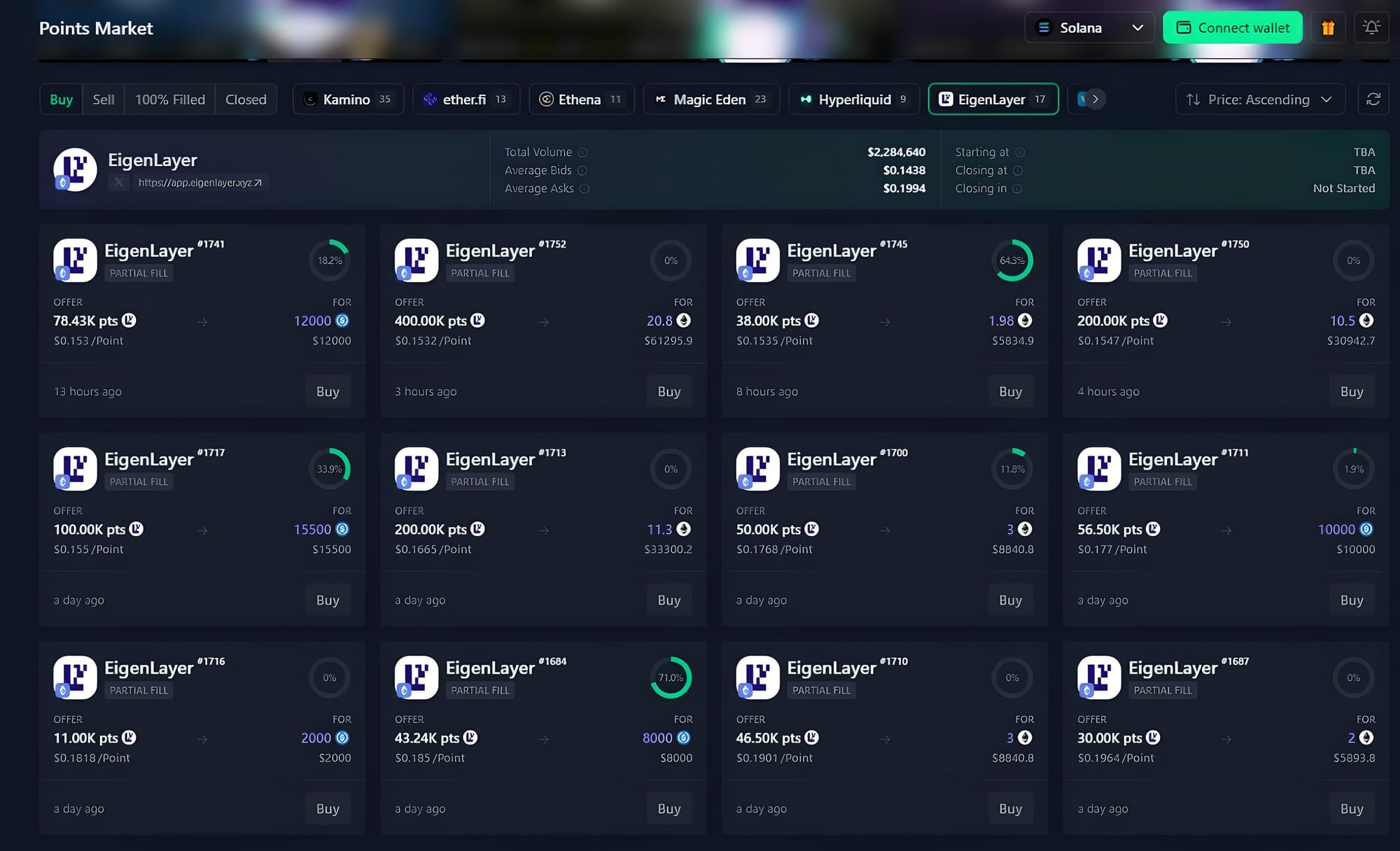

Currently, users and liquid restaking projects are actively collecting EigenLayer points, hoping to secure future airdrop tokens from the project. This has even given rise to derivatives platforms where points can be traded, such as Whales Market.

EigenLayer points have a total volume of over $2.1 million, with an average price of $0.14. With 1.7 billion points in circulation, the estimated market capitalization is $250 million.

Market Implications and Future Prospects

However, it’s important to note that EigenLayer founder Sreeram Kannan has stated the project currently has no plans to release a token.

The rapid adoption and significant deposits in Zircuit underscore the growing interest and potential in the restaking and liquid restaking markets. As more users and projects engage with these platforms, the sector is likely to see continued innovation and growth.

By focusing on the dynamic developments in the DeFi space, particularly in restaking and liquid restaking, Zircuit has positioned itself as a noteworthy player. The combination of strategic funding, substantial early deposits, and the innovative use of staking points highlights the evolving landscape of decentralized finance.